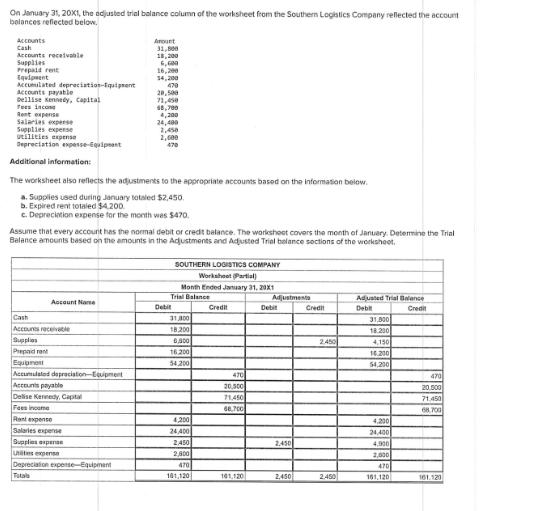

On January 31, 2001, the adjusted trial balance column of the worksheet from the Southern Logistics Company reflected the account belances reflected Accounts Cash

On January 31, 2001, the adjusted trial balance column of the worksheet from the Southern Logistics Company reflected the account belances reflected Accounts Cash Accounts receivable Supplies Prepaid rent Equipment Accumulated depreciation Equipment Accounts payable Dellise Kennedy, Capital Tees income Rent expense Salaries expense Supplies expense utilities expense Depreciation expesse-Equipment Additional information: The worksheet also reflects the adjustments to the appropriate accounts based on the information below. a. Supplies used during January totaled $2,450. b. Expired rent totaled $4,200 c. Depreciation expense for the month was $470. Account Name Assume that every account has the normal debit or credit balance. The workshoot covers the month of January. Determine the Trial Balance amounts based on the amounts in the Adjustments and Adjusted Trial balance sections of the worksheet. Cash Accounts receivable Supplies Prepaid rent Equipment Accumulated depreciation-Equipment Accounts payable Delise Kennedy, Capital Amount 31,800 18,200 6,00 16,200 14,200 470 20,508 71,450 48,700 Fees income Rant expense 4,200 24,400 2,450 2,000 470 Salaries expense Supplies expense Unites expensa Depreciation expense-Equipment Total SOUTHERN LOGISTICS COMPANY Worksheet (Partial) Month Ended January 31, 201 Trial Balance Debit 31,300 18.200 6,300 16.200 54,200 4,200 24,400 2450 2,800 470 101,120 Credit 470 20,500 71,450 40.700 101,120 Adjustment Debit 2,450 2,450 Credit 2.450 2.450 Adjusted Trial Balance Debit Credit 31,800 18.200 4,150 14.200 54,200 4,200 24,400 4.900 2,000 470 161,120 470 20.000 71.450 68.700 161.120 Exercise 5.10 (Algo) Completing the Worksheet from an Adjusted Trial Balance. LO 5-3 Assume the worksheet for Jason Taylor, Counselor and Attorney-at-Law, showed the following accounts and balances on January 31, 20X1 (the first month of operation), as reflected below. Cash Accounts receivable Supplies Prepaid rent Equipment Accumulated depreciation-Equipment Accounts payable Jason Taylor, Capital Jason Taylor, Drawing Fees income Rent expense Supplies expense 14,100 33,195 Salaries expense 570 Depreciation expense-Equipment Assume all accounts have normal balances. Complete the Income Statement and Balance Sheet sections of the worksheet. Account Name Cash Accounts receivable Supplies Prepaid rent Equipment Accumulated depreciation-Equipment Accounts payable Jason Taylor, Capital Jason Taylor, Drawing Fees income Rent expense Supplies expense Salaries expense Depreciation expense-Equipment Totals Net loss Totals 12,030 11,550 14,600 25,700 21,700 570 17,900 83,500 S 11,700 50,875 7,788 JASON TAYLOR COUNSELOR AND ATTORNEY-AT-LAW Worksheet (Partial) Month Ended January 31, 20X1 $ Adjusted Trial Balance Debit Credit 12,030 11,550 14,600 25,700 21,700 11,700 7,700 14,100 33,195 570 152,845 $ 570 17,900 83,500 50,875 152,845 $ $ Income Statement Debit 7,700 14,100 33,195 570 55,565 $ (4,690) 50.875 $ Credit 50,875 $ 50,875 S 50,875 S Balance Sheet Debit 12,030 11,550 14,600 25,700 21,700 11,700 97,280 $ 97,280 S Credit 570 17,900 83,500 101,970 (4,690) 97,280

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the provided information here are the completed Income Statement and Balance Sheet ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started