Question

on january 1,2018 fast delivery service purchased a truck at a cost of $67,000. before placing The truck in service, thought spent $2200 painting it,

on january 1,2018 fast delivery service purchased a truck at a cost of $67,000. before placing The truck in service, thought spent $2200 painting it, $500 replacing tires, and $5000 overhauling the engine. The truck should remain in service for five years and have a residual value of $5100. The truck's annual mileage is expected to be 20,000 miles in each of the first four years and 12,800 miles in the fifth year-92800 Miles in total. And deciding which depreciation method to use Carl Thomas the general manager request a depreciation schedule for each of the depreciation methods straight line units of production and double to Kliney balance

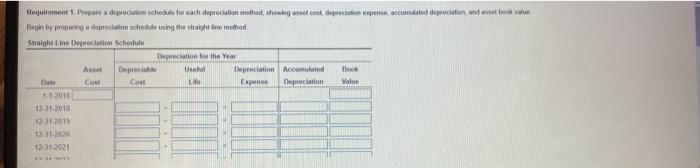

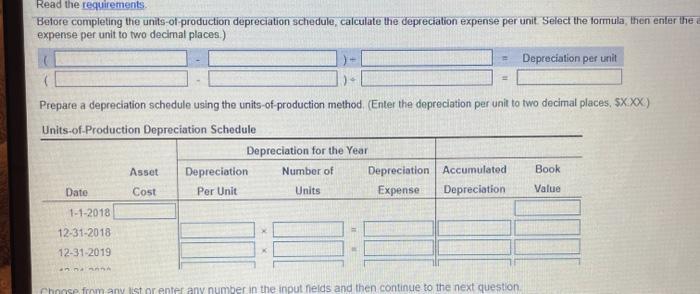

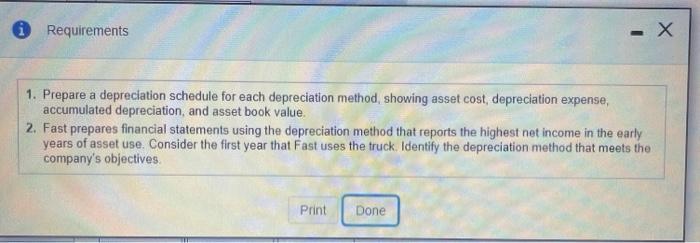

Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value Begin by preparing a depreciation schedule using the straight line method Straight Line Depreciation Schedule Date 1-1-2018 12-31-2018 12:31-2019 12-31-2020 12:31-2021 www Asset Cost Depreciable Cost Depreciation for the Year Useful Life - Depreciation Accumulated Book Expense Depreciation Value

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of cost of delivery truck Cost 67000 cost of painting 2200 cost of replacing tires 500 c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started