Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 16, Tree Co. paid $60,000 in property taxes on its factory for the current calendar year. On April 2, Tree paid $240,000

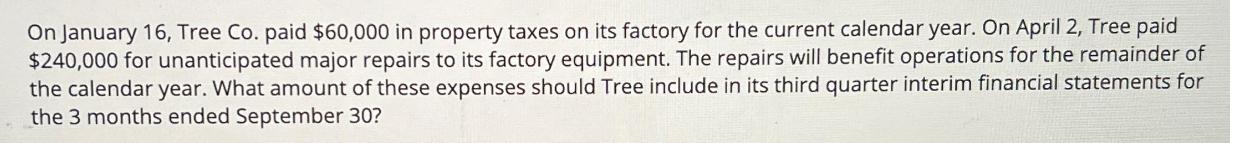

On January 16, Tree Co. paid $60,000 in property taxes on its factory for the current calendar year. On April 2, Tree paid $240,000 for unanticipated major repairs to its factory equipment. The repairs will benefit operations for the remainder of the calendar year. What amount of these expenses should Tree include in its third quarter interim financial statements for the 3 months ended September 30?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount of expenses that Tree Co should include in its third quarter interim financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e78eded81b_881663.pdf

180 KBs PDF File

661e78eded81b_881663.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started