Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2, 20Y4, Whitworth Company acquired 33% of the outstanding stock of Aloof Company for $330,000. For the year ended December 31, 20Y4,

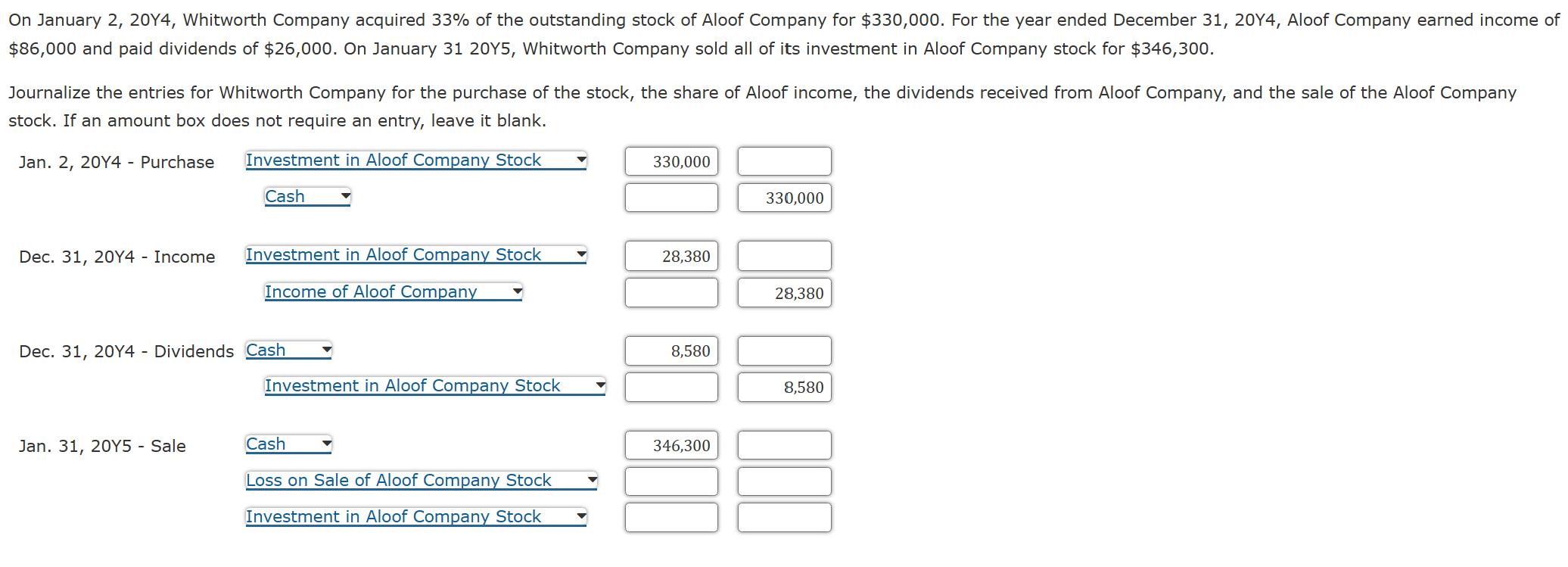

On January 2, 20Y4, Whitworth Company acquired 33% of the outstanding stock of Aloof Company for $330,000. For the year ended December 31, 20Y4, Aloof Company earned income of $86,000 and paid dividends of $26,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $346,300. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Investment in Aloof Company Stock Cash 330,000 330,000 Dec. 31, 20Y4 - Income Investment in Aloof Company Stock Income of Aloof Company 28,380 28,380 Dec. 31, 20Y4 Dividends Cash 8,580 Investment in Aloof Company Stock 8,580 Jan. 31, 20Y5 - Sale Cash 346,300 Loss on Sale of Aloof Company Stock Investment in Aloof Company Stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started