Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1,2020, ABC Company acquired 80 percent of DEF Company's Common Stock for P400,000 cash. At that date, DEF reported common stock outstanding

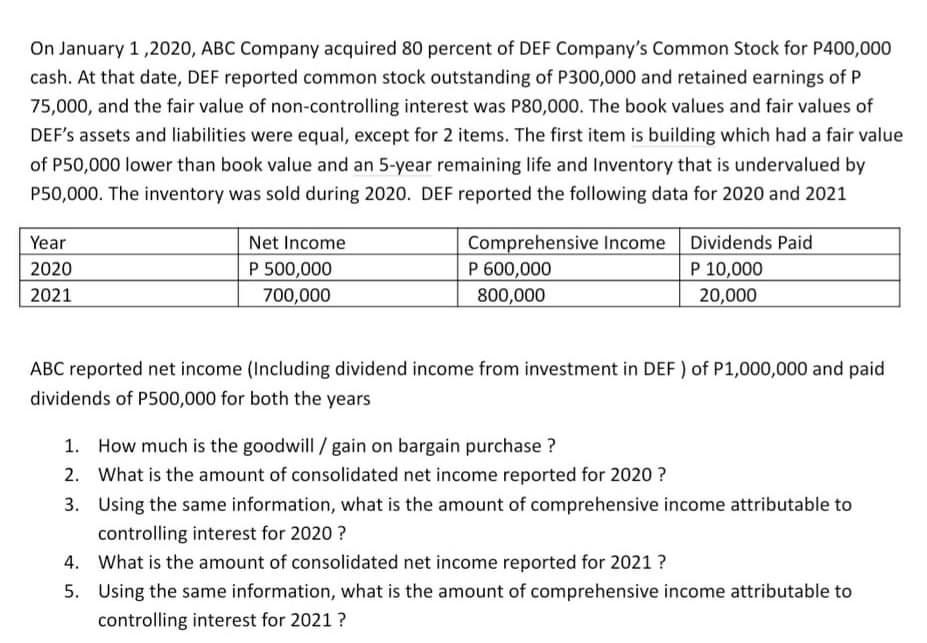

On January 1,2020, ABC Company acquired 80 percent of DEF Company's Common Stock for P400,000 cash. At that date, DEF reported common stock outstanding of P300,000 and retained earnings of P 75,000, and the fair value of non-controlling interest was P80,000. The book values and fair values of DEF's assets and liabilities were equal, except for 2 items. The first item is building which had a fair value of P50,000 lower than book value and an 5-year remaining life and Inventory that is undervalued by P50,000. The inventory was sold during 2020. DEF reported the following data for 2020 and 2021 Year 2020 2021 Net Income P 500,000 700,000 Comprehensive Income P 600,000 800,000 Dividends Paid P 10,000 20,000 ABC reported net income (Including dividend income from investment in DEF) of P1,000,000 and paid dividends of P500,000 for both the years 1. How much is the goodwill / gain on bargain purchase ? 2. What is the amount of consolidated net income reported for 2020? 3. Using the same information, what is the amount of comprehensive income attributable to controlling interest for 2020? 4. What is the amount of consolidated net income reported for 2021? 5. Using the same information, what is the amount of comprehensive income attributable to controlling interest for 2021?

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of goodwill Particulars Amount Outstanding common stock 300000 Retained earnings 75000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started