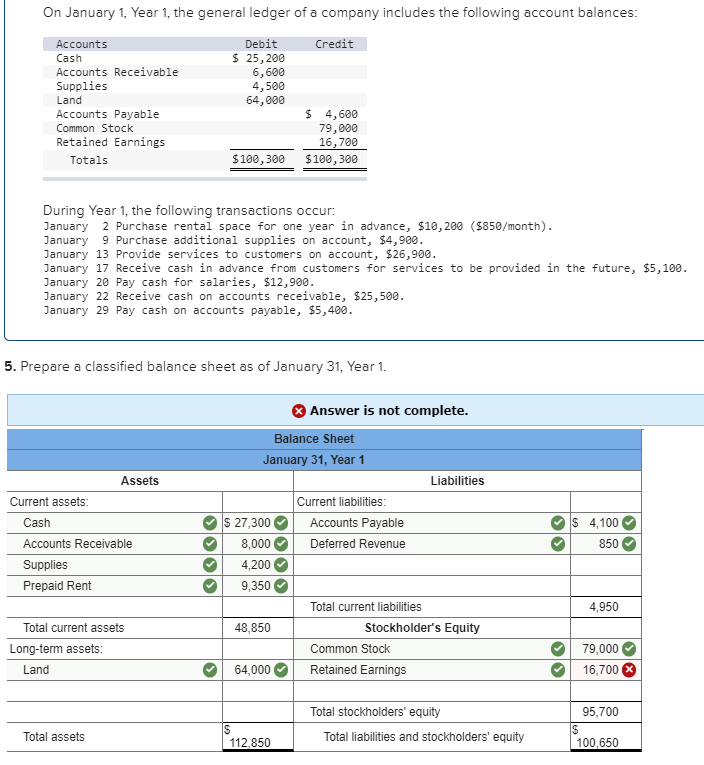

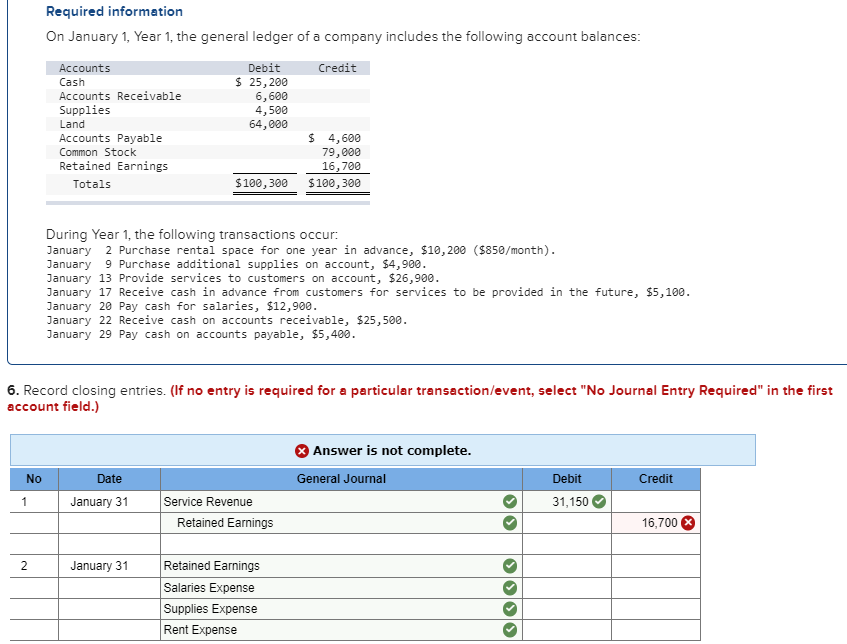

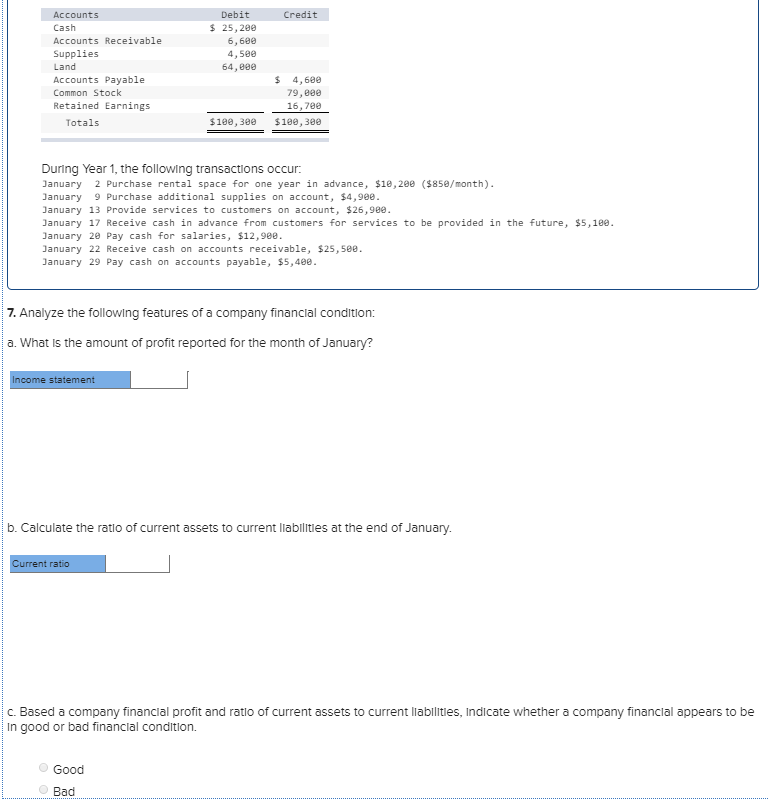

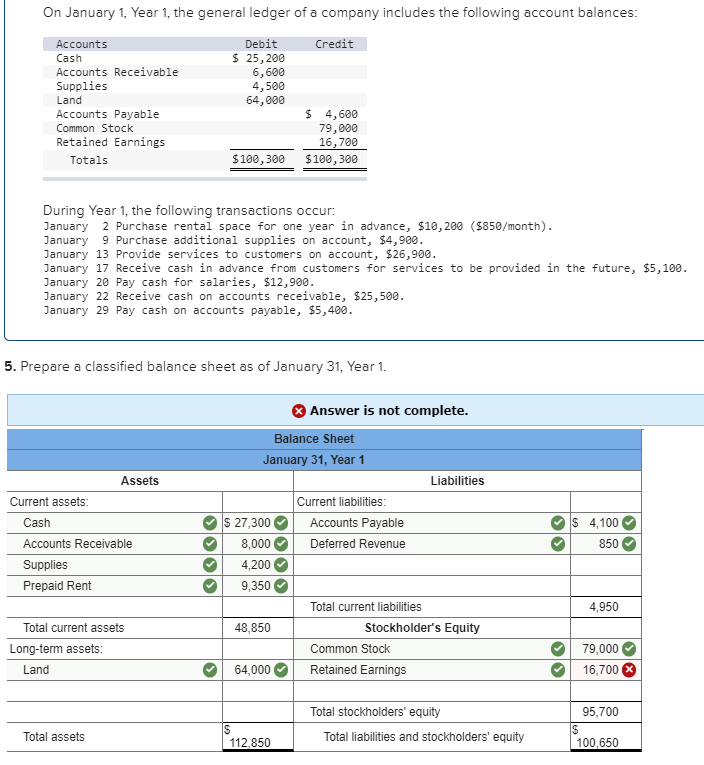

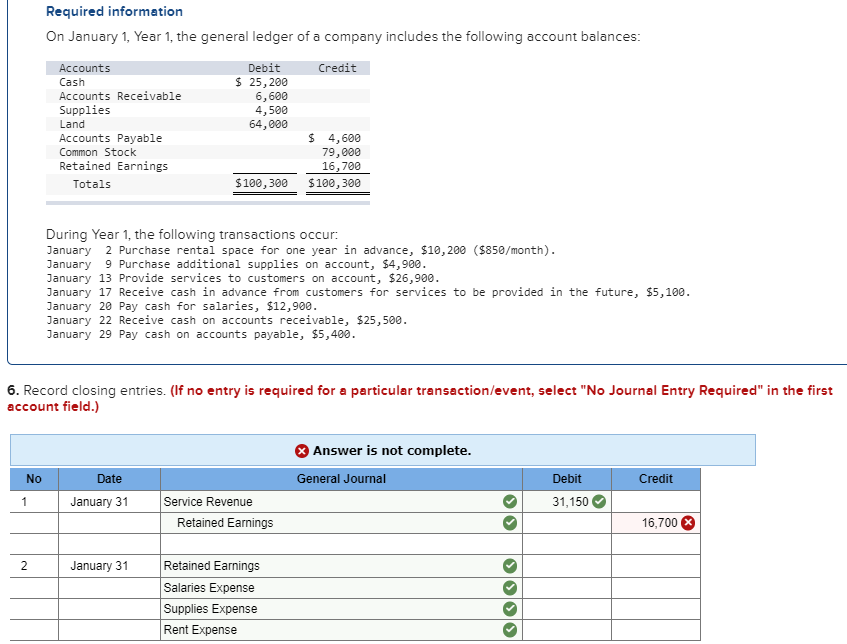

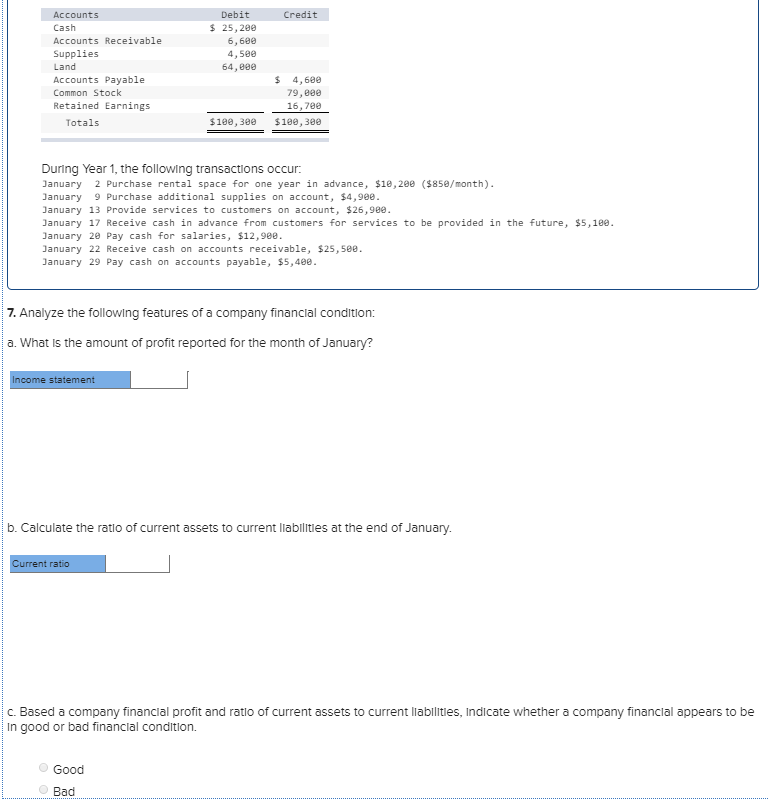

On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25,200 6,600 4,500 64,000 $ 4,600 79,000 16,700 $100,300 $100,300 During Year 1, the following transactions occur January 2 Purchase rental space for one year in advance, $10,200 ($850/month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,900. January 17 Receive cash in advance from customers for services to be provided in the future, $5,100. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. 5. Prepare a classified balance sheet as of January 31, Year 1. % Answer is not complete. Balance Sheet January 31, Year 1 Liabilities Assets Current assets: Cash Accounts Receivable Supplies Prepaid Rent Current liabilities: Accounts Payable Deferred Revenue $ 4,100 