Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 21 , the column totals of the payroll register for Great Products Company showed that its sales employees had earned $14,960, its truck

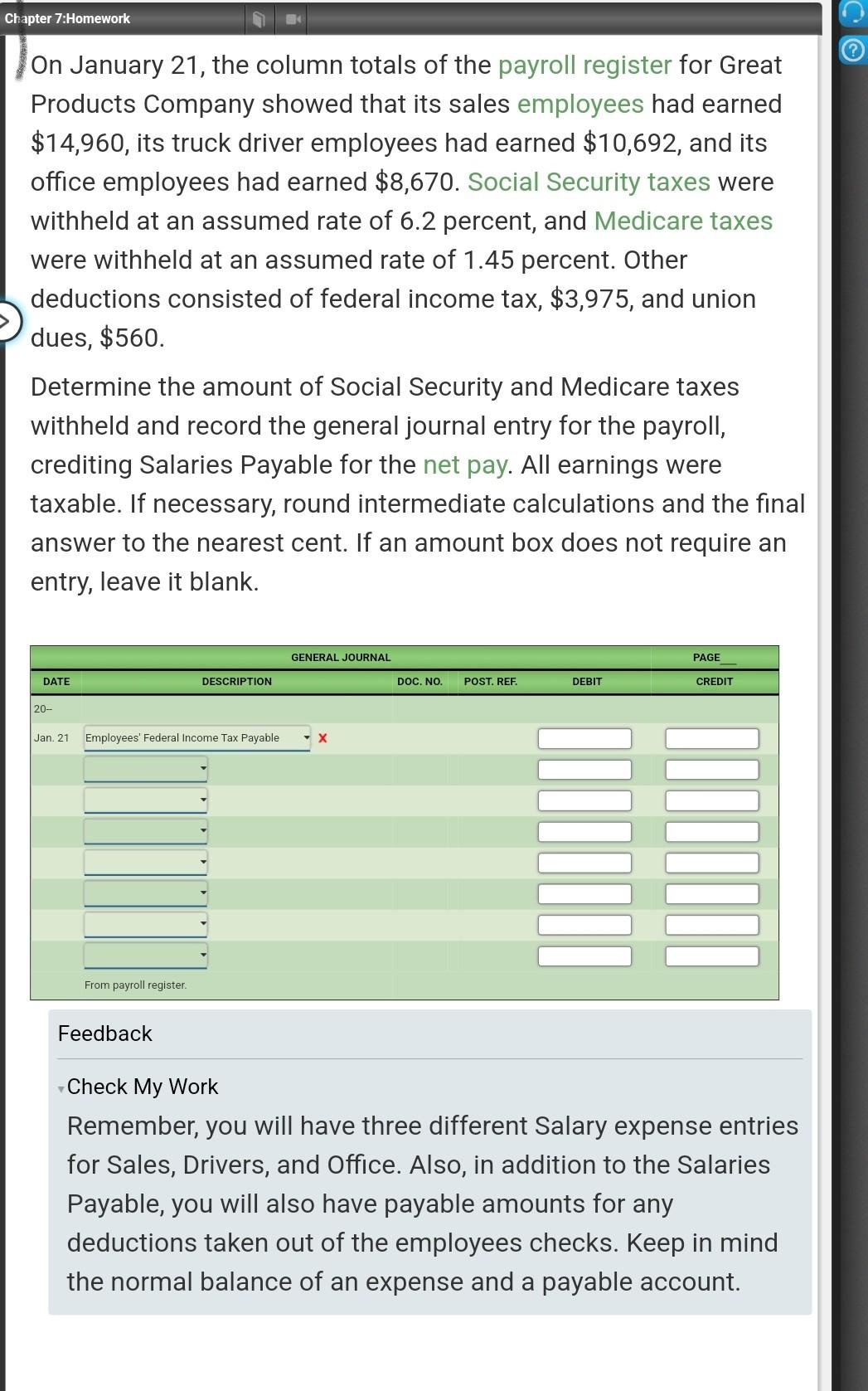

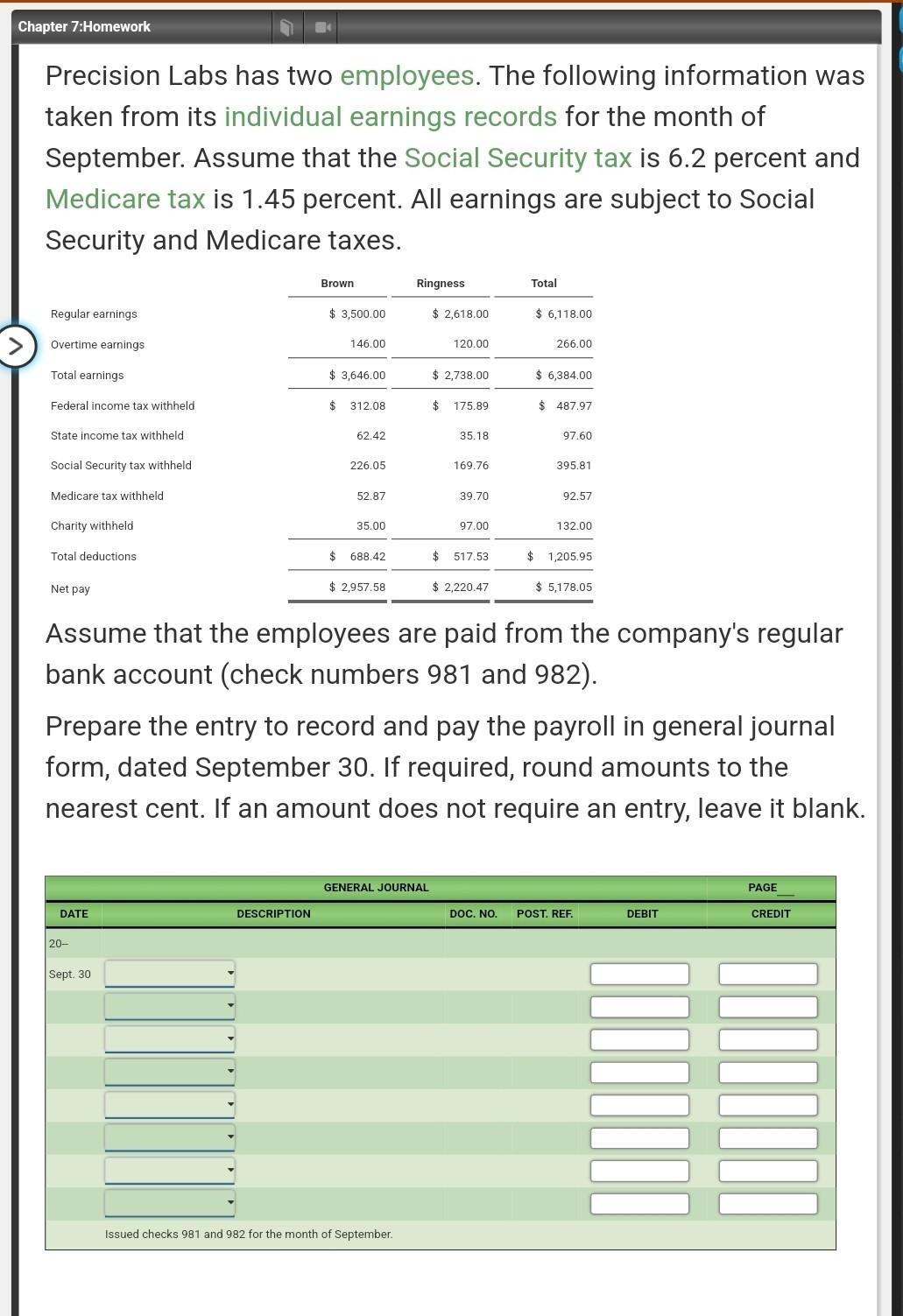

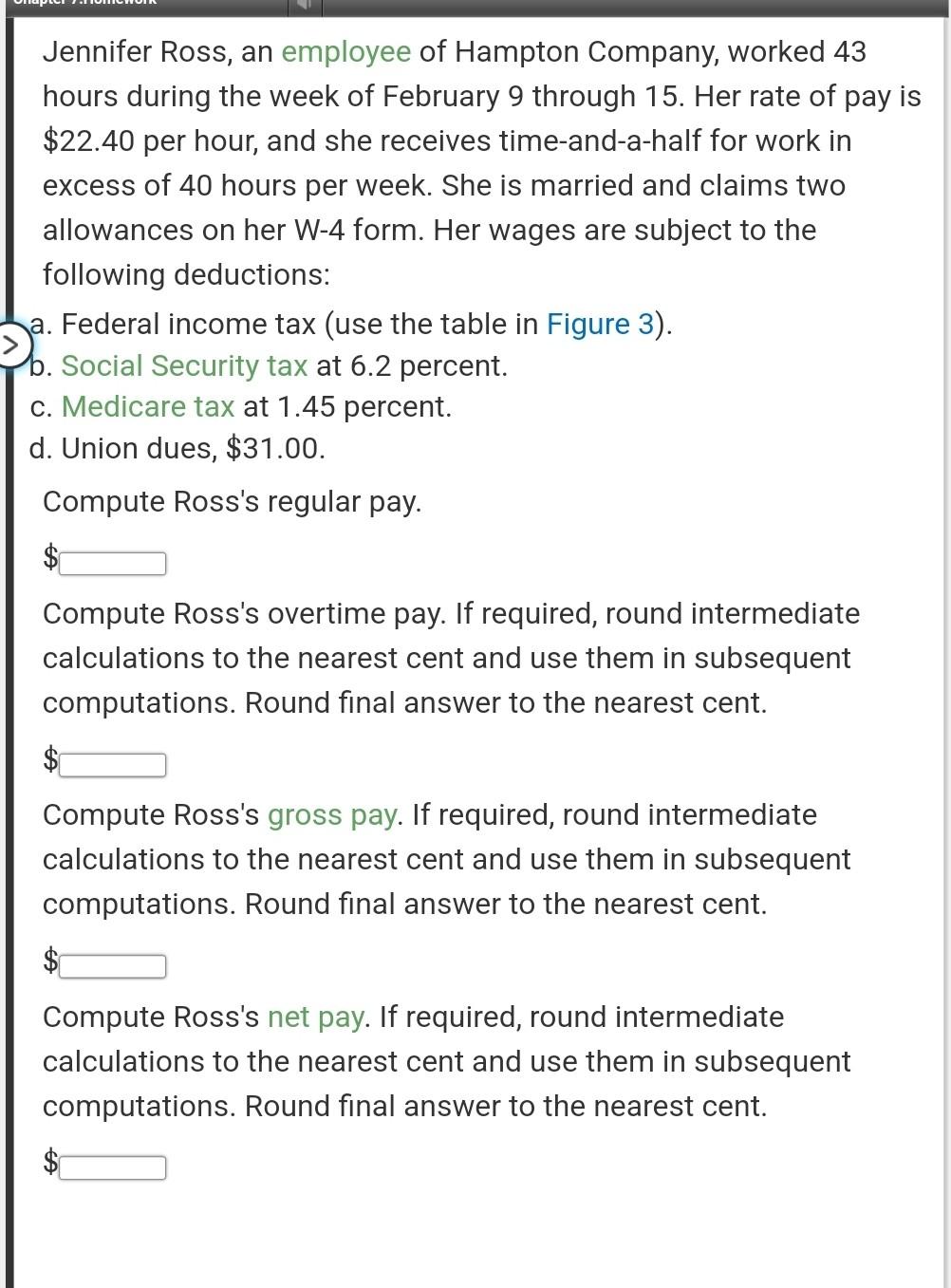

On January 21 , the column totals of the payroll register for Great Products Company showed that its sales employees had earned $14,960, its truck driver employees had earned $10,692, and its office employees had earned $8,670. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, $3,975, and union dues, $560. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. If necessary, round intermediate calculations and the final answer to the nearest cent. If an amount box does not require an entry, leave it blank. Feedback Check My Work Remember, you will have three different Salary expense entries for Sales, Drivers, and