Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Year 4, Domino purchased 100 percent of the outstanding common shares of Chess for 50,000 foreign currency units (FC). Chess is

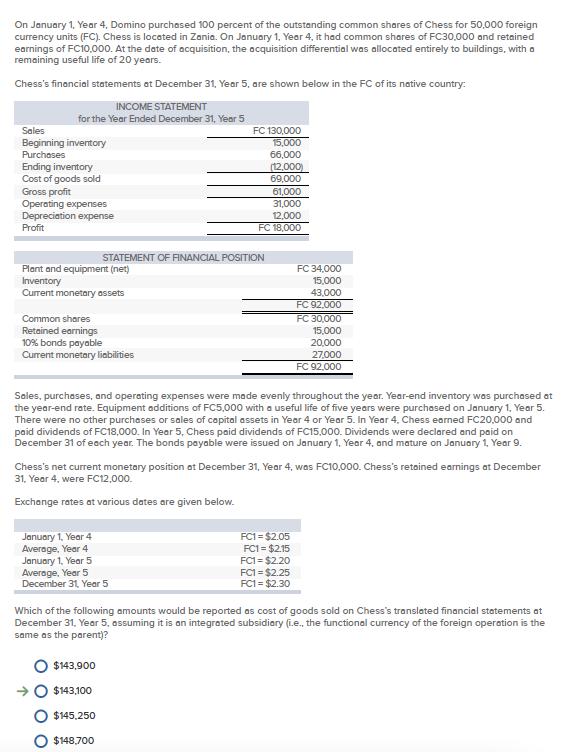

On January 1, Year 4, Domino purchased 100 percent of the outstanding common shares of Chess for 50,000 foreign currency units (FC). Chess is located in Zania. On January 1, Year 4, it had common shares of FC30.000 and retained earnings of FC10.000. At the date of acquisition, the ocquisition differential was allocated entirely to buildings, with a remaining useful life of 20 years. Chess's financial statements et December 31, Year 5, are shown below in the FC of its native country: INCOME STATEMENT for the Year Ended December 31, Year 5 Sales Beginning inventory FC 130,000 15,000 Purchases 66,000 (12,000) 69,000 Ending inventory Cost of goods sold Gross profit Operating expenses Depreciation expense 61,000 31,000 12,000 Profit FC 18,000 STATEMENT OF FINANCIAL POSITION Plant and equipment (net) Inventory Current monetary assets FC 34,000 15,000 43,000 FC 92.000 Common shares FC 30,000 15,000 Retained earnings 10% bonds payable 20,000 27,000 FC 92,000 Current monetary liabilities Soles, purchases, and operating expenses were made evenly throughout the year. Year-end inventory was purchased at the year-end rate. Equipment odditions of FC5,000 with a useful life of five years were purchased on January 1, Year 5. There were no other purcheses or sales of capital assets in Year 4 or Year 5. In Year 4, Chess earned FC20,000 and paid dividends of FC18,000. In Year 5, Chess paid dividends of FC15,000. Dividends were declared and paid on December 31 of each year. The bonds payable were issued on January 1, Year 4, and mature on January 1, Year 9. Chess's net current monetary position ot December 31, Year 4, was FC10,000. Chess's retained earnings at December 31, Year 4, were FC12,000. Exchange rates at various dates are given below. January 1, Year 4 Average, Year 4 January 1, Year 5 Average, Year 5 December 31, Year 5 FC1= $2.05 FC1 = $2.15 FC1= $2.20 FC1 = $2.25 FC1 = $2.30 Which of the following amounts would be reported as cost of goods sold on Chess's translated financial statements at December 31, Year 5, ossuming it is on integrated subsidiary (ie., the functional currency of the foreign operation is the same as the parent)? $143,900 $143,100 $145,250 $148,700

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The results and financial position of an entity whose functional currency is not the currency of a h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started