Question

On January 2, 20X2, Topsail purchased 50, $1,000 bonds issued by Charlie Company. The bonds pay interest on December 31, at 6% and mature

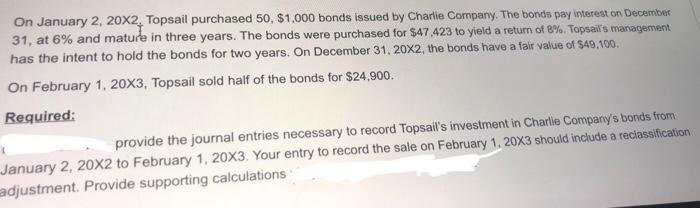

On January 2, 20X2, Topsail purchased 50, $1,000 bonds issued by Charlie Company. The bonds pay interest on December 31, at 6% and mature in three years. The bonds were purchased for $47,423 to yield a return of 8%. Topsail's management has the intent to hold the bonds for two years. On December 31, 20X2, the bonds have a fair value of $49,100. On February 1, 20X3, Topsail sold half of the bonds for $24,900. Required: provide the journal entries necessary to record Topsail's investment in Charlie Company's bonds from January 2, 20X2 to February 1, 20X3. Your entry to record the sale on February 1, 20X3 should include a reclassification adjustment. Provide supporting calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To record Topsails investment in Charlie Companys bonds from January 2 20X2 to February 1 20X3 and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App