Answered step by step

Verified Expert Solution

Question

1 Approved Answer

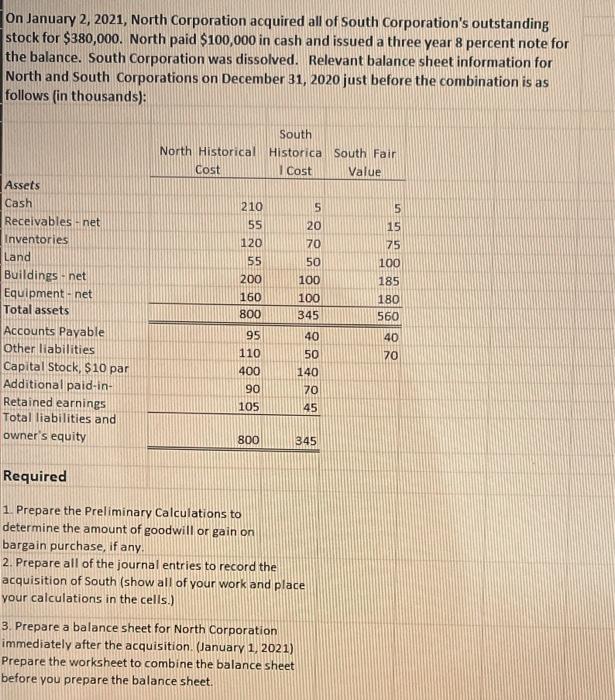

On January 2, 2021, North Corporation acquired all of South Corporation's outstanding stock for $380,000. North paid $100,000 in cash and issued a three

On January 2, 2021, North Corporation acquired all of South Corporation's outstanding stock for $380,000. North paid $100,000 in cash and issued a three year 8 percent note for the balance. South Corporation was dissolved. Relevant balance sheet information for North and South Corporations on December 31, 2020 just before the combination is as follows (in thousands): South North Historical Historica South Fair Cost I Cost Value Assets Cash Receivables - net 210 55 20 15 Inventories 120 70 75 Land 55 50 100 Buildings - net 200 100 185 Equipment - net Total assets 160 100 180 800 345 560 Accounts Payable Other liabilities Capital Stock, $10 par Additional paid-in- 95 40 40 110 50 70 400 140 90 70 Retained earnings Total liabilities and 105 45 owner's equity 800 345 Required 1. Prepare the Preliminary Calculations to determine the amount of goodwill or gain on bargain purchase, if any. 2. Prepare all of the journal entries to record the acquisition of South (show all of your work and place your calculations in the cells.) 3. Prepare a balance sheet for North Corporation immediately after the acquisition. (January 1, 2021) Prepare the worksheet to combine the balance sheet before you prepare the balance sheet.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Calculation of Goodwill or Gain on Bargain Purchase Particulars Amount in thousands Amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started