Answered step by step

Verified Expert Solution

Question

1 Approved Answer

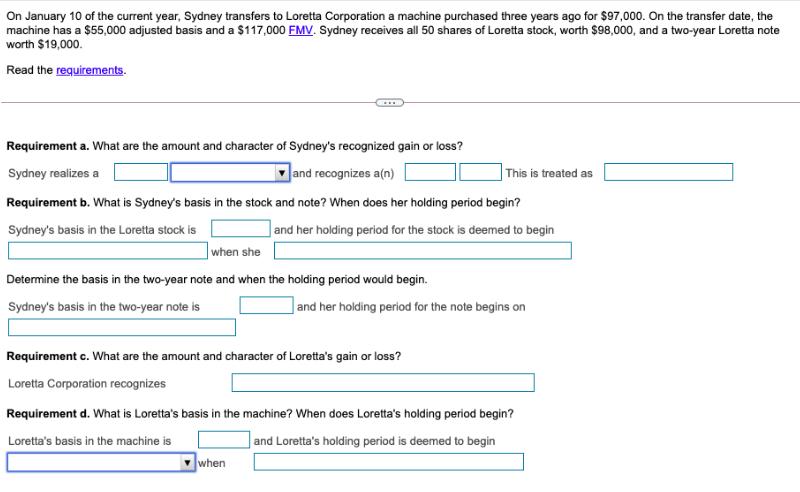

On January 10 of the current year, Sydney transfers to Loretta Corporation a machine purchased three years ago for $97,000. On the transfer date,

On January 10 of the current year, Sydney transfers to Loretta Corporation a machine purchased three years ago for $97,000. On the transfer date, the machine has a $55,000 adjusted basis and a $117,000 FMV. Sydney receives all 50 shares of Loretta stock, worth $98,000, and a two-year Loretta note worth $19,000. Read the requirements. Requirement a. What are the amount and character of Sydney's recognized gain or loss? Sydney realizes a and recognizes a(n) This is treated as Requirement b. What is Sydney's basis in the stock and note? When does her holding period begin? Sydney's basis in the Loretta stock is and her holding period for the stock is deemed to begin when she Determine the basis in the two-year note and when the holding period would begin. Sydney's basis in the two-year note is and her holding period for the note begins on Requirement c. What are the amount and character of Loretta's gain or loss? Loretta Corporation recognizes Requirement d. What is Loretta's basis in the machine? When does Loretta's holding period begin? Loretta's basis in the machine is and Loretta's holding period is deemed to begin when

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Sydneys Recognized Gain or Loss Sydney realizes a gain or loss when she transfers the machine to L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started