Question

On January 31st 2021, Kimi Ford, a portfolio manager at NorthPoint Group, a mutual-fund management firm, pored over analysts write-ups of Nike, Inc., the athletic

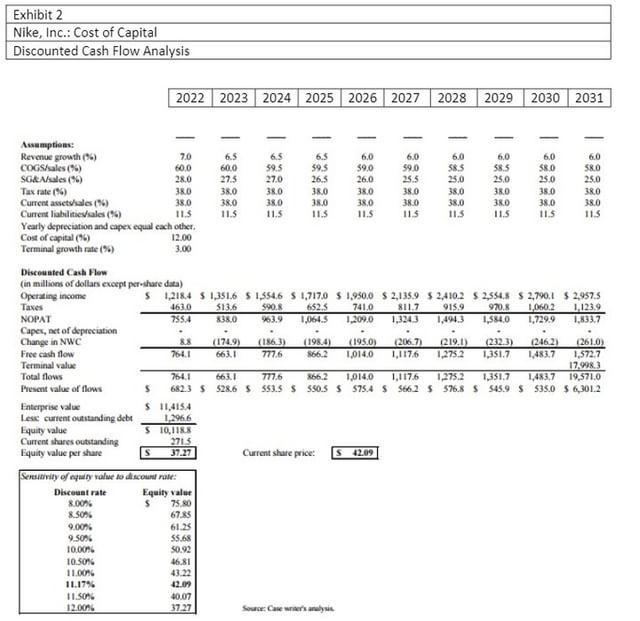

On January 31st 2021, Kimi Ford, a portfolio manager at NorthPoint Group, a mutual-fund management firm, pored over analysts’ write-ups of Nike, Inc., the athletic manufacturer. Nike’s share price had declined significantly from the beginning of the year. Ford was considering buying some shares for the fund she managed, the NorthPoint Large-Cap Fund, which invested mostly in Fortune 500 companies, with an emphasis on value investing. Its top holdings included ExxonMobil, General Motors, McDonald’s, 3M, and other large-cap, generally old-economy stocks. While the stock market had declined over the last 18 months, the NorthPoint Large-Cap Fund had performed extremely well. In 2019, the fund earned a return of 20.7%, even as the S&P 500 fell 10.1%. At the end of June 2020, the fund’s year-to-date returns stood at 6.4% versus -7.3% for the S&P 500.Only a week earlier, on January 20, 2021, Mike had held an analysts’ meeting to disclose its fiscal-year 2020 results. The meeting, however, had another purpose: Nike management wanted to communicate a strategy for revitalizing the company. Since 2017, its revenues had plateaued at around $9 billion, while net income had fallen from almost $800 million to $580 million. Nike’s market share in U.S. athletic shoes had fallen from 48%, in 2016, to 42% in 2019. In addition, recent supply-chain issues and the adverse effect of a strong dollar had negatively affected revenue.At the meeting, management revealed plans to address both top-line growth and operating performance. To boost revenue, the company would develop more athletic-shoe products in the midpriced segment-a segment that Nike had overlooked in recent years. Nike also planned to push its apparel line, which, under the recent leadership of industry veteran Mindy Grossman, had performed extremely well. On the cost side, Nike would exert more effort to expense control. Finally, company executives reiterated their long-term revenue-growths targets of 8% to 10% and earnings-growth targets above 15%. Analysts’ reactions were mixed. Some thought the financial targets were too aggressive; others saw significant growth opportunities in apparel and in Nike’s international businesses.Kimi Ford read all the analysts’ reports that she could find about the January 31st meeting, but the reports gave her no clear guidance: a Lehman Brothers report recommended a strong buy, while UBS Warburg and CSFB analysts expressed misgivings about the company and recommended a hold. Ford decided instead to develop her own discounted cash flow forecast to come to a clearer conclusion.Her forecast showed that, at a discount rate of 12%, Nike was overvalued at its current share price of $42.09. However, she had done a quick sensitivity analysis and revealed Nike was undervalued at

discount rates below 11.17%. Because she was about to go into a meeting, she needs an analyst to estimate Nike’s cost of capital and price per share.