850 $ 27,300 8,000 4,200 9,350 4,950 48,850 Total current assets Long-term assets: Land Total current liabilities Stockholder's Equity Common Stock Retained Earnings 79,000 16,700 64,000 95,700 Total stockholders' equity Total liabilities and stockholders' equity Total assets 112,850 100,650 Required information On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Debit $ 25,200 6,600 4,500 64,000 Land Accounts Payable Common Stock Retained Earnings Totals $ 4,600 79,000 16,700 $100,300 $100,300 During Year 1, the following transactions occur: January 2 Purchase rental space for one year in advance, $10,200 ($850/month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,900. January 17 Receive cash in advance from customers for services to be provided in the future, $5,100. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. 6. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No General Journal Credit Date January 31 Debit 31,150 Service Revenue Retained Earnings 16,700 X January 31 Retained Earnings Salaries Expense Supplies Expense Rent Expense Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25, 200 6,600 4,500 64,000 $ 4,600 79,000 16.789 $100,300 $100,300 During Year 1, the following transactions occur January 2 Purchase rental space for one year in advance, $10,200 ($850/month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,980. January 17 Receive cash in advance from customers for services to be provided in the future, $5,180. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. 7. Analyze the following features of a company financial condition: a. What is the amount of profit reported for the month of January? Income statement b. Calculate the ratio of current assets to current liabilities at the end of January. Current ratio C. Based a company financial profit and ratio of current assets to current liabilities, indicate whether a company financial appears to be In good or bad financial condition. Good Bad