Question

On January 1, Year 1, Popa Inc. acquired 80% of the outstanding common shares of Montreal Ltd. for a total cost of $5,360. Coincidently, the

On January 1, Year 1, Popa Inc. acquired 80% of the outstanding common shares of Montreal Ltd. for a total cost of $5,360. Coincidently, the carrying amounts of Montreals assets and liabilities were equal to their fair values on this date.

The year 1 financial statements for Popa and Montreal were as follows:

| INCOME STATEMENTS | ||||||

| For year ending December 31, Year 1 | ||||||

| Popa | Montreal | |||||

| Sales | $ | 13,000 | $ | 4,400 | ||

| Equity method income | 640 | 0 | ||||

| Total income | 13,640 | 4,400 | ||||

| Cost of goods sold | 10,100 | 2,900 | ||||

| Other expenses | 1,400 | 700 | ||||

| Total expenses | 11,500 | 3,600 | ||||

| Profit | $ | 2,140 | $ | 800 | ||

| STATEMENTS OF FINANCIAL POSITION | ||||||

| December 31, Year 11 | ||||||

| Popa | Montreal | |||||

| Land | $ | 5,000 | $ | 1,500 | ||

| Plant and equipment, net | 19,200 | 12,200 | ||||

| Investment in Montreal | 5,600 | |||||

| Current assets | 4,540 | 2,700 | ||||

| Total assets | $ | 34,340 | $ | 16,400 | ||

| Ordinary shares | $ | 10,000 | $ | 2,400 | ||

| Retained earnings | 10,440 | 4,600 | ||||

| Long-term liabilities | 8,000 | 5,500 | ||||

| Current liabilities | 5,900 | 3,900 | ||||

| Total equity and liabilities | $ | 34,340 | $ | 16,400 | ||

Additional Information

- Popa uses the equity method to account for its investment in Montreal.

- Montreal paid dividends of $500 in Year 1.

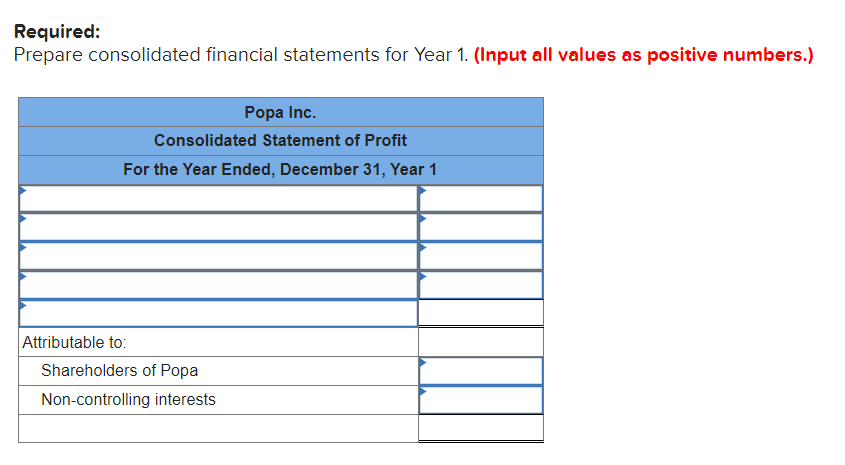

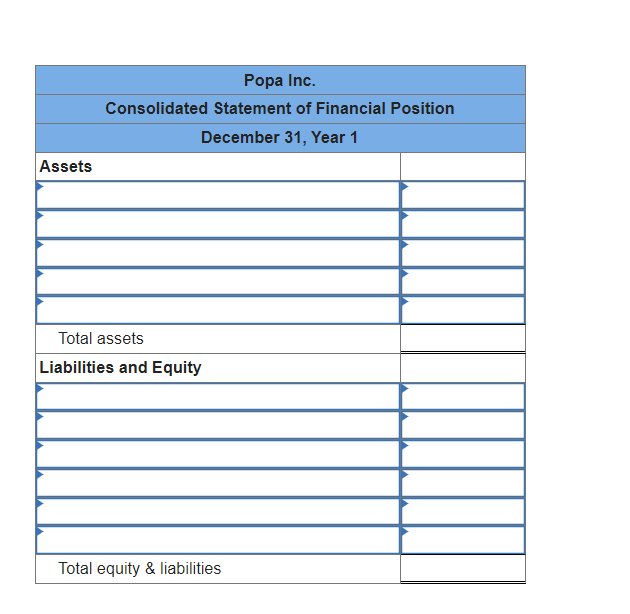

Required: Prepare consolidated financial statements for Year 1. (Input all values as positive numbers.)

On January 1, Year 1, Popa Inc. acquired 80% of the outstanding common shares of Montreal Ltd. for a total cost of $5,360. Coincidently, the carrying amounts of Montreals assets and liabilities were equal to their fair values on this date.

The year 1 financial statements for Popa and Montreal were as follows:

| INCOME STATEMENTS | ||||||

| For year ending December 31, Year 1 | ||||||

| Popa | Montreal | |||||

| Sales | $ | 13,000 | $ | 4,400 | ||

| Equity method income | 640 | 0 | ||||

| Total income | 13,640 | 4,400 | ||||

| Cost of goods sold | 10,100 | 2,900 | ||||

| Other expenses | 1,400 | 700 | ||||

| Total expenses | 11,500 | 3,600 | ||||

| Profit | $ | 2,140 | $ | 800 | ||

| STATEMENTS OF FINANCIAL POSITION | ||||||

| December 31, Year 11 | ||||||

| Popa | Montreal | |||||

| Land | $ | 5,000 | $ | 1,500 | ||

| Plant and equipment, net | 19,200 | 12,200 | ||||

| Investment in Montreal | 5,600 | |||||

| Current assets | 4,540 | 2,700 | ||||

| Total assets | $ | 34,340 | $ | 16,400 | ||

| Ordinary shares | $ | 10,000 | $ | 2,400 | ||

| Retained earnings | 10,440 | 4,600 | ||||

| Long-term liabilities | 8,000 | 5,500 | ||||

| Current liabilities | 5,900 | 3,900 | ||||

| Total equity and liabilities | $ | 34,340 | $ | 16,400 | ||

Additional Information

- Popa uses the equity method to account for its investment in Montreal.

- Montreal paid dividends of $500 in Year 1.

Required: Prepare consolidated financial statements for Year 1. (Input all values as positive numbers.)

Required: Prepare consolidated financial statements for Year 1. (Input all values as positive numbers.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started