Answered step by step

Verified Expert Solution

Question

1 Approved Answer

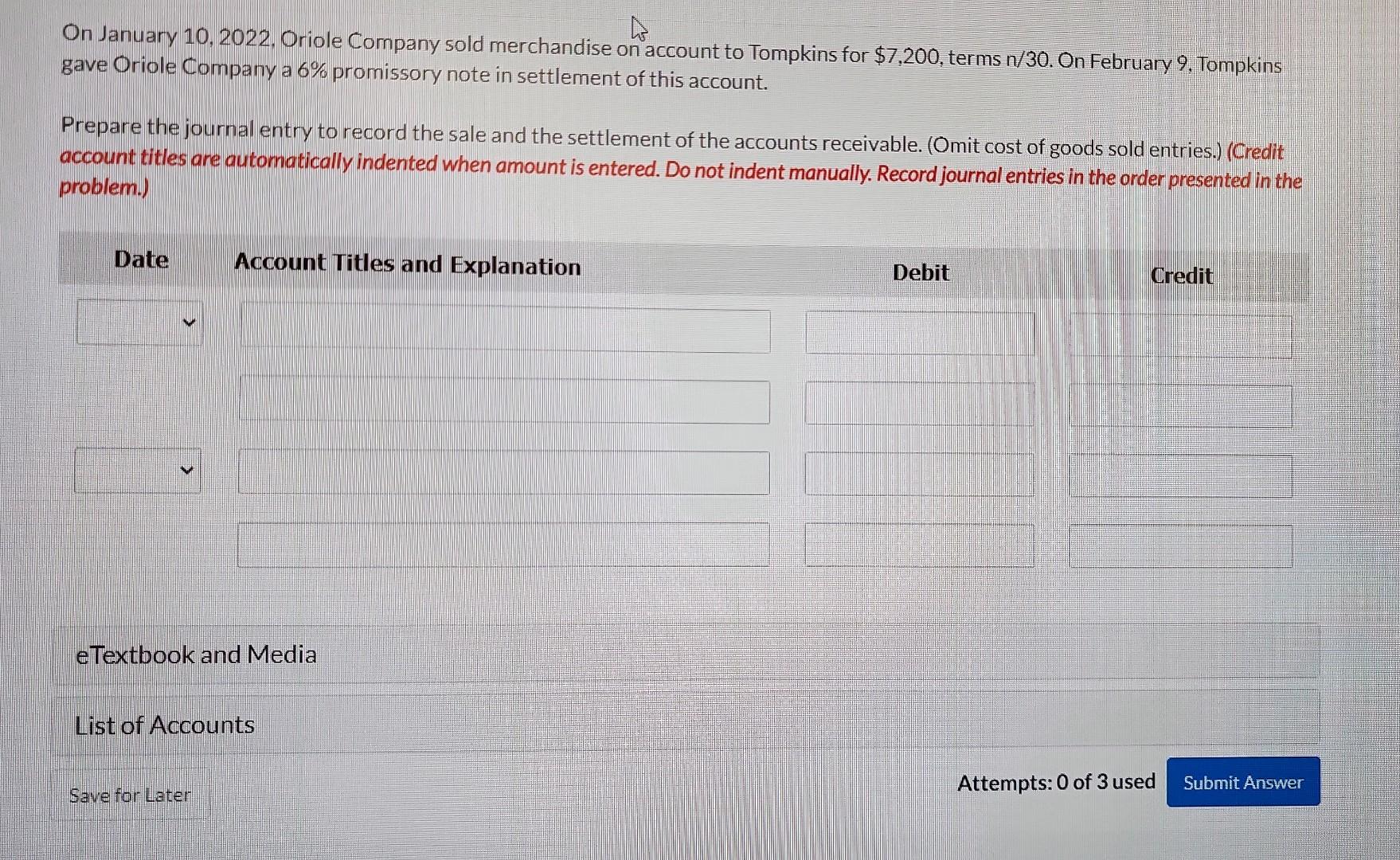

On January 10, 2022, Oriole Company sold merchandise on account to Tompkins for $7,200, terms n/30. On February 9 , Tompkins gave Oriole Company a

