Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 26, 2022, it was reported in the financial that Simple Computers Inc. (SCI) posted record 2021 fourth-quarter results. Despite $20.5 million in

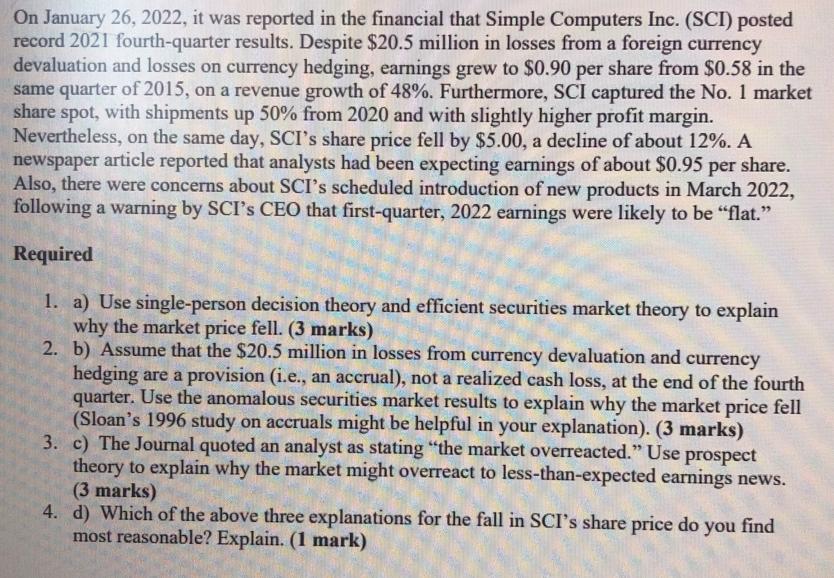

On January 26, 2022, it was reported in the financial that Simple Computers Inc. (SCI) posted record 2021 fourth-quarter results. Despite $20.5 million in losses from a foreign currency devaluation and losses on currency hedging, earnings grew to $0.90 per share from $0.58 in the same quarter of 2015, on a revenue growth of 48%. Furthermore, SCI captured the No. 1 market share spot, with shipments up 50% from 2020 and with slightly higher profit margin. Nevertheless, on the same day, SCI's share price fell by $5.00, a decline of about 12%. A newspaper article reported that analysts had been expecting earnings of about $0.95 per share. Also, there were concerns about SCI's scheduled introduction of new products in March 2022, following a warning by SCI's CEO that first-quarter, 2022 earnings were likely to be "flat." Required 1. a) Use single-person decision theory and efficient securities market theory to explain why the market price fell. (3 marks) 2. b) Assume that the $20.5 million in losses from currency devaluation and currency hedging are a provision (i.e., an accrual), not a realized cash loss, at the end of the fourth quarter. Use the anomalous securities market results to explain why the market price fell (Sloan's 1996 study on accruals might be helpful in your explanation). (3 marks) 3. c) The Journal quoted an analyst as stating "the market overreacted." Use prospect theory to explain why the market might overreact to less-than-expected earnings news. (3 marks) 4. d) Which of the above three explanations for the fall in SCI's share price do you find most reasonable? Explain. (1 mark)

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a The market price fell because Simple Computers Inc SCI did not meet the markets expectations for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started