Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of Year Three, Parent Company acquired 80% of Subtwo Company outstanding common stock. Parent Company paid total consideration of $45,000, which

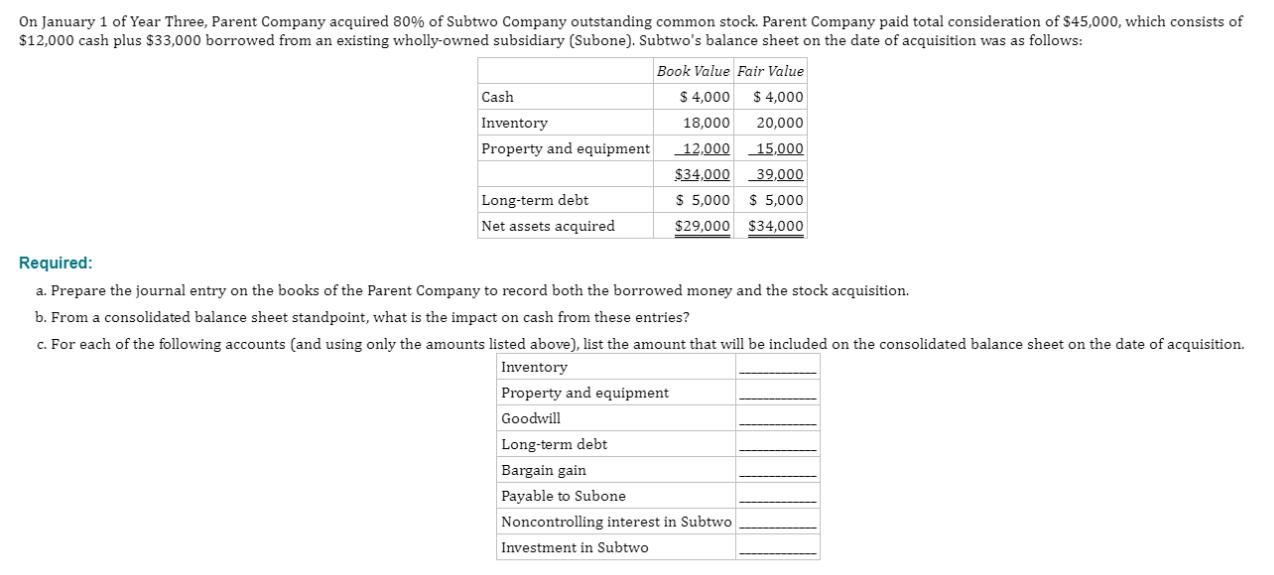

On January 1 of Year Three, Parent Company acquired 80% of Subtwo Company outstanding common stock. Parent Company paid total consideration of $45,000, which consists of $12,000 cash plus $33,000 borrowed from an existing wholly-owned subsidiary (Subone). Subtwo's balance sheet on the date of acquisition was as follows: Cash Inventory Property and equipment Long-term debt Net assets acquired Book Value Fair Value $ 4,000 $ 4,000 18,000 20,000 12,000 15,000 $34,000 39,000 $ 5,000 $5,000 $29,000 $34,000 Required: a. Prepare the journal entry on the books of the Parent Company to record both the borrowed money and the stock acquisition. b. From a consolidated balance sheet standpoint, what is the impact on cash from these entries? c. For each of the following accounts (and using only the amounts listed above), list the amount that will be included on the consolidated balance sheet on the date of acquisition. Inventory Property and equipment Goodwill Long-term debt Bargain gain Payable to Subone Noncontrolling interest in Subtwo Investment in Subtwo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started