Answered step by step

Verified Expert Solution

Question

1 Approved Answer

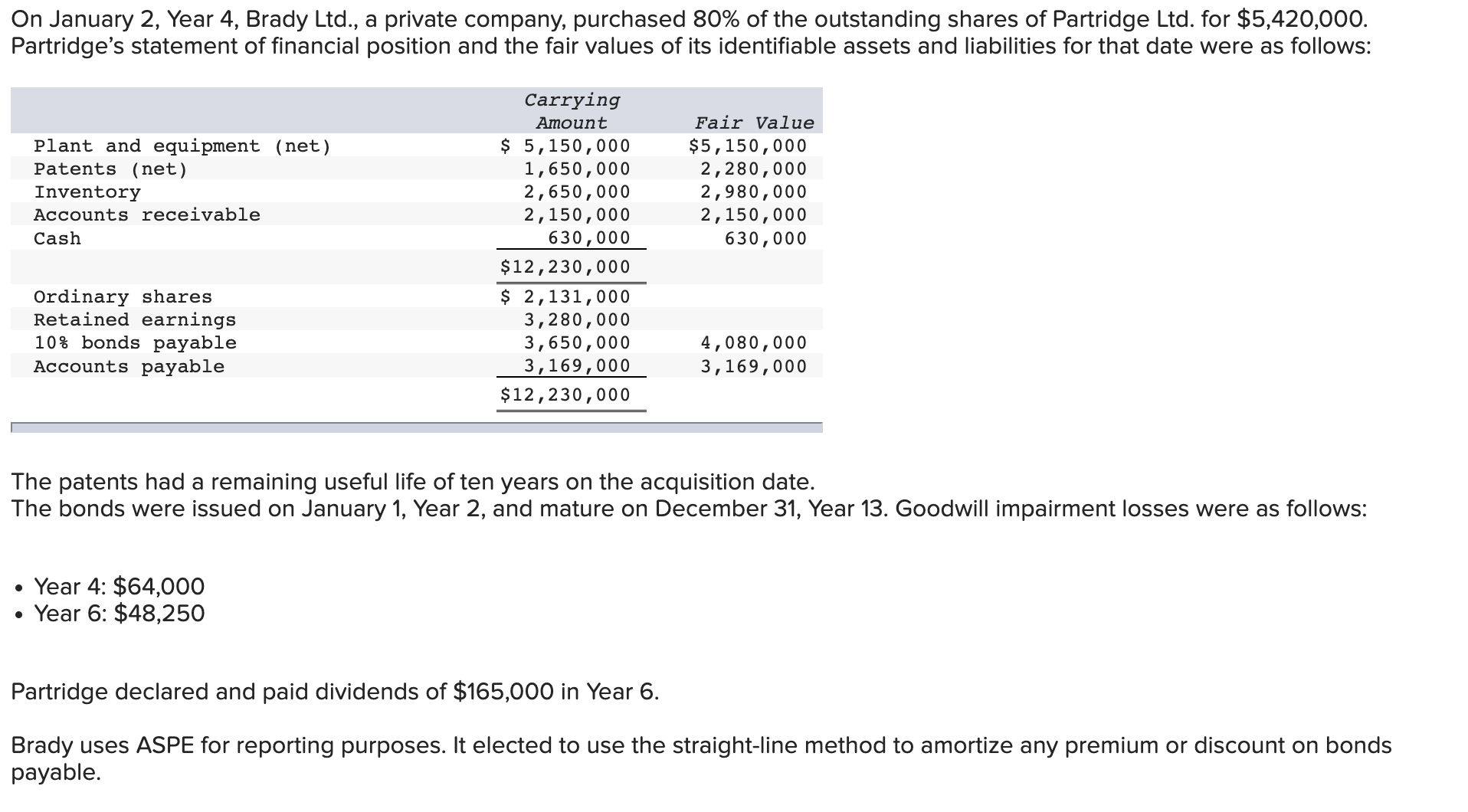

On January 2, Year 4, Brady Ltd., a private company, purchased 80% of the outstanding shares of Partridge Ltd. for $5,420,000. Partridge's statement of