Office. Also, in addition to the Salaries Payable, you will also have payable amounts for any deductions taken out of the employees checks. Keep in mind the normal balance of an expense and a payable account. Precision Labs has two employees. The following information was taken from its individual earnings records for the month of September. Assume that the Social Security tax is 6.2 percent and Medicare tax is 1.45 percent. All earnings are subject to Social Security and Medicare taxes. Assume that the employees are paid from the company's regular bank account (check numbers 981 and 982). Prepare the entry to record and pay the payroll in general journal form, dated September 30. If required, round amounts to the nearest cent. If an amount does not require an entry, leave it blank. Jennifer Ross, an employee of Hampton Company, worked 43 hours during the week of February 9 through 15. Her rate of pay $22.40 per hour, and she receives time-and-a-half for work in excess of 40 hours per week. She is married and claims two allowances on her W-4 form. Her wages are subject to the following deductions: a. Federal income tax (use the table in Figure 3). b. Social Security tax at 6.2 percent. c. Medicare tax at 1.45 percent. d. Union dues, \$31.00. Compute Ross's regular pay. $ Compute Ross's overtime pay. If required, round intermediate calculations to the nearest cent and use them in subsequent computations. Round final answer to the nearest cent. $ Compute Ross's gross pay. If required, round intermediate calculations to the nearest cent and use them in subsequent computations. Round final answer to the nearest cent. 4 Compute Ross's net pay. If required, round intermediate calculations to the nearest cent and use them in subsequent computations. Round final answer to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started