Question

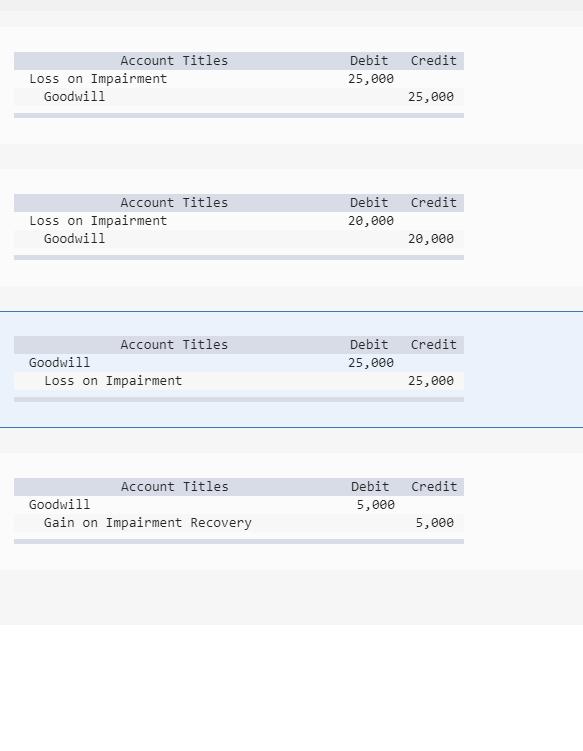

On January 1, Year 1, East Company purchased $60,000 of goodwill. On December 31, Year 4 East determined that the goodwill suffered a $25,000 permanent

Account Titles Loss on Impairment Goodwill Goodwill Account Titles Loss on Impairment Goodwill Account Titles Loss on Impairment Account Titles Goodwill Gain on Impairment Recovery Debit Credit 25,000 Debit 20,000 Debit 25,000 5,000 Credit Debit Credit 25,000 20,000 25,000 Credit 5,000

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER OPTION Account titles Loss on impairment Goo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting In Canada

Authors: Hilton Murray, Herauf Darrell

7th Edition

1259066487, 978-1259066481

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App