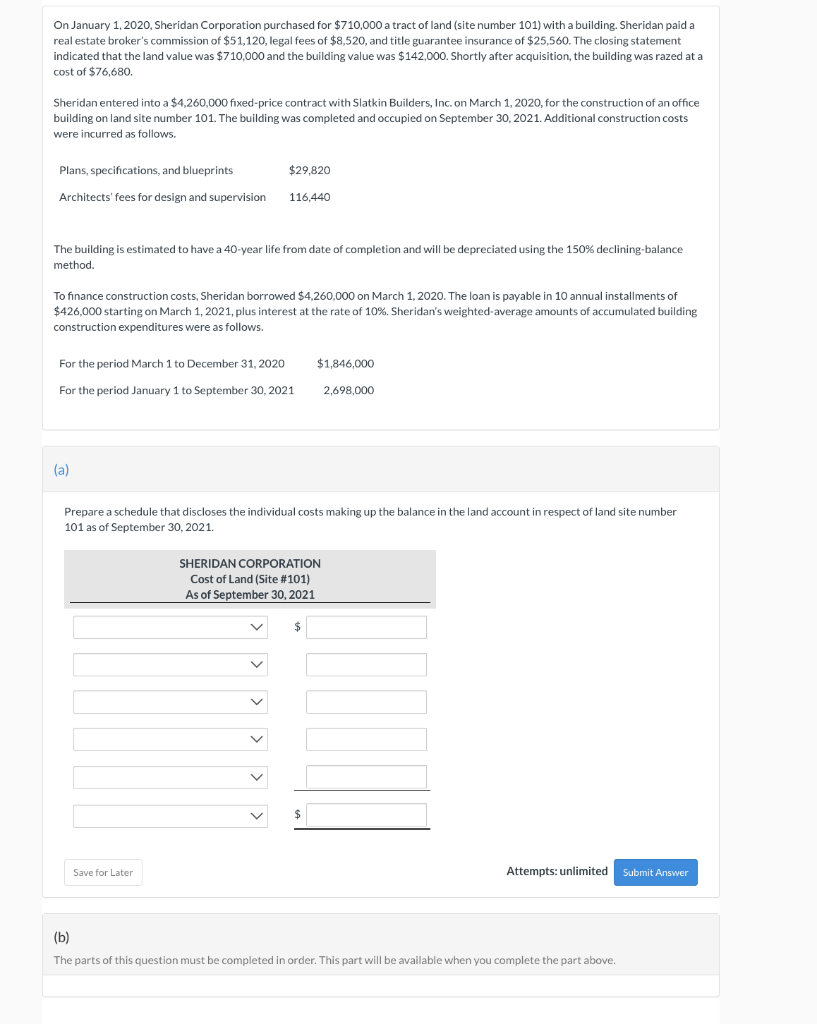

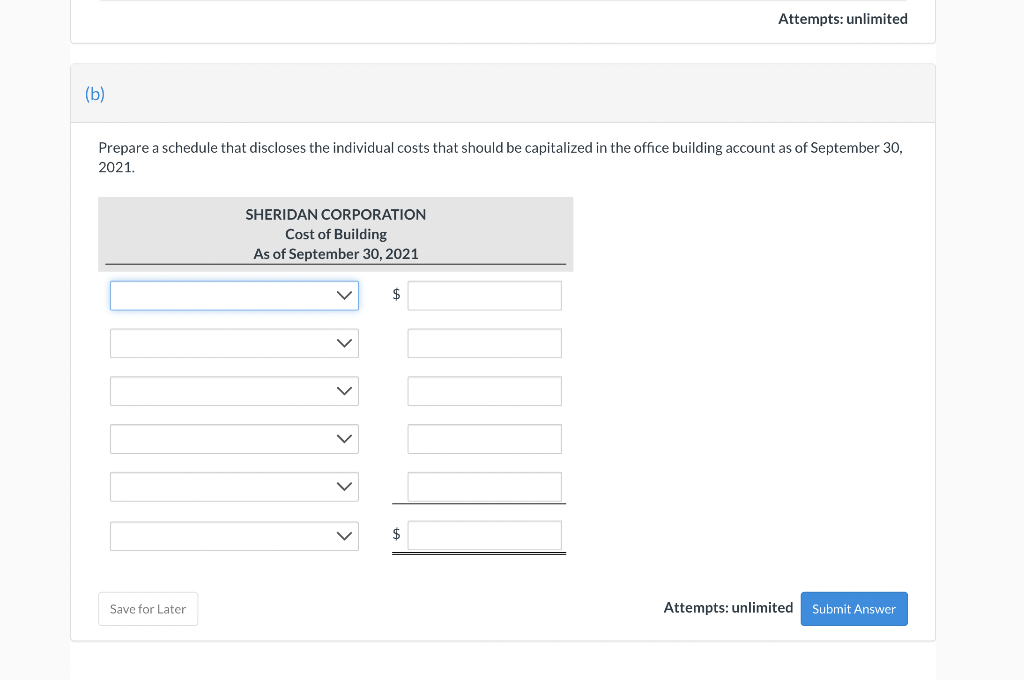

On January 1,2020, Sheridan Corporation purchased for $710,000 a tract of land (site number 101 ) with a building. Sheridan paid a real estate broker's commission of $51,120, legal fees of $8,520, and title guarantee insurance of $25,560. The closing statement indicated that the land value was $710,000 and the building value was $142,000. Shortly after acquisition, the building was razed at a cost of $76,680. Sheridan entered into a $4,260,000 fixed-price contract with Slatkin Builders, Inc. on March 1, 2020, for the construction of an office building on land site number 101 . The building was completed and occupied on September 30,2021 . Additional construction costs were incurred as follows. The building is estimated to have a 40 -year life from date of completion and will be depreciated using the 150% declining-balance method. To finance construction costs, Sheridan borrowed $4,260,000 on March 1, 2020. The loan is payable in 10 annual installments of $426,000 starting on March 1, 2021, plus interest at the rate of 10%. Sheridan's weighted-average amounts of accumulated building construction expenditures were as follows. (a) Prepare a schedule that discloses the individual costs making up the balance in the land account in respect of land site number 101 as of September 30, 2021. Attempts: unlimited (b) The parts of this question must be completed in order. This part will be available when you complete the part above. Prepare a schedule that discloses the individual costs that should be capitalized in the office building account as of September 30 , 2021. On January 1,2020, Sheridan Corporation purchased for $710,000 a tract of land (site number 101 ) with a building. Sheridan paid a real estate broker's commission of $51,120, legal fees of $8,520, and title guarantee insurance of $25,560. The closing statement indicated that the land value was $710,000 and the building value was $142,000. Shortly after acquisition, the building was razed at a cost of $76,680. Sheridan entered into a $4,260,000 fixed-price contract with Slatkin Builders, Inc. on March 1, 2020, for the construction of an office building on land site number 101 . The building was completed and occupied on September 30,2021 . Additional construction costs were incurred as follows. The building is estimated to have a 40 -year life from date of completion and will be depreciated using the 150% declining-balance method. To finance construction costs, Sheridan borrowed $4,260,000 on March 1, 2020. The loan is payable in 10 annual installments of $426,000 starting on March 1, 2021, plus interest at the rate of 10%. Sheridan's weighted-average amounts of accumulated building construction expenditures were as follows. (a) Prepare a schedule that discloses the individual costs making up the balance in the land account in respect of land site number 101 as of September 30, 2021. Attempts: unlimited (b) The parts of this question must be completed in order. This part will be available when you complete the part above. Prepare a schedule that discloses the individual costs that should be capitalized in the office building account as of September 30 , 2021