Answered step by step

Verified Expert Solution

Question

1 Approved Answer

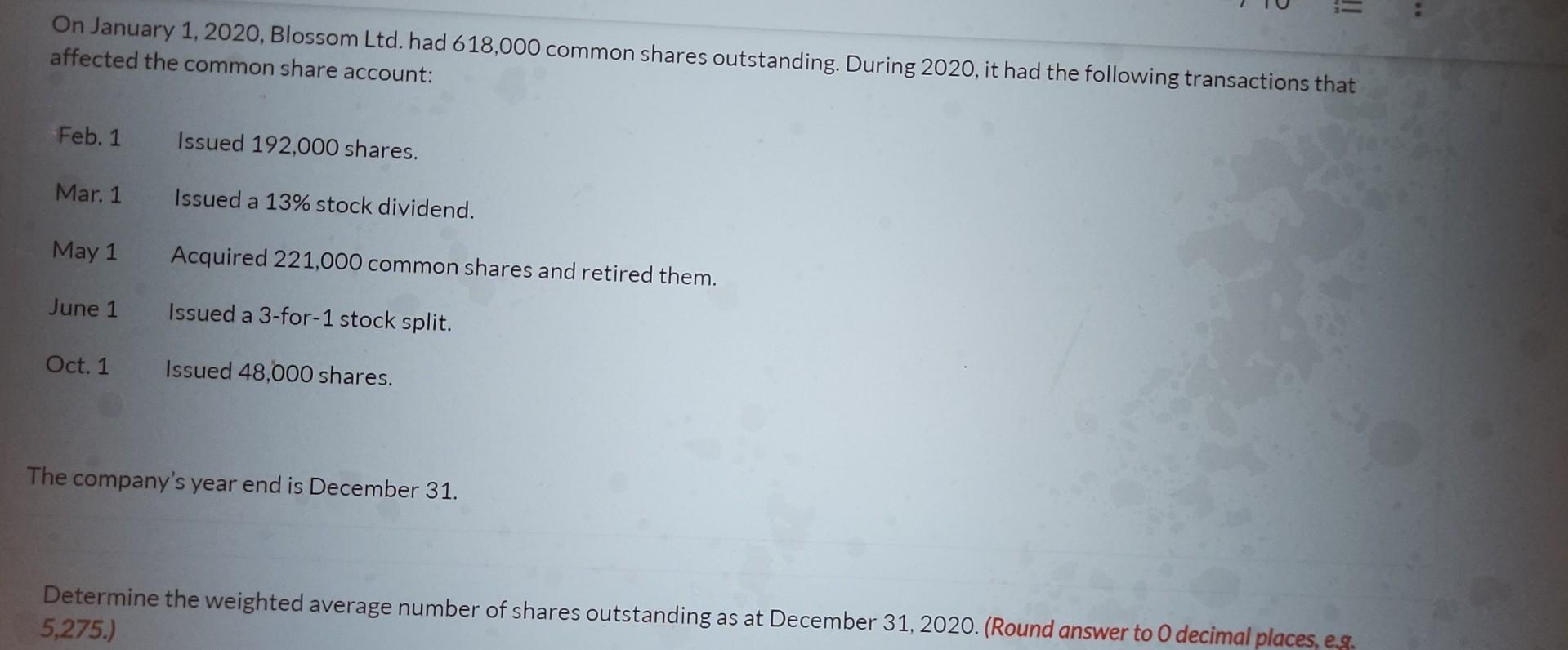

On January 1,2020, Blossom Ltd. had 618,000 common shares outstanding. During 2020, it had the following transactions that affected the common share account: Feb. 1

