Question

On January 25, 2008, the LIA made a $100 million investment in a transaction regarding 11.2 million shares of Citigroup. Essentially, the trade combined two

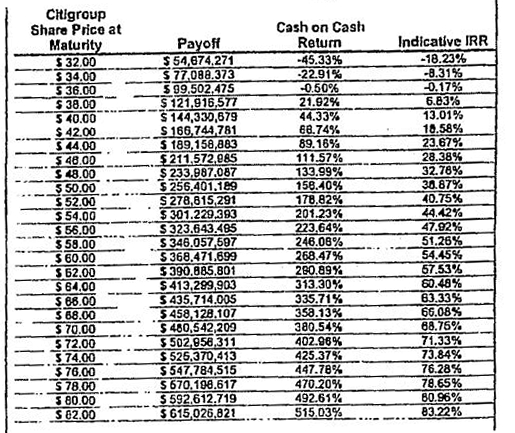

On January 25, 2008, the LIA made a $100 million investment in a transaction regarding 11.2 million shares of Citigroup. Essentially, the trade combined two derivative instruments: (1) an atthe-money forward contract and (2) an at-the-money put option. Both had a three-year maturity. The underlying Citigroup shares closed at $26.64 on the day of the trade. 3 The forward was an over-the-counter contract between the LIA and Goldman.4 It committed the LIA to purchasing at maturity (i.e., in three years time) 11.2 million shares of Citigroup from Goldman for a set delivery price agreed upon initially, and committed Goldman to selling the shares to the LIA at that price. The forward was at-the-money, meaning that the delivery price coincided with the share price on the day they entered the trade, i.e., $26.64 per share, or a total of $298 million for 11.2 million shares. The contract was cash-settled, so that instead of delivering shares at maturity, Goldman would owe the LIA a cash amount equal to the market value of those shares at maturity, i.e., 11.2 million times the price per Citigroup share prevailing at maturity. Therefore, if that amount exceeded $298 million, i.e., if the share price at maturity exceeded $26.64, Goldman would owe the difference to the LIA, while if it was below $26.64 at maturity, the LIA would owe the difference to Goldman. The at-the-money put was also an over-the-counter contract. It gave the LIA the right (but no obligation) to sell Goldman 11.2 million Citigroup shares at a strike price of $26.64 a piece, or $298 million in total, in three years time but not before (i.e., this was a European option). Conversely, it committed Goldman to buying the shares from the LIA at that price should the LIA exercise the option. Obviously, the LIA would exercise the put option only if it was in-the-money at maturity, i.e., if Citigroups stock price three years hence was below the options $26.64 strike price. The trade was also cash-settled: were the LIA to exercise the put, it would not have to deliver Citigroup shares to Goldman, nor would Goldman have to pay the LIA the full $298 million. Instead, Goldman would simply pay the LIA a cash amount equal to 11.2 million times the difference between Citigroups stock price at maturity and the strike price. The overall transaction was a synthetic position as it did not involve the LIA making a direct investment in Citigroup shares.5 Instead, only cash would change hands, first at the time of the trade (i.e., the $100 million investment) and then at maturity. Goldman would not retain the exposure the position implied but instead hedge it to the extent possible. It would do so by undertaking reciprocal trades over-the-counter with other banks, or via offsetting market transactions, including positions in Citigroup shares, in options on Citigroup shares, or in more liquid options on stock indices correlated with Citigroups stock. In preparatory talks, Goldmans men had shown the LIA an analysis of the performance of the trade across different scenarios for Citigroups stock price at maturity (Exhibit 4). For each scenario, the performance metrics included the cash amount the LIA would receive from Goldman at maturity (payoff), the percentage of the initial investment of $100 million the payoff would represent (cash-on-cash return), and the internal rate of return (IRR) the payoff would imply for the $100 million investment over the contracts three-year duration. Based on your own estimates, what do you think of the scenario analysis Goldman provided to the LIA (Exhibit 4)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started