Question

On January 2, 2020, Cruise Ltd. signed a ten-year non-cancellable lease for a heavy-duty drill press. The lease required annual payments of $52,500, starting

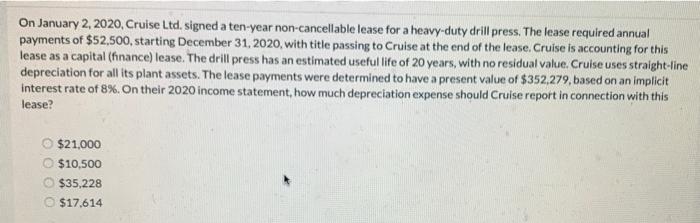

On January 2, 2020, Cruise Ltd. signed a ten-year non-cancellable lease for a heavy-duty drill press. The lease required annual payments of $52,500, starting December 31, 2020, with title passing to Cruise at the end of the lease. Cruise is accounting for this lease as a capital (finance) lease. The drill press has an estimated useful life of 20 years, with no residual value. Cruise uses straight-line depreciation for all its plant assets. The lease payments were determined to have a present value of $352,279, based on an implicit interest rate of 8%. On their 2020 income statement, how much depreciation expense should Cruise report in connection with this lease? $21,000 O $10,500 $35,228 O $17,614

Step by Step Solution

There are 3 Steps involved in it

Step: 1

On their 2020 income statement how much depreciati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume II

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

16th Canadian edition

1259261433, 978-1260305838

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App