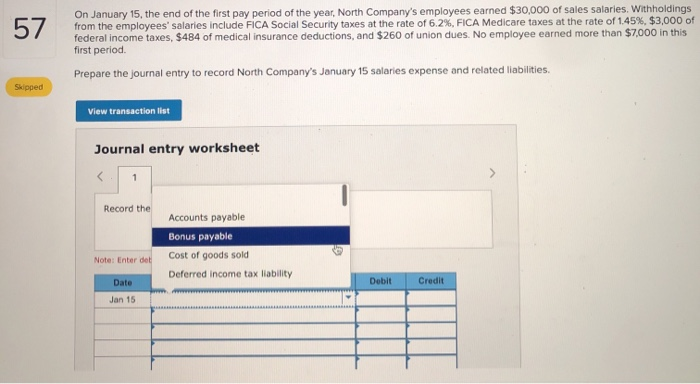

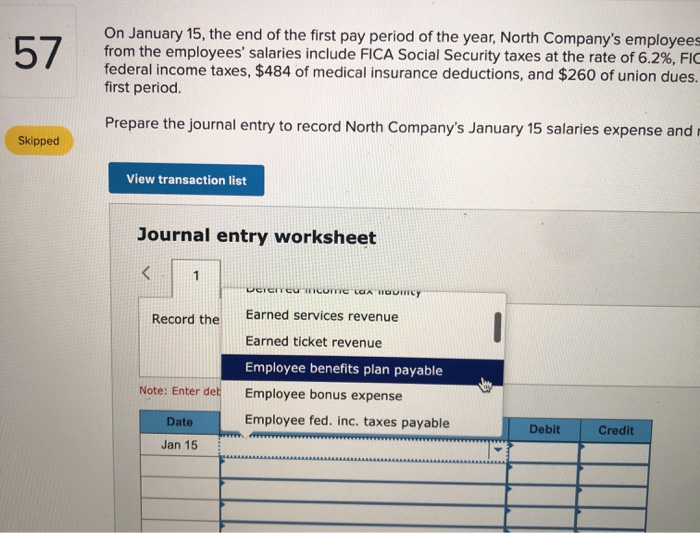

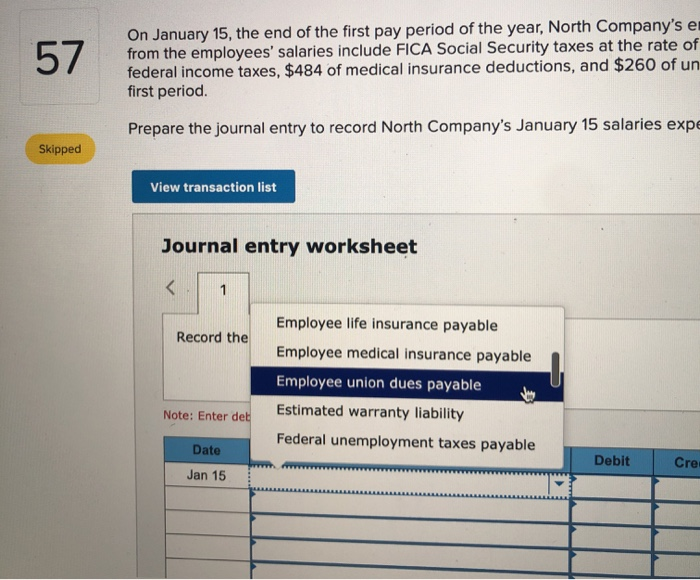

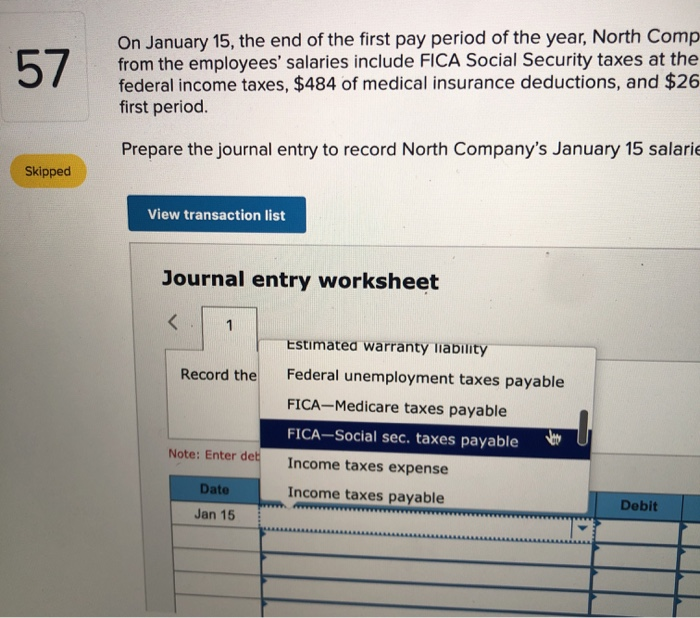

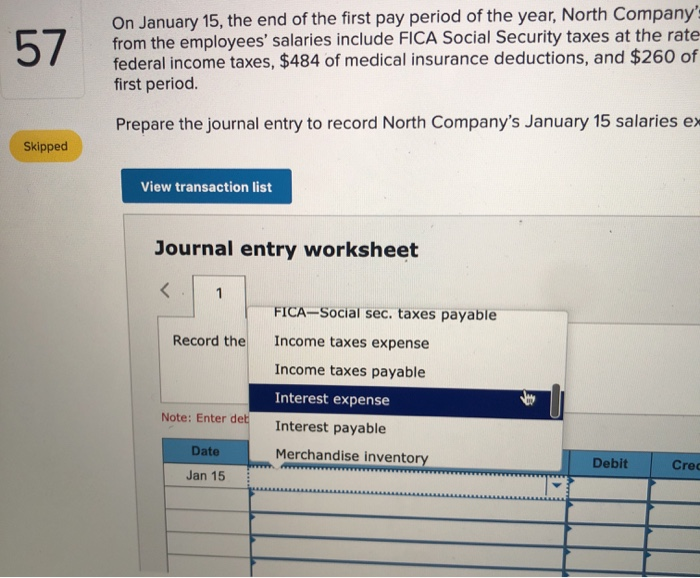

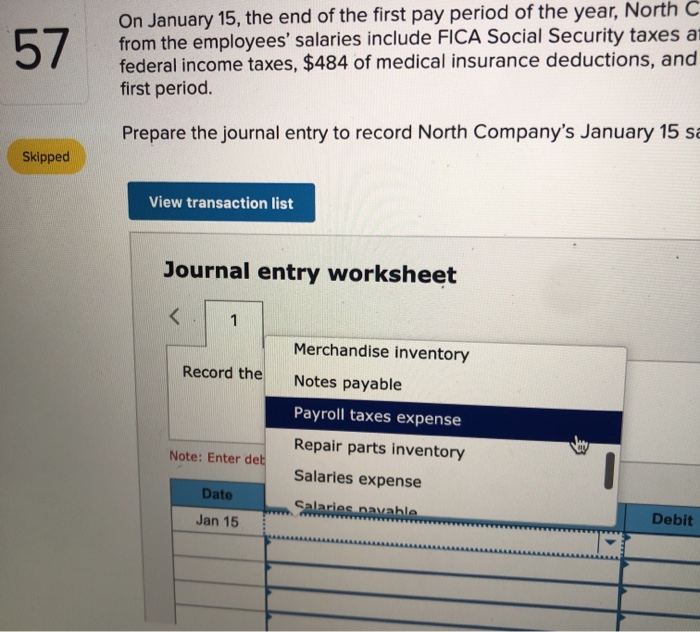

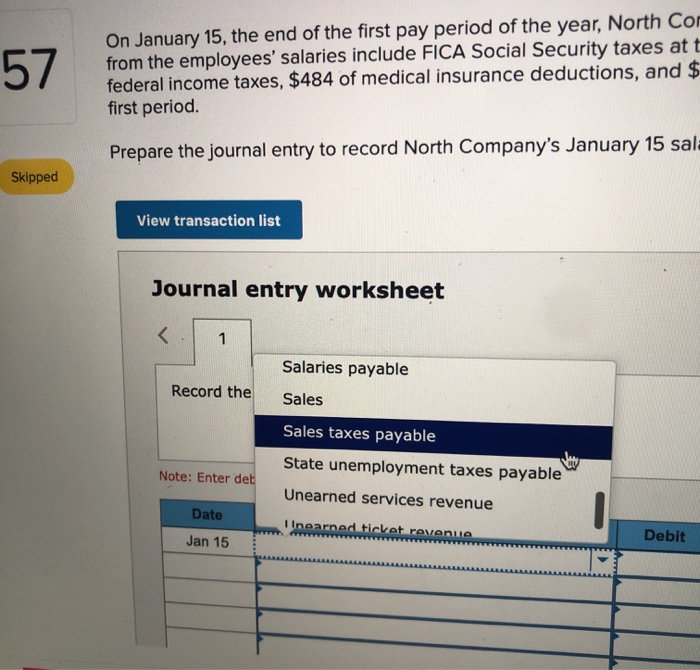

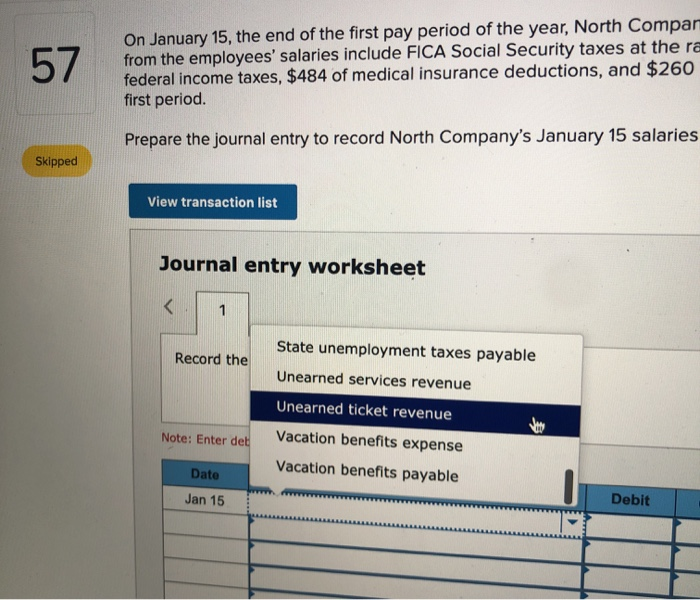

On January 15, the end of the first pay period of the year, North Company's employees earned $30,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $484 of medical insurance deductions, and $260 of union dues. No employee earned more than $7,000 in this first period Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. Spoed View transaction list Journal entry worksheet Record the Accounts payable Bonus payable Note: Enter det Cost of goods sold Deferred income tax liability Date Debit Credit Jan 15 57 On January 15, the end of the first pay period of the year, North Company's employees from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FIC federal income taxes, $484 of medical insurance deductions, and $260 of union dues. first period. Prepare the journal entry to record North Company's January 15 salaries expense and Skipped View transaction list Journal entry worksheet Verere come A WOUNCE Record the Earned services revenue Earned ticket revenue Employee benefits plan payable Employee bonus expense Employee fed. inc. taxes payable Note: Enter det Date Debit Credit Jan 15 On January 15, the end of the first pay period of the year, North Company's e from the employees' salaries include