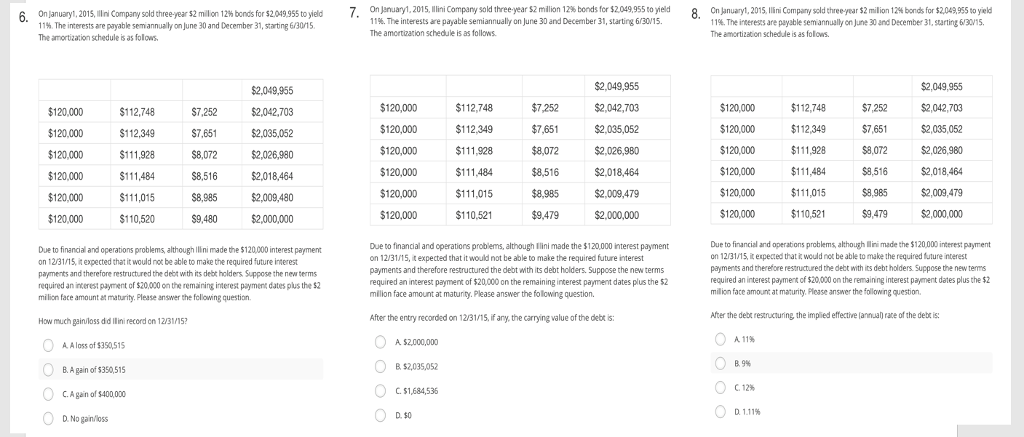

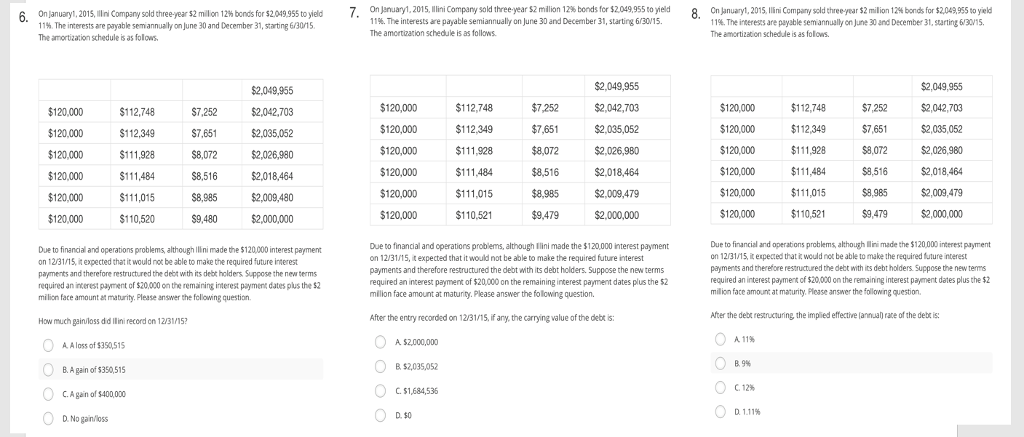

On january, 2015,lli Company sold threeyear s2 millon 12h bondts for $2.049,95to yield 7. anjsnuanl.2015, ilihi Compay sol tree ear s2 mlion bsfer 2093 to eld8. Onjnuary1,2015,lini Compary sald three year S2 milion 12w bonds for s20495 t eld 11% Theinterests are payable semannuallyon June 30 and December 31, starting 6/30/15. The amortization schedule is as folows 11%. The interests are payable semiannually on June 30 and December 31, starting 6/30/15. The amortzation schedule is as follows On January1, 2015, lini Company sold three-year $2 milion 12% bonds for $2,049,955 to yield 11%. The interests are payable semannually on June 30 and December 31, starting 63015. The amortization schedule is as folows. $120,000 $120,000 $120,000 $120,000 $120,000 $120,000 $112,748 $112.349 $111,928 $111,484 $111,015 $110,521 $2,049,955 $2,042,703 2,035,052 $2,026,980 $2,018,464 $2,009,479 $2.000,000 $2,049,955 $2,042,703 $2,035,052 $2,026,980 2,018,464 $2,009,479 $2,000,000 $7,252 $7,651 $8,072 $120,000 $120,000 $120,000 $120,000 $120,000 $120,000 112,748 $112,349 $111,928 $7,252 $120,000 $120,000 $120,000 $120,000 $120,000 $120,000 112,748 112,349 111,928 $111,484 $111,015 $110,520 $7,252 $7,651 $8,072 $2,042,703 $2,035,052 $2,026,980 $2,018,464 $2,009,480 $2,000,000 $7,651 $8,516 $8,985 $9,479 8,985 $8,985 $111,015 $110,521 Due to financial and operations problems, although Illini made the $120,000 interest payment on 12/31/15, it expected that it would not be able to make the required future interest payments and therefore restructured the debt with its debr holders Suppose the new terms required an incerest payment of $20,000 on the remaining interest paymenk dates plus the $2 milion face amount at maturity. Flease answer the following question Due to financial and operations problems, although lini made the $120,000 interest payment on 12/31/15, it expected that it would not be able to make the required future interest payments and therefore restructured the debt with its debt holders. Suppose the new terms required an incerest payment of $20,000 on the remaining interest payment dates plus the $2 milion face amount at maturity. Please answer the following question. Due to financial and operations problems, although llini made the $120,000 interest payment on 12/3115,it expected that it would not be able to make the required future interest paymenns and therefore restructured the debt with its debt holders. Suppose the new tems required an interest payment cf $20,000 on the remaining interest payment dates plus the $2 million face amount at maturity. Please answer the following question, How much gainuloss dd llini record cn 1 After the entry recorded on 12/31/15, if any, the carrying value of the debt s After the debr restructuring the implied effective lannua) race of the deb is: A. A A loss of $350,515 B.A gain of $350515 C.A gain of $400,000 D. No gan loss B $2,035,052 C. $1,684,535 D. $0 C. 12% D. 1.11% On january, 2015,lli Company sold threeyear s2 millon 12h bondts for $2.049,95to yield 7. anjsnuanl.2015, ilihi Compay sol tree ear s2 mlion bsfer 2093 to eld8. Onjnuary1,2015,lini Compary sald three year S2 milion 12w bonds for s20495 t eld 11% Theinterests are payable semannuallyon June 30 and December 31, starting 6/30/15. The amortization schedule is as folows 11%. The interests are payable semiannually on June 30 and December 31, starting 6/30/15. The amortzation schedule is as follows On January1, 2015, lini Company sold three-year $2 milion 12% bonds for $2,049,955 to yield 11%. The interests are payable semannually on June 30 and December 31, starting 63015. The amortization schedule is as folows. $120,000 $120,000 $120,000 $120,000 $120,000 $120,000 $112,748 $112.349 $111,928 $111,484 $111,015 $110,521 $2,049,955 $2,042,703 2,035,052 $2,026,980 $2,018,464 $2,009,479 $2.000,000 $2,049,955 $2,042,703 $2,035,052 $2,026,980 2,018,464 $2,009,479 $2,000,000 $7,252 $7,651 $8,072 $120,000 $120,000 $120,000 $120,000 $120,000 $120,000 112,748 $112,349 $111,928 $7,252 $120,000 $120,000 $120,000 $120,000 $120,000 $120,000 112,748 112,349 111,928 $111,484 $111,015 $110,520 $7,252 $7,651 $8,072 $2,042,703 $2,035,052 $2,026,980 $2,018,464 $2,009,480 $2,000,000 $7,651 $8,516 $8,985 $9,479 8,985 $8,985 $111,015 $110,521 Due to financial and operations problems, although Illini made the $120,000 interest payment on 12/31/15, it expected that it would not be able to make the required future interest payments and therefore restructured the debt with its debr holders Suppose the new terms required an incerest payment of $20,000 on the remaining interest paymenk dates plus the $2 milion face amount at maturity. Flease answer the following question Due to financial and operations problems, although lini made the $120,000 interest payment on 12/31/15, it expected that it would not be able to make the required future interest payments and therefore restructured the debt with its debt holders. Suppose the new terms required an incerest payment of $20,000 on the remaining interest payment dates plus the $2 milion face amount at maturity. Please answer the following question. Due to financial and operations problems, although llini made the $120,000 interest payment on 12/3115,it expected that it would not be able to make the required future interest paymenns and therefore restructured the debt with its debt holders. Suppose the new tems required an interest payment cf $20,000 on the remaining interest payment dates plus the $2 million face amount at maturity. Please answer the following question, How much gainuloss dd llini record cn 1 After the entry recorded on 12/31/15, if any, the carrying value of the debt s After the debr restructuring the implied effective lannua) race of the deb is: A. A A loss of $350,515 B.A gain of $350515 C.A gain of $400,000 D. No gan loss B $2,035,052 C. $1,684,535 D. $0 C. 12% D. 1.11%