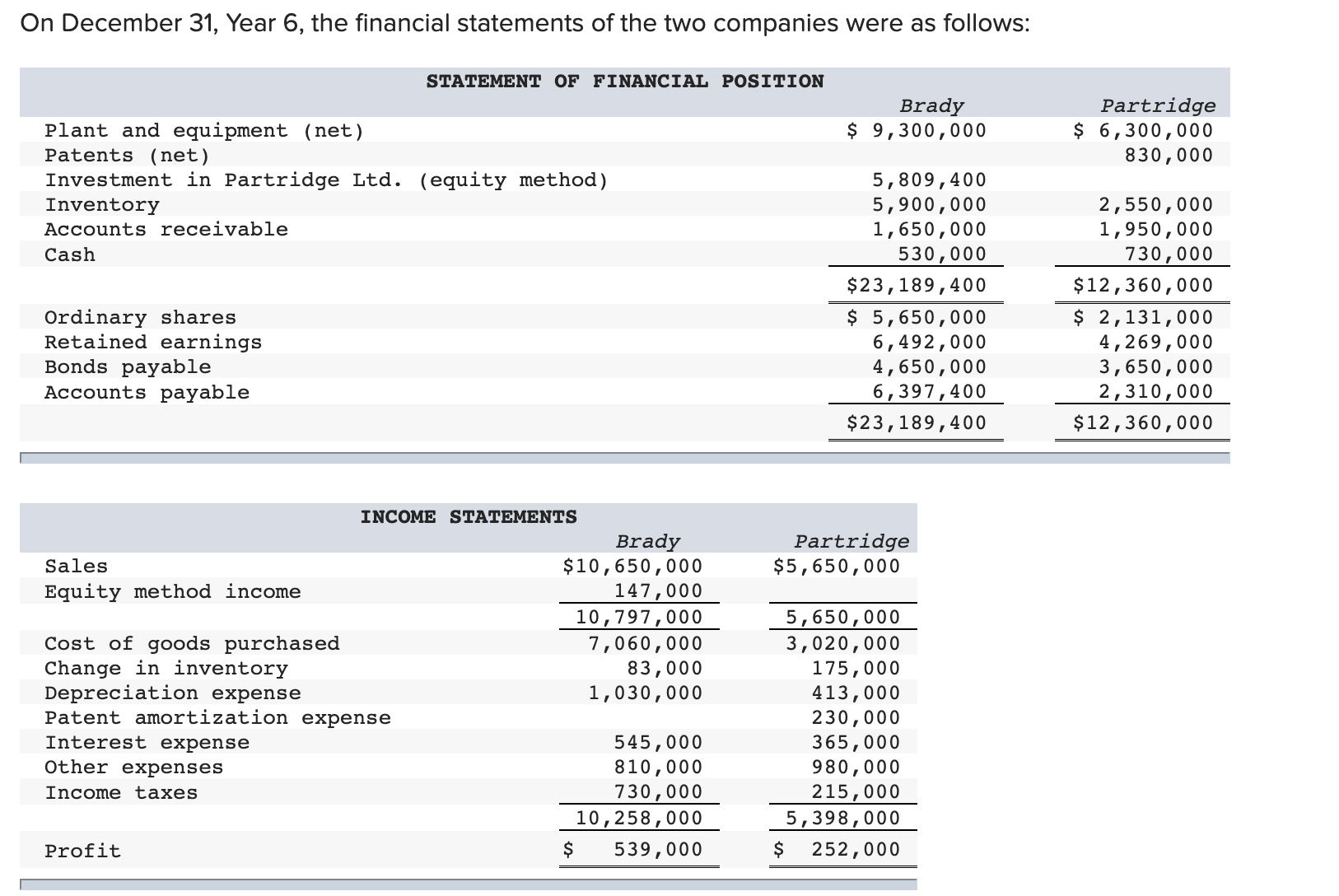

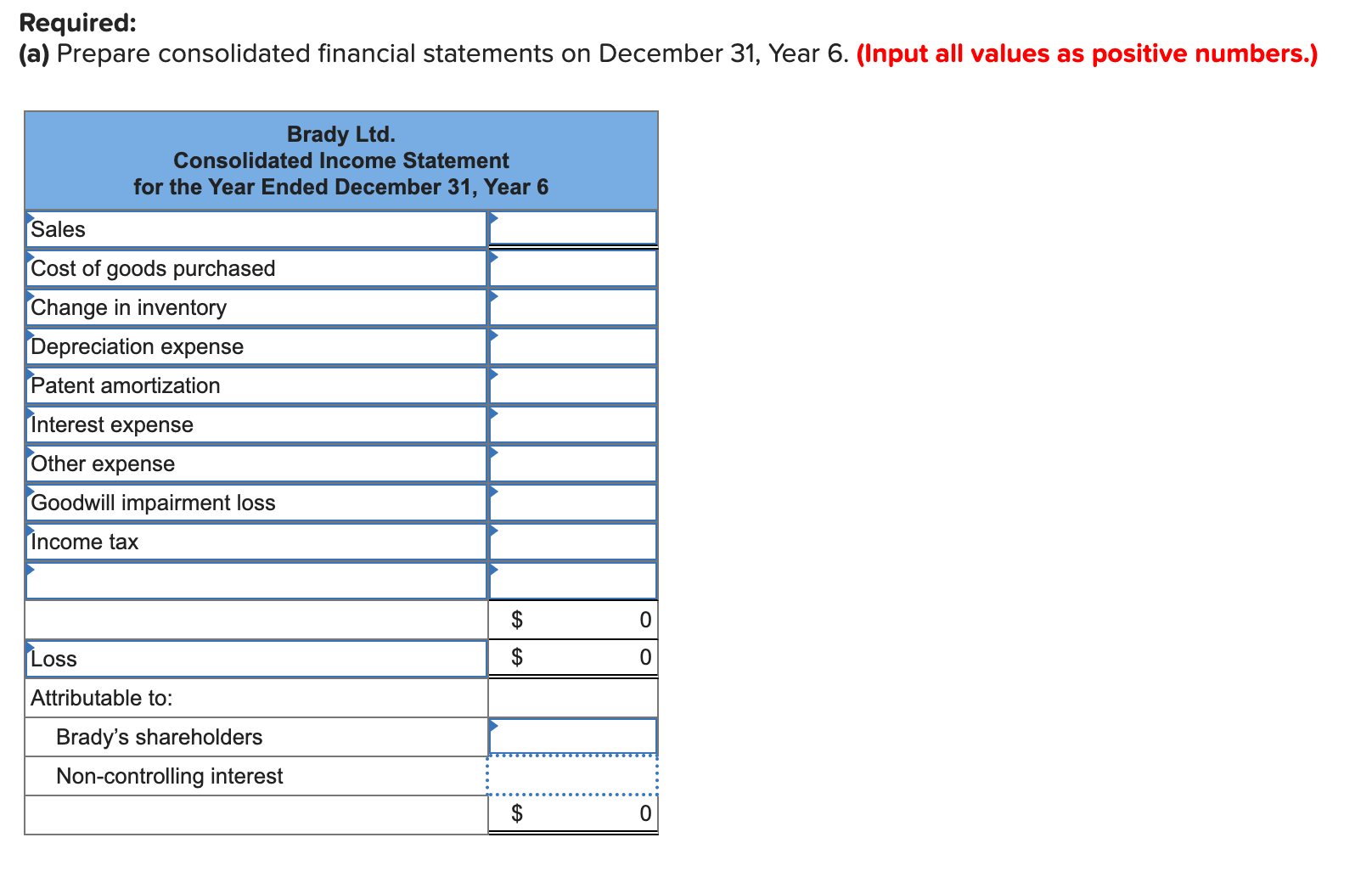

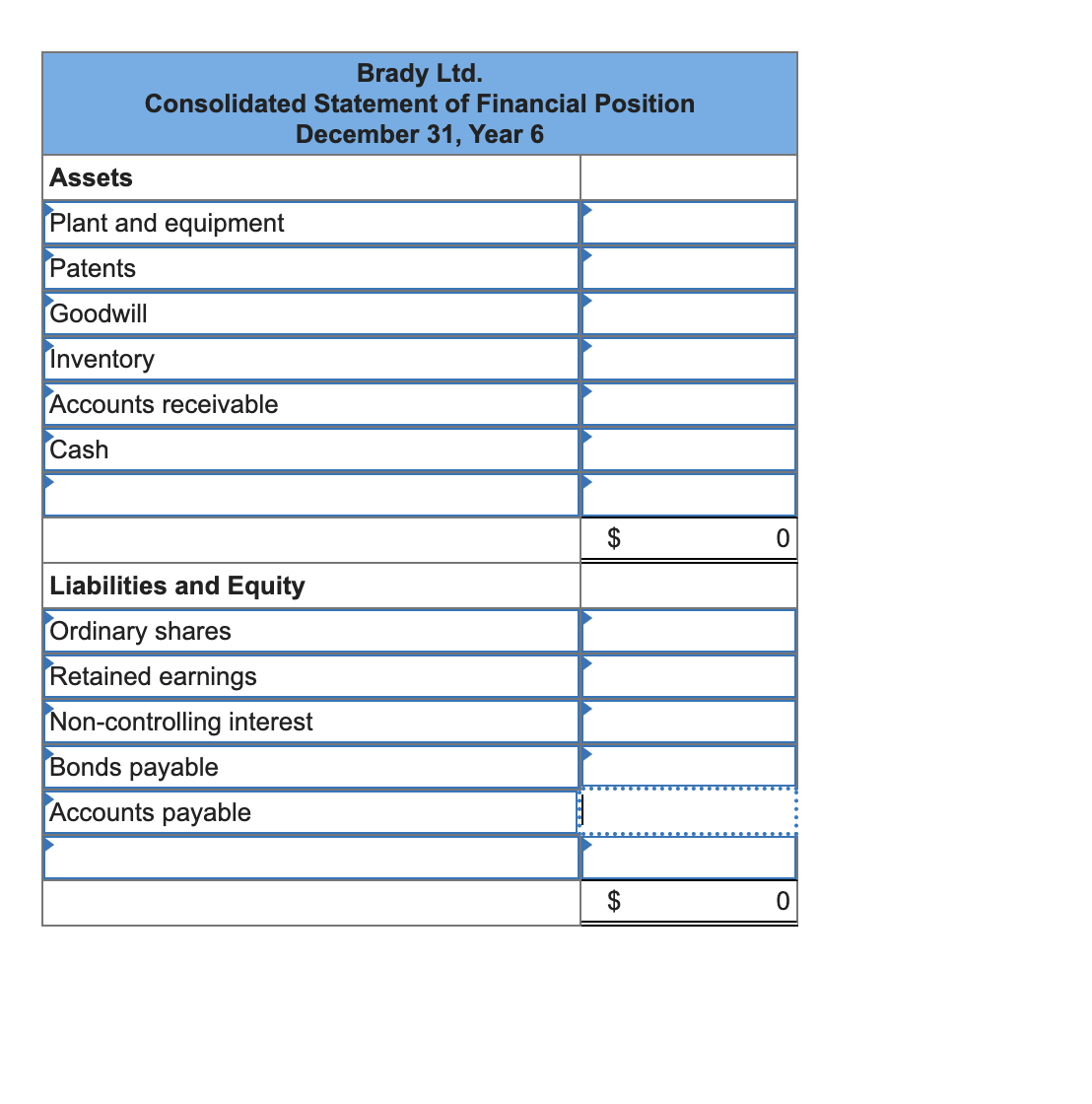

On January 2, Year 4, Brady Ltd., a private company, purchased 80% of the outstanding shares of Partridge Ltd. for $5,420,000. Partridge's statement of financial position and the fair values of its identifiable assets and liabilities for that date were as follows: Plant and equipment (net) Patents (net) Inventory Accounts receivable Cash Carrying Amount $ 5,150,000 Fair Value $5,150,000 2,280,000 1,650,000 2,650,000 2,980,000 2,150,000 2,150,000 630,000 $12,230,000 630,000 Ordinary shares Retained earnings 10% bonds payable Accounts payable $ 2,131,000 3,280,000 3,650,000 3,169,000 $12,230,000 4,080,000 3,169,000 The patents had a remaining useful life of ten years on the acquisition date. The bonds were issued on January 1, Year 2, and mature on December 31, Year 13. Goodwill impairment losses were as follows: Year 4: $64,000 Year 