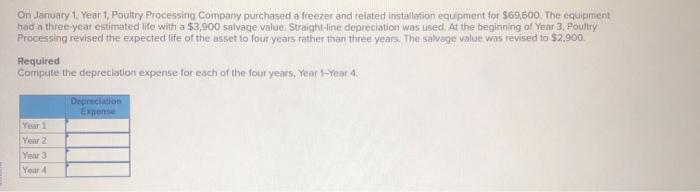

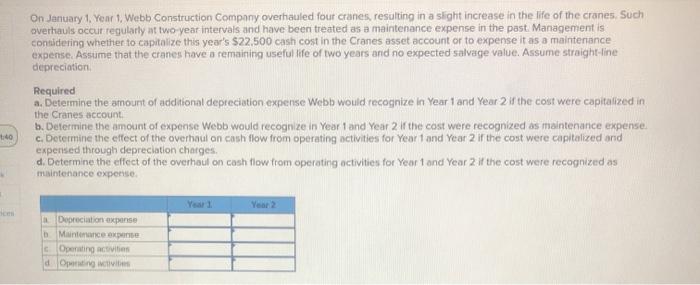

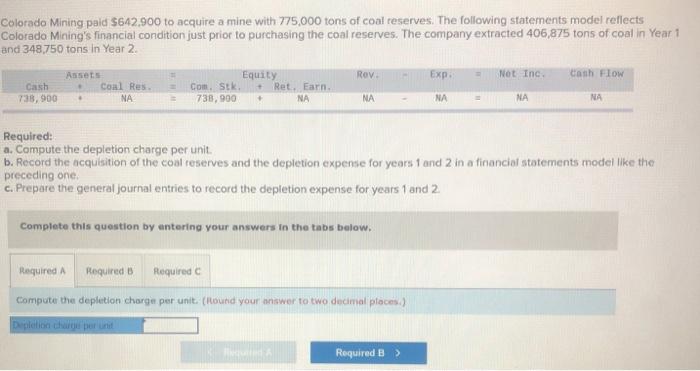

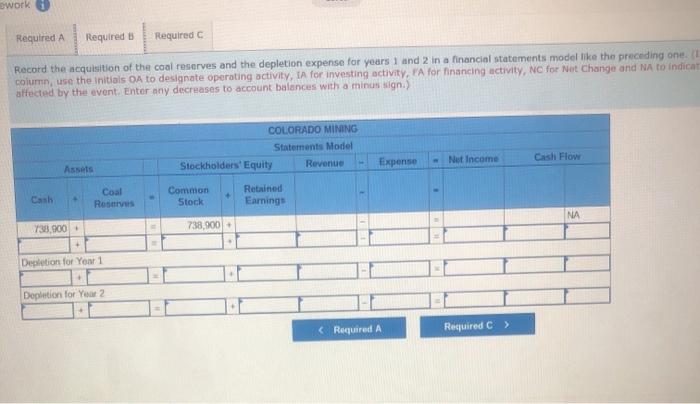

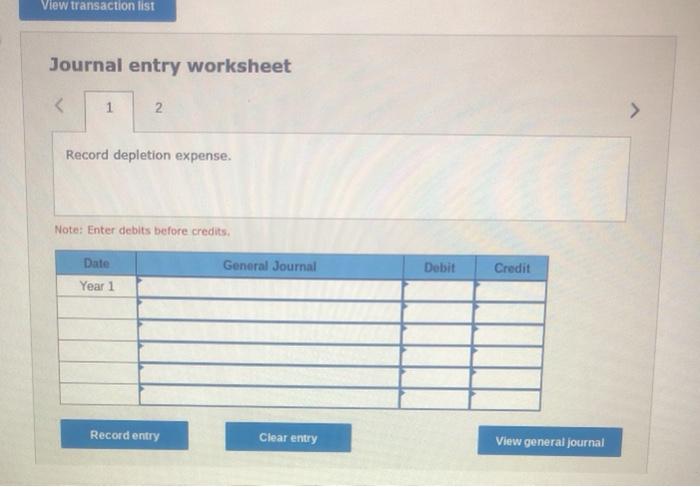

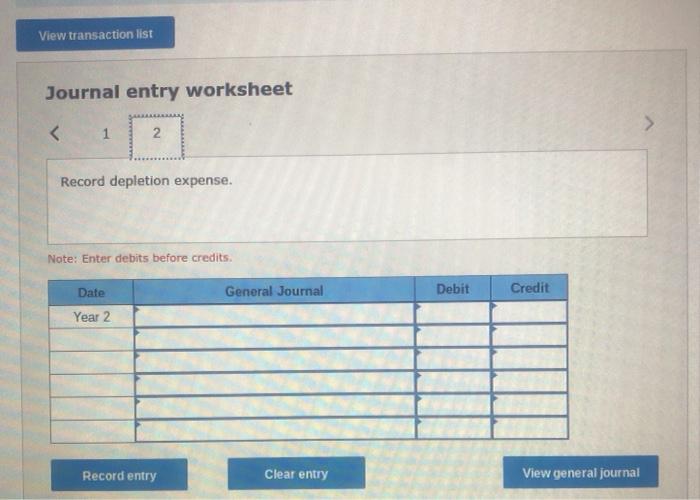

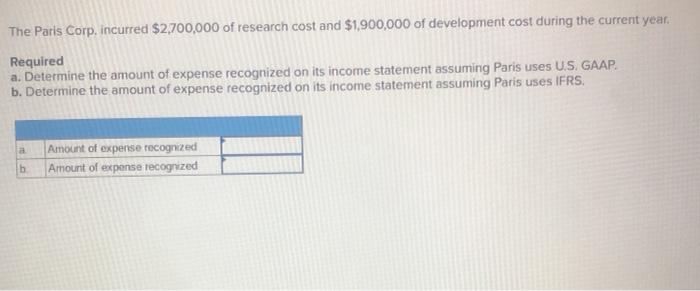

On January 1. Year 1, Poultry Processing Company purchased a freezer and related installation equipment for $69,600. The equipment had a three-year estimated life with a $3,900 salvage value Straight-line depreciation was used. At the beginning of Year 3, Poultry Processing revised the expected life of the asset to four years father than three years. The salvage value was revised to $2,900 Required Compute the depreciation expense for each of the four years, Year 1-Year 4. Depreciation Expense Year Year 2 Year 3 Year 4 On January 1. Yourt, Webb Construction Company overhauled four cranes, resulting in a slight increase in the life of the cranes. Such overhauls occur regularly at two year intervals and have been treated as a maintenance expense in the past. Management is considering whether to capitalize this year's $22,500 cash cost in the Cranes asset account or to expense it as a maintenance expense. Assume that the cranes have a remaining useful life of two years and no expected salvage value. Assume straight line depreciation Required a. Determine the amount of additional depreciation expense Webb would recognize in Year and Year 2 the cost were capitalized in the Cranes account b. Determine the amount of expense Webb would recognize in Year 1 and Year 2 if the cost were recognized as maintenance expense c. Determine the effect of the overhaul on cash flow from operating activities for Year 1 and Year 