Question:

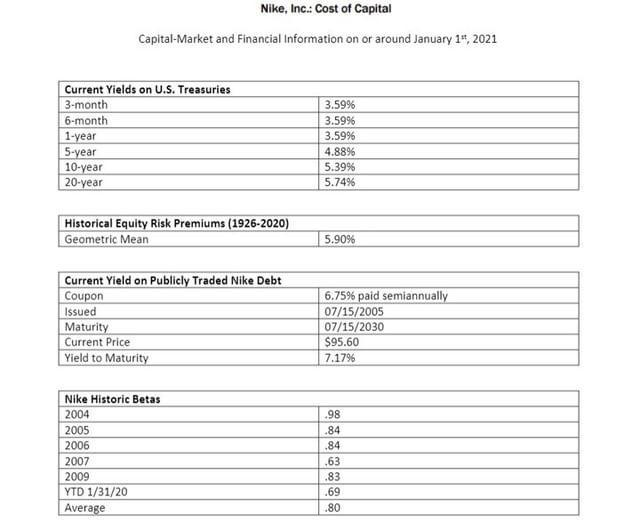

Please calculate the cost of capital (WACC) and price per share. Remember that in your calculations, beta is truly a matter of expectations rather than history and the selection of a risk-free rate of return should be consistent with the remaining life of the asset being valued.

Exhibit 2 Nike, Inc.: Cost of Capital Discounted Cash Flow Analysis 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 - Assumptions: Revenue growth (6) COGS/ales () SGRAsales (%) Tax rate (6) Current assetsales (6) Current liabilities/sales (%) Yearly depreciation and capex equal cach other. Cost of capital (1) Terminal growth rate (%) 10 6.0 58.5 25.0 6.5 6.5 6.5 6.0 59.0 25.5 6.0 6.0 6.0 SKO 25.0 6.0 60.0 27.5 60.0 59.5 27.0 38.0 59.5 26.5 59.0 26.0 58.5 25.0 38.0 S8.0 25.0 38.0 28.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 380 38.0 11.5 38.0 38.0 11.5 38.0 38.0 38.0 38.0 38.0 38.0 115 11.5 11.S 113 11.5 11.5 12.00 3.00 Discounted Cash Flow (in millions of dollars exoept per-share data) Operating income Taves NOPAT Capes, net of depreciation Change in NWC Free cash flow Terminal value Total flows S 1,218.4 S 1,351.6 S 1,554.6 S 1,717.0 S 1,950.0 $ 2,135.9 $ 2,410.2 S 2,554.8 $ 2,790.1 $ 2,957.5 741.0 1,209.0 463.0 970.8 $13.6 838.0 652.5 1,064.5 811.7 590.8 963.9 915.9 1,494.3 1,060.2 1,729.9 L,123.9 1,833.7 755.4 1,3243 1,584.0 88 764.1 (1863) 777.6 (206.7) 1,117.6 (261.0) 1,572.7 17,998.3 1,483,7 19,571.0 682.3 S 528.6 S 553.5 S S50.5 S 575.4 S S662 S 576.8 S 545.9 S 535.0 $ 6,301.2 (174.9) 663.1 (198.4) S66.2 (195.0) L,014.0 219.1) 1,275.2 (232.3) 1,351.7 (246.2) 1,483.7 764.1 663.1 777.6 866.2 1,014.0 1,117.6 1275.2 1,351.7 Present value of flows Enterprise value Lese current outstanding debt Equity value Current shares outstanding Equity value per share S I1,4154 1,2966 S 10,1188 2715 37.27 Current share price: 42.09 Sensutivity of equity value to discoust rate: Equity value 75,80 Discount rate 8.00% 8.SO% 67.85 61.25 9.00% 9.50% 55.68 10.00% 50.92 10.50% 46.81 11.00% IL17% 43.22 42.09 I1.SO% 40.07 12.00 37.27 Source: Case wraers analysia

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A B E F H 1 Risk Free Rate 10 yr treasury rate 00539 Average Be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started