Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2, Year 1, Verdi Company acquired a machine for $240,000 cash. In addition to the purchase price, Verdi spent $5,000 for shipping

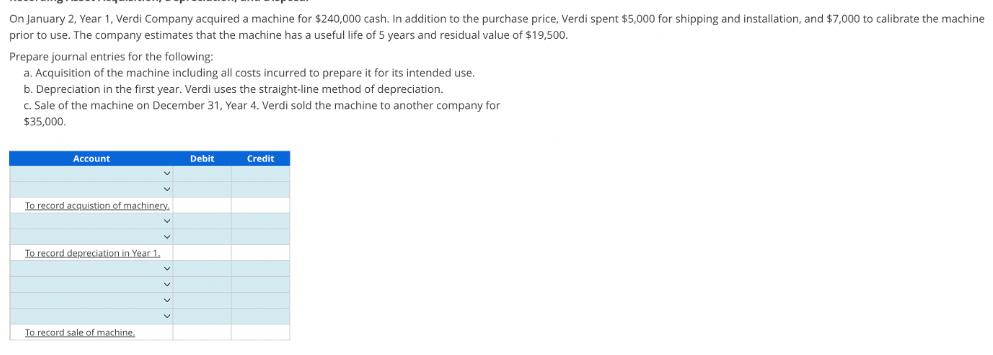

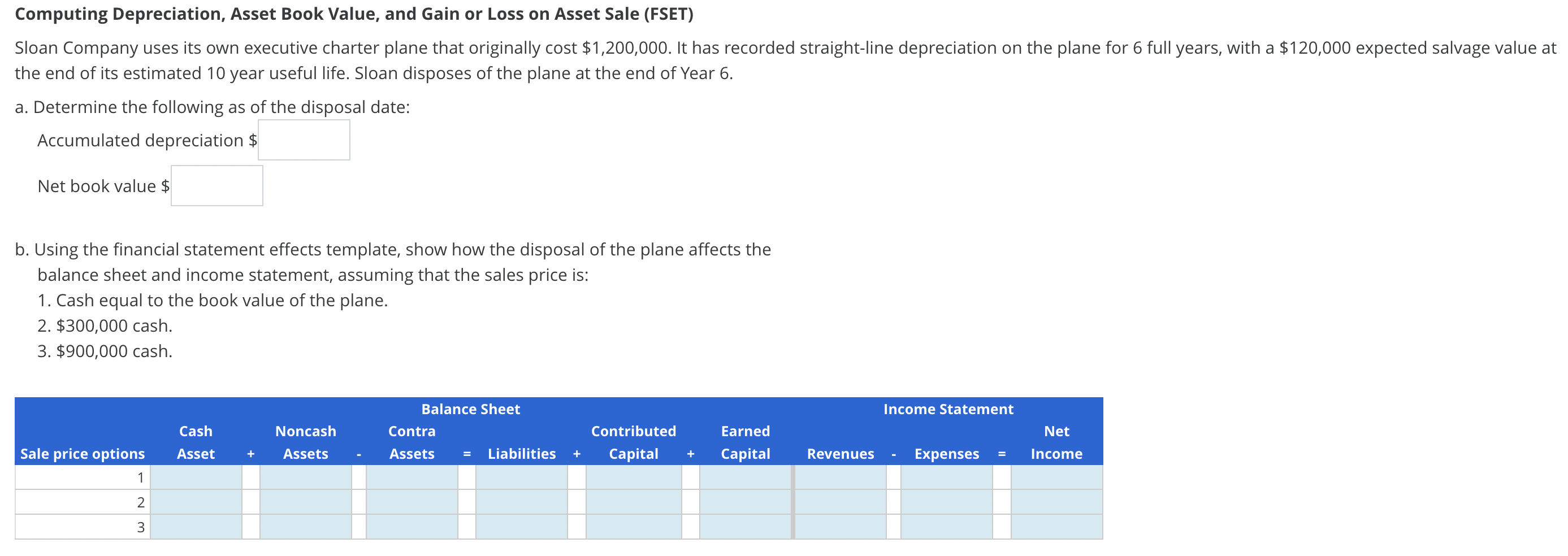

On January 2, Year 1, Verdi Company acquired a machine for $240,000 cash. In addition to the purchase price, Verdi spent $5,000 for shipping and installation, and $7,000 to calibrate the machine prior to use. The company estimates that the machine has a useful life of 5 years and residual value of $19,500. Prepare journal entries for the following: a. Acquisition of the machine including all costs incurred to prepare it for its intended use. b. Depreciation in the first year. Verdi uses the straight-line method of depreciation. c. Sale of the machine on December 31, Year 4. Verdi sold the machine to another company for $35,000. Account To record acquistion of machinery. To record depreciation in Year 1. To record sale of machine. Debit Credit Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale (FSET) Sloan Company uses its own executive charter plane that originally cost $1,200,000. It has recorded straight-line depreciation on the plane for 6 full years, with a $120,000 expected salvage value at the end of its estimated 10 year useful life. Sloan disposes of the plane at the end of Year 6. a. Determine the following as of the disposal date: Accumulated depreciation $ Net book value $ b. Using the financial statement effects template, show how the disposal of the plane affects the balance sheet and income statement, assuming that the sales price is: 1. Cash equal to the book value of the plane. 2. $300,000 cash. 3. $900,000 cash. Balance Sheet Income Statement Cash Sale price options Asset + Noncash Assets Contra Assets Contributed Earned Net = Liabilities + Capital + Capital Revenues - Expenses = Income 1 2 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started