Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 10 of the current year, Vicky transfers to Loretta Corporation a machine purchased three years ago for $97,000. On the transfer date,

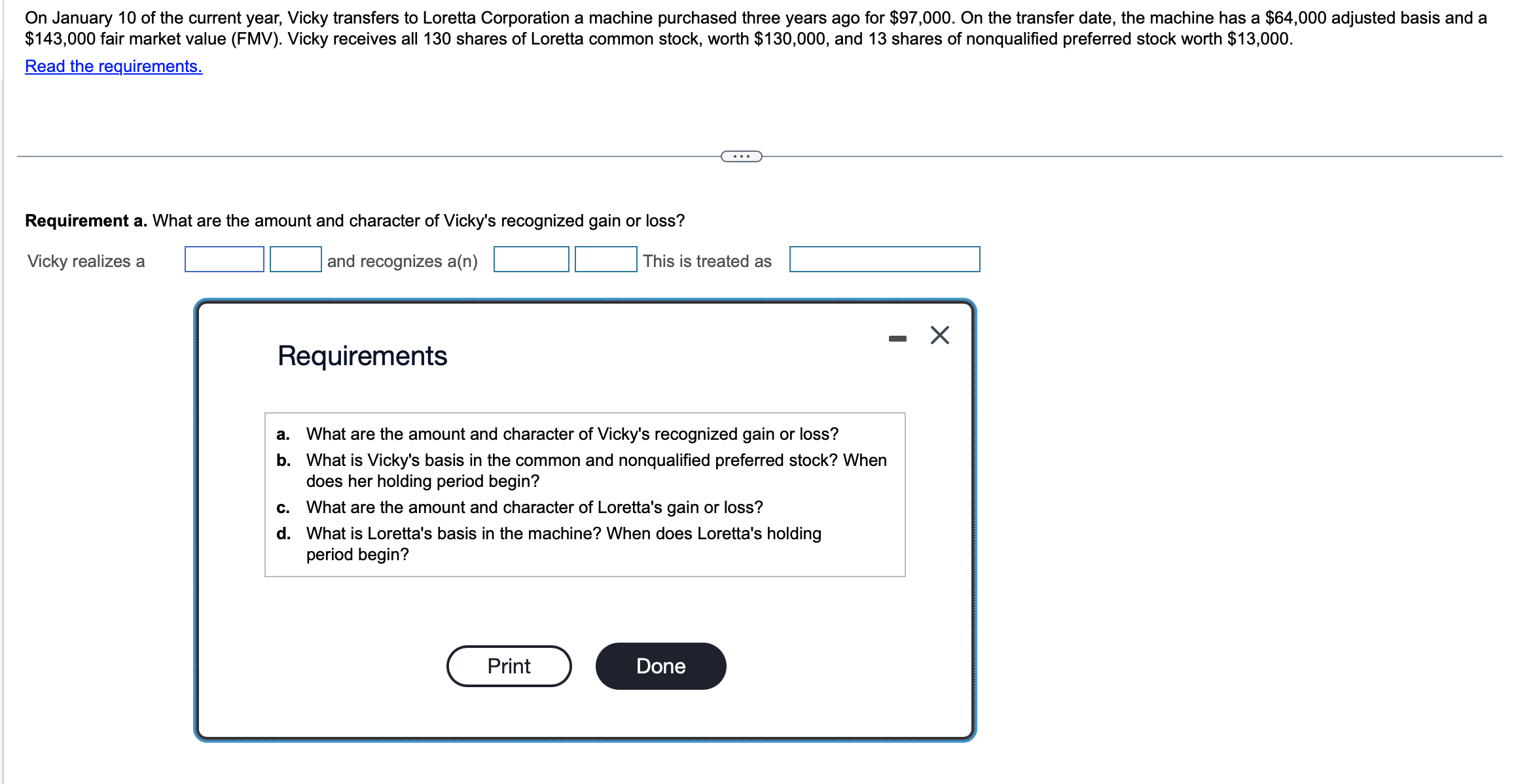

On January 10 of the current year, Vicky transfers to Loretta Corporation a machine purchased three years ago for $97,000. On the transfer date, the machine has a $64,000 adjusted basis and a $143,000 fair market value (FMV). Vicky receives all 130 shares of Loretta common stock, worth $130,000, and 13 shares of nonqualified preferred stock worth $13,000. Read the requirements. Requirement a. What are the amount and character of Vicky's recognized gain or loss? Vicky realizes a and recognizes a(n) Requirements a. What are the amount and character of Vicky's recognized gain or loss? b. What is Vicky's basis in the common and nonqualified preferred stock? When does her holding period begin? c. d. This is treated as What are the amount and character of Loretta's gain or loss? What is Loretta's basis in the machine? When does Loretta's holding period begin? Print Done X

Step by Step Solution

★★★★★

3.45 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the image Vicky transfers a machine with an adjusted basis of 64000 to Loretta Corporation In return she receives ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started