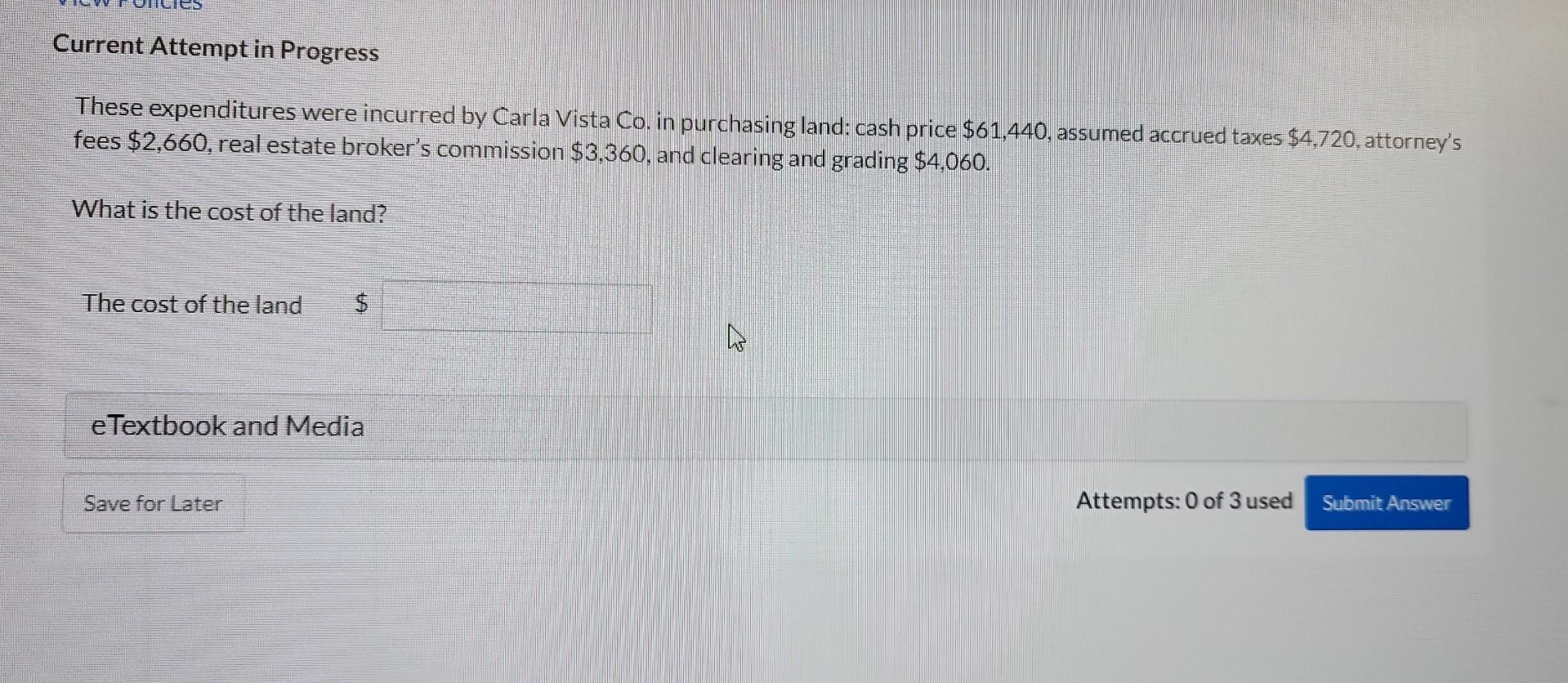

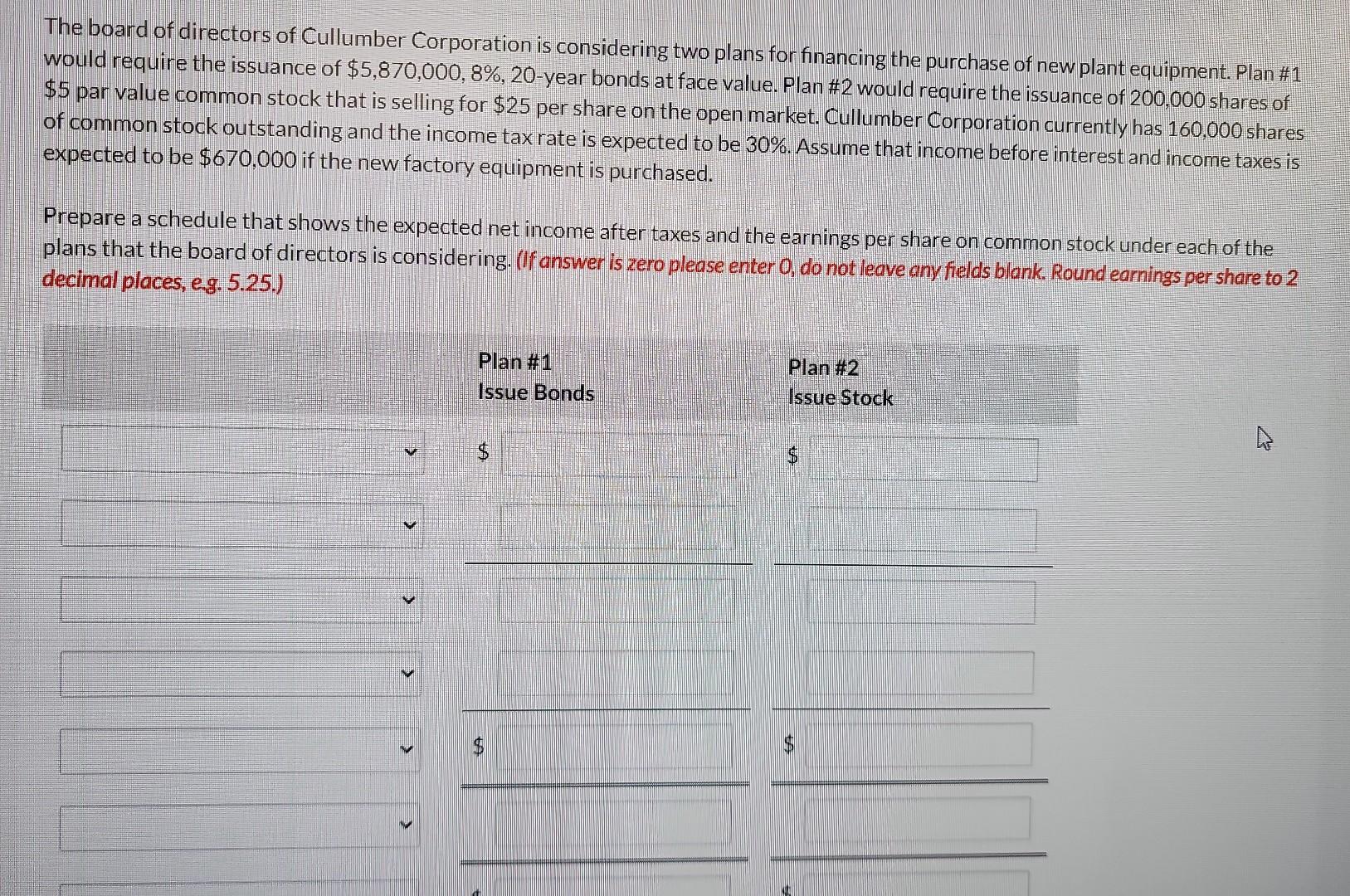

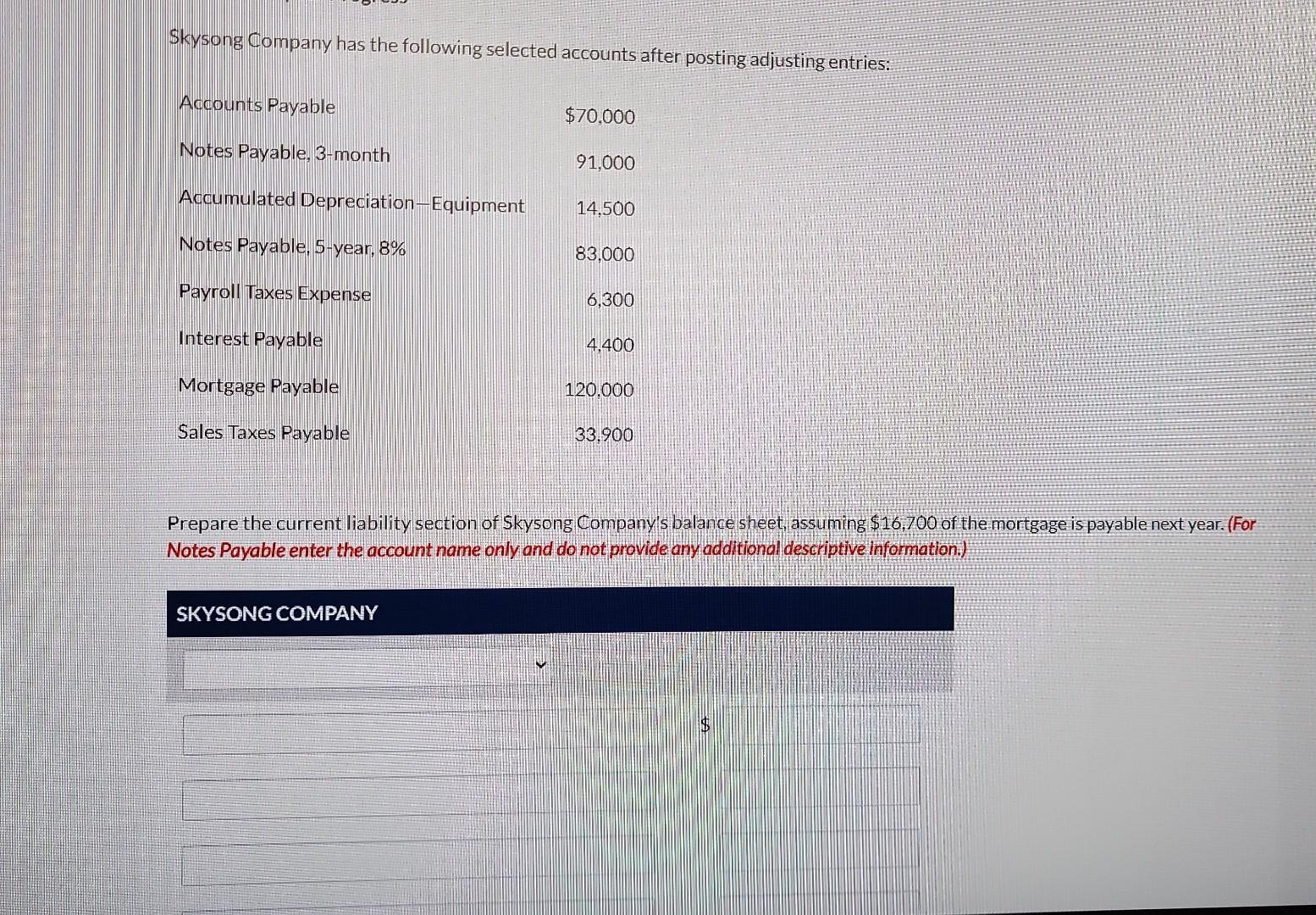

On January 10, 2022, Oriole Company sold merchandise on account to Tompkins for $7,200, terms n/30. On February 9 , Tompkins gave Oriole Company a 6% promissory note in settlement of this account. Prepare the journal entry to record the sale and the settlement of the accounts receivable. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) eTextbook and Media Current Attempt in Progress These expenditures were incurred by Carla Vista Co. in purchasing land: cash price $61,440, assumed accrued taxes $4,720, attorney's fees $2,660, real estate broker's commission $3,360, and clearing and grading $4,060. What is the cost of the land? eTextbook and Media Attempts: 0 of 3 used The board of directors of Cullumber Corporation is considering two plans for financing the purchase of new plant equipment. Plan \#1 would require the issuance of $5,870,000,8%,20-year bonds at face value. Plan \#2 would require the issuance of 200,000 shares of $5 par value common stock that is selling for $25 per share on the open market. Cullumber Corporation currently has 160,000 shares of common stock outstanding and the income tax rate is expected to be 30%. Assume that income before interest and income taxes is expected to be $670,000 if the new factory equipment is purchased. Prepare a schedule that shows the expected net income after taxes and the earnings per share on common stock under each of the plans that the board of directors is considering. (If answer is zero please enter 0 , do not leave any fields blank. Round earnings per share to 2 decimal places, eg. 5.25.) Skysong Company has the following selected accounts after posting adjusting entries: Prepare the current liability section of Skysong Company's balance sheet, assuming $16,700 of the mortgage is payable next year. (For Notes Payable enter the account name only and do not provide any additional descriptive information.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started