Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January, 2011, Salty of Saltpond consigned 200 bags of salt costing GHC400 each to Tasty in Tamale at a pro-forma invoiced price of

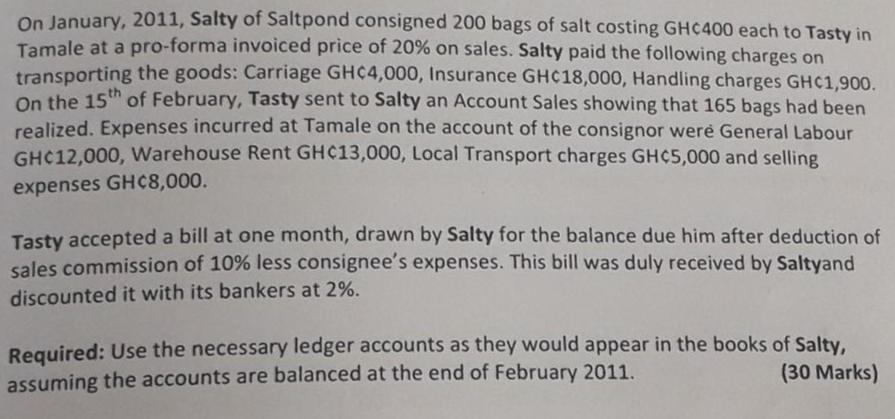

On January, 2011, Salty of Saltpond consigned 200 bags of salt costing GHC400 each to Tasty in Tamale at a pro-forma invoiced price of 20% on sales. Salty paid the following charges on transporting the goods: Carriage GHC4,000, Insurance GHC18,000, Handling charges GHC1,900. On the 15th of February, Tasty sent to Salty an Account Sales showing that 165 bags had been realized. Expenses incurred at Tamale on the account of the consignor were General Labour GHC12,000, Warehouse Rent GH13,000, Local Transport charges GH5,000 and selling expenses GHC8,000. Tasty accepted a bill at one month, drawn by Salty for the balance due him after deduction of sales commission of 10% less consignee's expenses. This bill was duly received by Saltyand discounted it with its bankers at 2%. Required: Use the necessary ledger accounts as they would appear in the books of Salty, (30 Marks) assuming the accounts are balanced at the end of February 2011.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Ledger accounts in the books of Salty Con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started