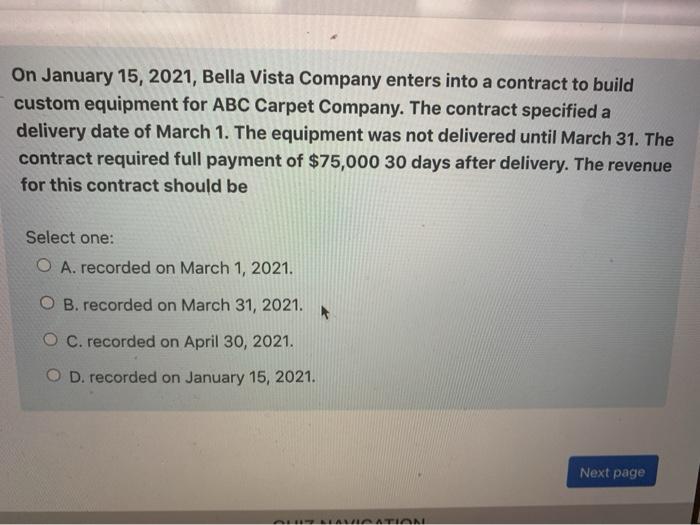

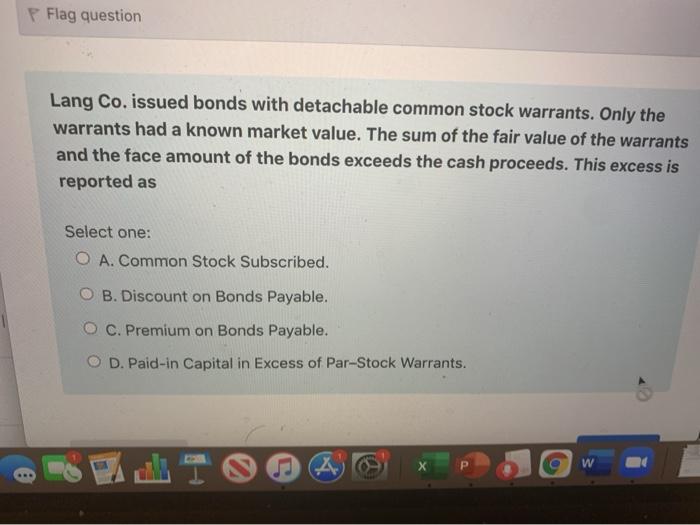

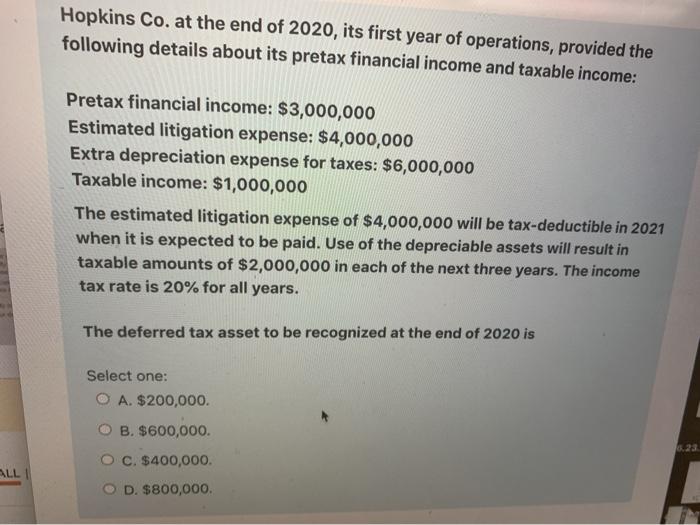

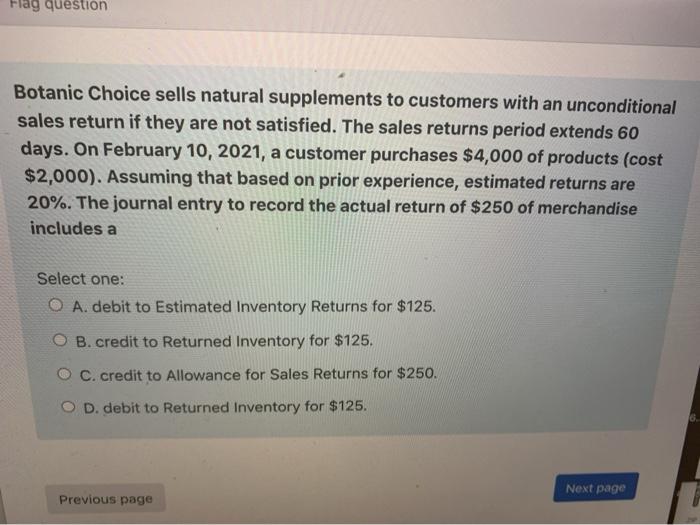

On January 15, 2021, Bella Vista Company enters into a contract to build custom equipment for ABC Carpet Company. The contract specified a delivery date of March 1. The equipment was not delivered until March 31. The contract required full payment of $75,000 30 days after delivery. The revenue for this contract should be Select one: O A. recorded on March 1, 2021. O B. recorded on March 31, 2021. O C. recorded on April 30, 2021. O D. recorded on January 15, 2021. Next page LAATIAN P Flag question Lang Co. issued bonds with detachable common stock warrants. Only the warrants had a known market value. The sum of the fair value of the warrants and the face amount of the bonds exceeds the cash proceeds. This excess is reported as Select one: O A. Common Stock Subscribed. O B. Discount on Bonds Payable. O C. Premium on Bonds Payable. O D. Paid-in Capital in Excess of Par-Stock Warrants. 4 w Hopkins Co. at the end of 2020, its first year of operations, provided the following details about its pretax financial income and taxable income: Pretax financial income: $3,000,000 Estimated litigation expense: $4,000,000 Extra depreciation expense for taxes: $6,000,000 Taxable income: $1,000,000 The estimated litigation expense of $4,000,000 will be tax-deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $2,000,000 in each of the next three years. The income tax rate is 20% for all years. The deferred tax asset to be recognized at the end of 2020 is Select one: O A. $200,000. B. $600,000 C. $400,000 ALLI D. $800,000 Flag question Botanic Choice sells natural supplements to customers with an unconditional sales return if they are not satisfied. The sales returns period extends 60 days. On February 10, 2021, a customer purchases $4,000 of products (cost $2,000). Assuming that based on prior experience, estimated returns are 20%. The journal entry to record the actual return of $250 of merchandise includes a Select one: O A. debit to Estimated Inventory Returns for $125. O B. credit to Returned Inventory for $125. C. credit to Allowance for Sales Returns for $250. D. debit to Returned Inventory for $125. Next page Previous page