FICA Social Security taxes at the rate of federal income taxes, $484 of medical insurance deductions, and $260 of un first period. Prepare the journal entry to record North Company's January 15 salaries expe Skipped View transaction list Journal entry worksheet Record the Employee life insurance payable Employee medical insurance payable Employee union dues payable Estimated warranty liability Federal unemployment taxes payable Note: Enter det Date Debit Cre Jan 15 On January 15, the end of the first pay period of the year, North Comp from the employees' salaries include FICA Social Security taxes at the federal income taxes, $484 of medical insurance deductions, and $26 first period. Prepare the journal entry to record North Company's January 15 salarie Skipped View transaction list Journal entry worksheet Record the Estimated warranty liability Federal unemployment taxes payable FICA-Medicare taxes payable FICA-Social sec. taxes payable Income taxes expense Note: Enter det Date Income taxes payable Debit Jan 15 On January 15, the end of the first pay period of the year, North Company from the employees' salaries include FICA Social Security taxes at the rate federal income taxes, $484 of medical insurance deductions, and $260 of first period. Prepare the journal entry to record North Company's January 15 salaries ex Skipped View transaction list Journal entry worksheet Record the FICA-Social sec. taxes payable Income taxes expense Income taxes payable Interest expense Interest payable Merchandise inventory Note: Enter det