Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 10, of Year 1, D created an irrevocable trust (T). The trust purchased a life insurance policy on the life of D.

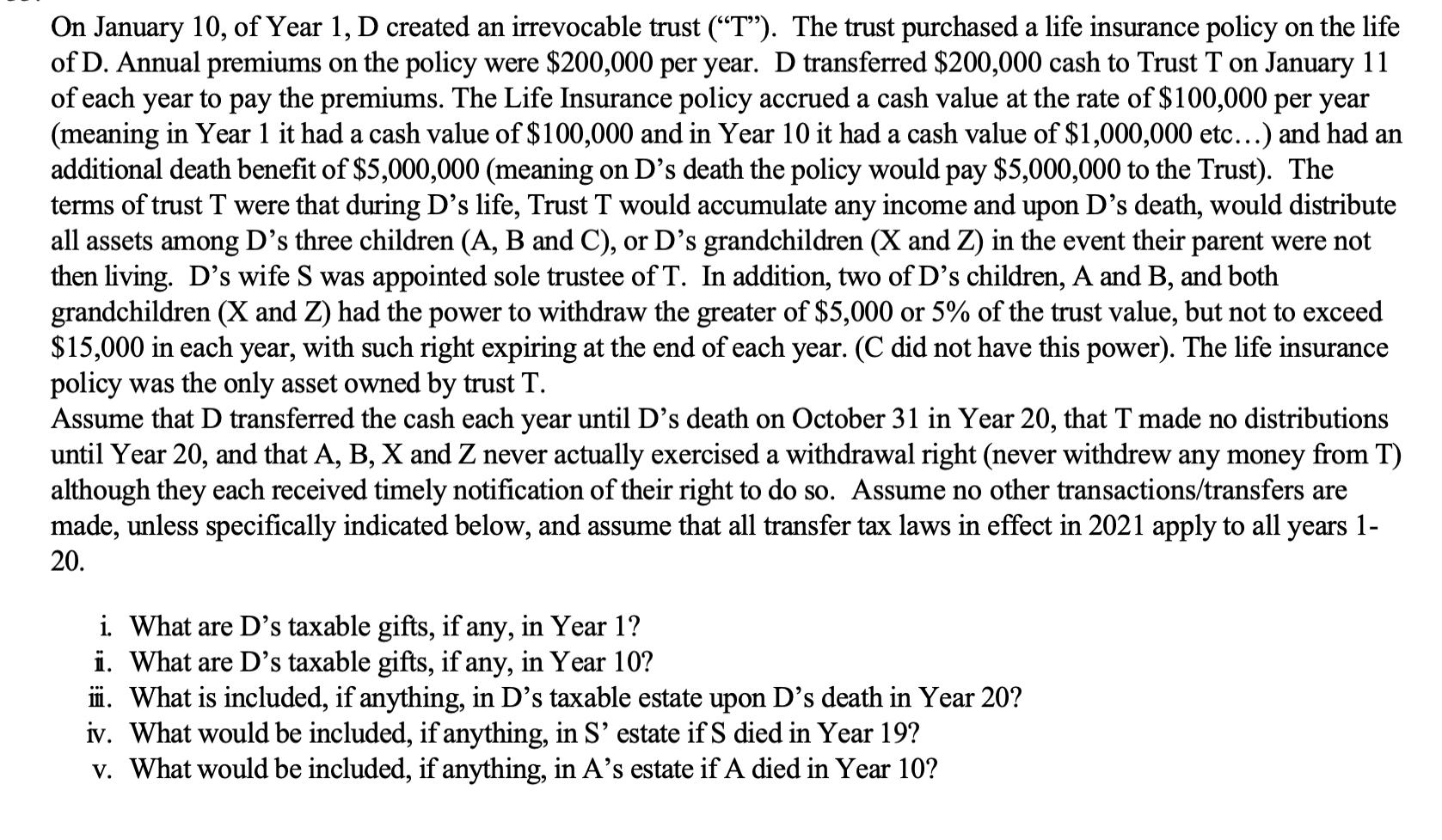

On January 10, of Year 1, D created an irrevocable trust ("T"). The trust purchased a life insurance policy on the life of D. Annual premiums on the policy were $200,000 per year. D transferred $200,000 cash to Trust T on January 11 of each year to pay the premiums. The Life Insurance policy accrued a cash value at the rate of $100,000 per year (meaning in Year 1 it had a cash value of $100,000 and in Year 10 it had a cash value of $1,000,000 etc...) and had an additional death benefit of $5,000,000 (meaning on D's death the policy would pay $5,000,000 to the Trust). The terms of trust T were that during D's life, Trust T would accumulate any income and upon D's death, would distribute all assets among D's three children (A, B and C), or D's grandchildren (X and Z) in the event their parent were not then living. D's wife S was appointed sole trustee of T. In addition, two of D's children, A and B, and both grandchildren (X and Z) had the power to withdraw the greater of $5,000 or 5% of the trust value, but not to exceed $15,000 in each year, with such right expiring at the end of each year. (C did not have this power). The life insurance policy was the only asset owned by trust T. Assume that D transferred the cash each year until D's death on October 31 in Year 20, that T made no distributions until Year 20, and that A, B, X and Z never actually exercised a withdrawal right (never withdrew any money from T) although they each received timely notification of their right to do so. Assume no other transactions/transfers are made, unless specifically indicated below, and assume that all transfer tax laws in effect in 2021 apply to all years 1- 20. i. What are D's taxable gifts, if any, in Year 1? i. What are D's taxable gifts, if any, in Year 10? iii. What is included, if anything, in D's taxable estate upon D's death in Year 20? iv. What would be included, if anything, in S' estate if S died in Year 19? v. What would be included, if anything, in A's estate if A died in Year 10?

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

i Transfers made to an irrevocable trust are subject to gift tax Based on Crummy Powers case law cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started