Question

On January 2, 2023, Tom Company invested $4,150,000 in Jerry Ltd. for 40% of its outstanding common shares. At this time, the book value

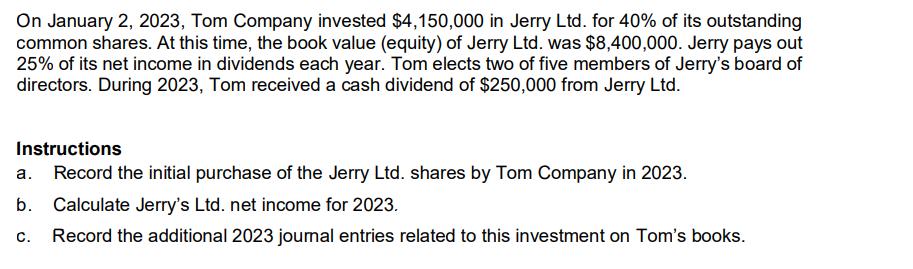

On January 2, 2023, Tom Company invested $4,150,000 in Jerry Ltd. for 40% of its outstanding common shares. At this time, the book value (equity) of Jerry Ltd. was $8,400,000. Jerry pays out 25% of its net income in dividends each year. Tom elects two of five members of Jerry's board of directors. During 2023, Tom received a cash dividend of $250,000 from Jerry Ltd. Instructions a. Record the initial purchase of the Jerry Ltd. shares by Tom Company in 2023. b. Calculate Jerry's Ltd. net income for 2023. C. Record the additional 2023 journal entries related to this investment on Tom's books.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The initial purchase of Jerry Ltd shares by Tom Company in 2023 can be recorded as follows Date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

9th International Edition

1266268537, 9781266268533

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App