Question

On January 2, 2018, Falstaff Company issued $10,000,000 of their 10-year bonds. The bonds have a stated rate of 7% and the semi-annual interest

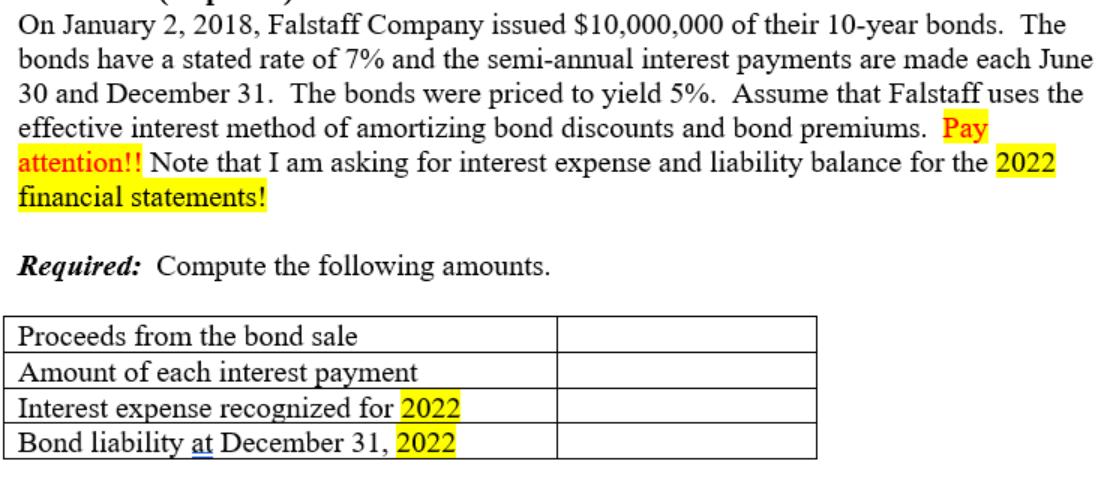

On January 2, 2018, Falstaff Company issued $10,000,000 of their 10-year bonds. The bonds have a stated rate of 7% and the semi-annual interest payments are made each June 30 and December 31. The bonds were priced to yield 5%. Assume that Falstaff uses the effective interest method of amortizing bond discounts and bond premiums. Pay attention!! Note that I am asking for interest expense and liability balance for the 2022 financial statements! Required: Compute the following amounts. Proceeds from the bond sale Amount of each interest payment Interest expense recognized for 2022 Bond liability at December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Charles T. Horngren, Walter T. Harrison Jr., Jo Ann L. Johnston, Carol A. Meissner, Peter R. Norwood

9th Canadian Edition volume 2

013269008X, 978-0133122855, 133122859, 978-0132690089

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App