6: $48,250 Partridge declared and paid dividends of $165,000 in Year 6. Brady uses ASPE for reporting purposes. It elected to use the straight-line method to amortize any premium or discount on bonds payable. On December 31, Year 6, the financial statements of the two companies were as follows: STATEMENT OF FINANCIAL POSITION Brady Partridge Plant and equipment (net) Patents (net) Investment in Partridge Ltd. (equity method) Inventory Accounts receivable Cash $ 9,300,000 $ 6,300,000 830,000 5,809,400 5,900,000 1,650,000 Ordinary shares Retained earnings Bonds payable Accounts payable 530,000 $23,189,400 $ 5,650,000 6,492,000 4,650,000 2,550,000 1,950,000 730,000 $12,360,000 $ 2,131,000 4,269,000 3,650,000 6,397,400 2,310,000 $23,189,400 INCOME STATEMENTS Sales Equity method income Brady $10,650,000 Partridge $5,650,000 147,000 10,797,000 5,650,000 Cost of goods purchased 7,060,000 3,020,000 Change in inventory 83,000 175,000 Depreciation expense 1,030,000 413,000 Patent amortization expense 230,000 Interest expense 545,000 365,000 Other expenses Income taxes 810,000 980,000 730,000 215,000 10,258,000 5,398,000 Profit $ 539,000 $ 252,000 $12,360,000 Required: (a) Prepare consolidated financial statements on December 31, Year 6. (Input all values as positive numbers.) Brady Ltd. Consolidated Income Statement for the Year Ended December 31, Year 6 Sales Cost of goods purchased Change in inventory Depreciation expense Patent amortization Interest expense Other expense Goodwill impairment loss Income tax Loss Attributable to: Brady's shareholders Non-controlling interest EA $ EA 0 0 $ 0 Brady Ltd. Consolidated Statement of Financial Position December 31, Year 6 Assets Plant and equipment Patents Goodwill Inventory Accounts receivable Cash Liabilities and Equity Ordinary shares Retained earnings Non-controlling interest Bonds payable Accounts payable $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started