Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2, 2022, Pet Salon purchased fixtures for $37,400 cash, expecting the fixtures to remain in service for six years. Pet Salon has depreciated

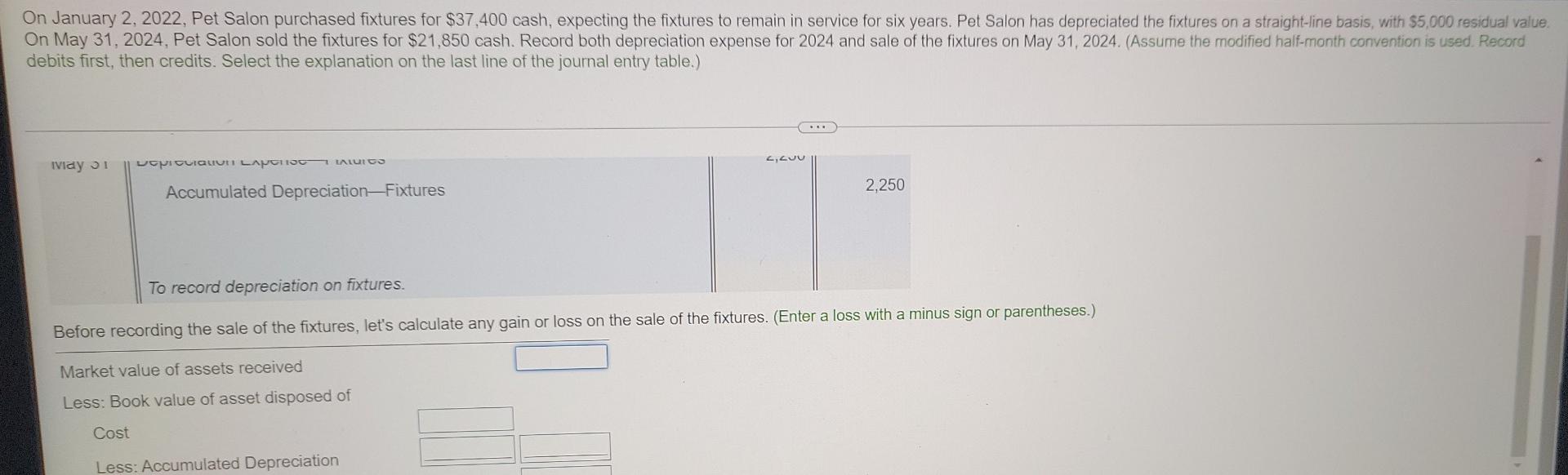

On January 2, 2022, Pet Salon purchased fixtures for $37,400 cash, expecting the fixtures to remain in service for six years. Pet Salon has depreciated the fixtures on a straight-line basis with $5,000 residual value. On May 31, 2024, Pet Salon sold the fixtures for $21,850 cash. Record both depreciation expense for 2024 and sale of the fixtures on May 31, 2024. (Assume the modified half-month convention is used Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Vidy 31 PICUIQUEI LAVORSC_AUICO Accumulated DepreciationFixtures 2,250 To record depreciation on fixtures. Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started