2 in the cost were capitalized and expensed through depreciation charges d. Determine the effect of the overhaul on cash flow from operating activities for Yeart and Year 2 if the cost were recognized as maintenance expense Year Vear 2 Depreciation expense Maintenance Operating activities dating Colorado Mining paid $642,900 to acquire a mine with 775,000 tons of coal reserves. The following statements model reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 406,875 tons of coal in Year 1 and 348,750 tons In Year 2 Rov Exp: Not Inc Cash Flow Cash 738,900 Assets Coal Res NA Com. Stk 738,900 Equity Ret. Earn + NA NA NA NA NA Required: a. Compute the depletion charge per unit. b. Record the acquisition of the coal reserves and the depletion expense for years and 2 in a financial statements model like the preceding one c. Prepare the general journal entries to record the depletion expense for years 1 and 2 Complete this question by entering your answers in the tabs below. Required Required Required Compute the depletion charge per unit (round your answer to two decimal places) Depletion har per unit Required B work Required A Required B Required Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model like the preceding one. column, use the initials OA to designate operating activity, IA for investing activity, PA for financing activity, NC for Net Change and NA to indicat affected by the event. Enter any decreases to account balances with a minus sign.) COLORADO MINING Statements Model Stockholders' Equity Revenue Cash Flow Expense - Nut Income Coal Ros Common Stock Retained Earnings NA 738.900 738,900 Deletion for Your 1 Depletion for Year 2 View transaction list Journal entry worksheet