Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1st, 2018, Deutsche bank is concerned that 6-month LIBOR will fall below expectations and their $1,000,000 worth of Eurocredit is rolled over

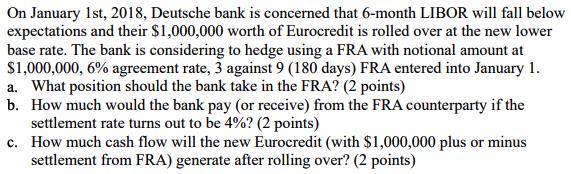

On January 1st, 2018, Deutsche bank is concerned that 6-month LIBOR will fall below expectations and their $1,000,000 worth of Eurocredit is rolled over at the new lower base rate. The bank is considering to hedge using a FRA with notional amount at $1,000,000, 6% agreement rate, 3 against 9 (180 days) FRA entered into January 1. a. What position should the bank take in the FRA? (2 points) b. How much would the bank pay (or receive) from the FRA counterparty if the settlement rate turns out to be 4%? (2 points) c. How much cash flow will the new Eurocredit (with $1,000,000 plus or minus settlement from FRA) generate after rolling over? (2 points)

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To hedge against the risk of 6month LIBOR falling below expectations Deutsche Bank should take a l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started