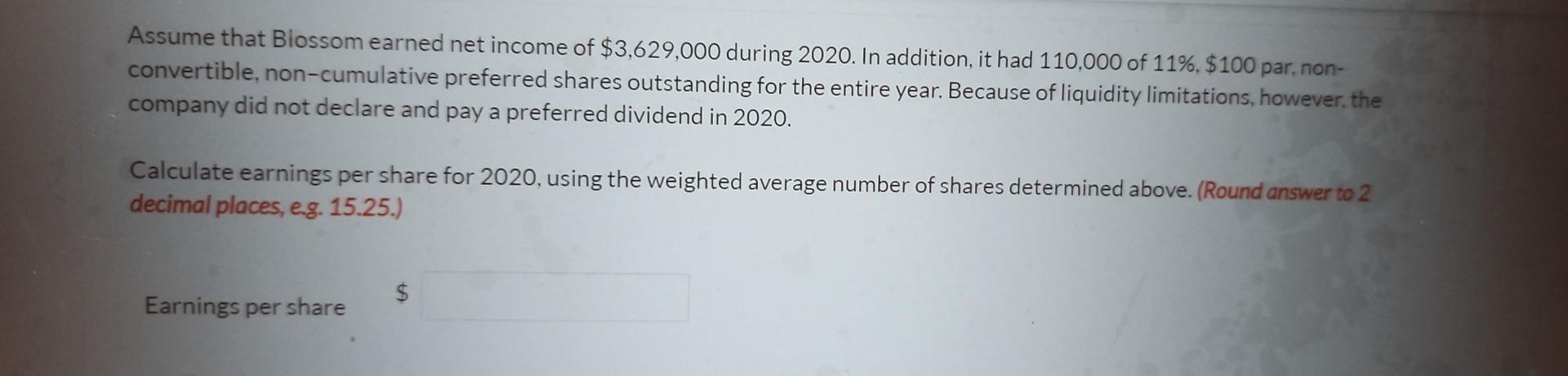

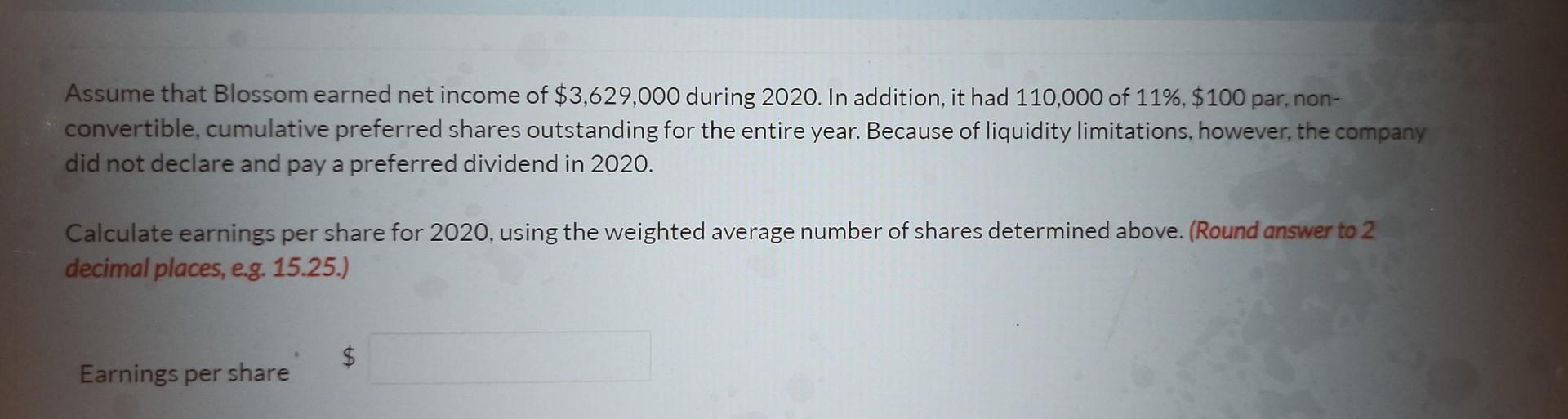

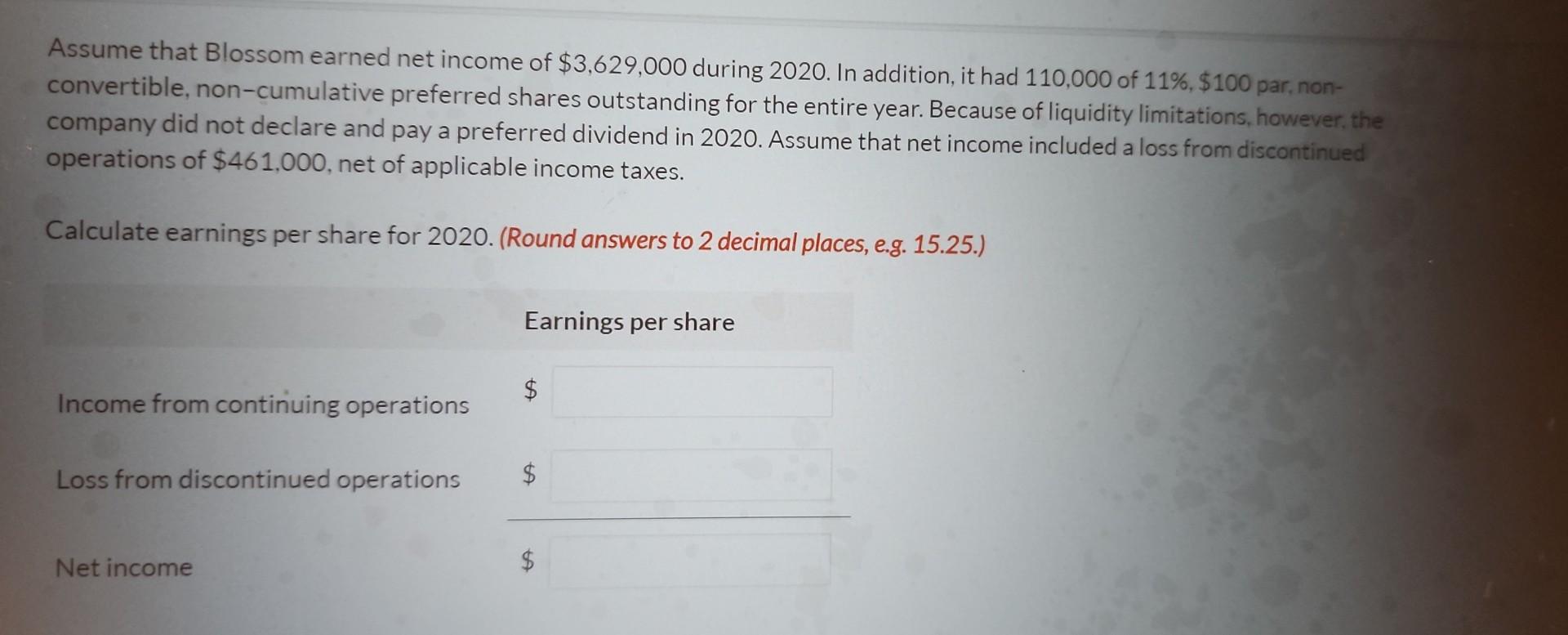

On January 1,2020, Blossom Ltd. had 618,000 common shares outstanding. During 2020, it had the following transactions that affected the common share account: Feb. 1 Issued 192,000 shares. Mar. 1 Issued a 13% stock dividend. May 1 Acquired 221,000 common shares and retired them. June 1 Issued a 3-for-1 stock split. Oct. 1 Issued 48,000 shares. The company's year end is December 31. Determine the weighted average number of shares outstanding as at December 31, 2020. (Round answer to 0 decimal places, e.c. 5,275.) Weighted average number of shares outstanding shares Assume that Biossom earned net income of \$3,629,000 during 2020. In addition, it had 110,000 of 11%,$100 par, nonconvertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Calculate earnings per share for 2020 , using the weighted average number of shares determined above. (Round answer to 2 decimal places, eg. 15.25.) Earnings per share Assume that Blossom earned net income of $3,629,000 during 2020 . In addition, it had 110,000 of 11%,$100 par, nonconvertible, cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Calculate earnings per share for 2020 , using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per share Assume that Blossom earned net income of \$3,629,000 during 2020. In addition, it had 110,000 of 11%,$100 par, nonconvertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Assume that net income included a loss from discontinued operations of $461,000, net of applicable income taxes. Calculate earnings per share for 2020 . (Round answers to 2 decimal places, e.g. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started