Debit Cre Date Jan 15 On January 15, the end of the first pay period UI LITE YU from the employees' salaries include FICA Social Security taxes a federal income taxes, $484 of medical insurance deductions, and first period. Prepare the journal entry to record North Company's January 15 si Skipped View transaction list Journal entry worksheet Record the Merchandise inventory Notes payable Payroll taxes expense Repair parts inventory Salaries expense Note: Enter det Date Debi Salaries navable Jan 15 On January 15, the end of the first pay period of the year, North Cor from the employees' salaries include FICA Social Security taxes att federal income taxes, $484 of medical insurance deductions, and $ first period. Prepare the journal entry to record North Company's January 15 sala Skipped View transaction list Journal entry worksheet Salaries payable Record the Sales Sales taxes payable Note: Enter det State unemployment taxes payable Unearned services revenue Unearned ticket revenue Date Jan 15 Debit 57 On January 15, the end of the first pay period of the year, North Compar from the employees' salaries include FICA Social Security taxes at the ra federal income taxes, $484 of medical insurance deductions, and $260 first period. Prepare the journal entry to record North Company's January 15 salaries Skipped View transaction list Journal entry worksheet Record the State unemployment taxes payable Unearned services revenue Unearned ticket revenue Vacation benefits expense Vacation benefits payable Note: Enter det Date Jan 15 Debit