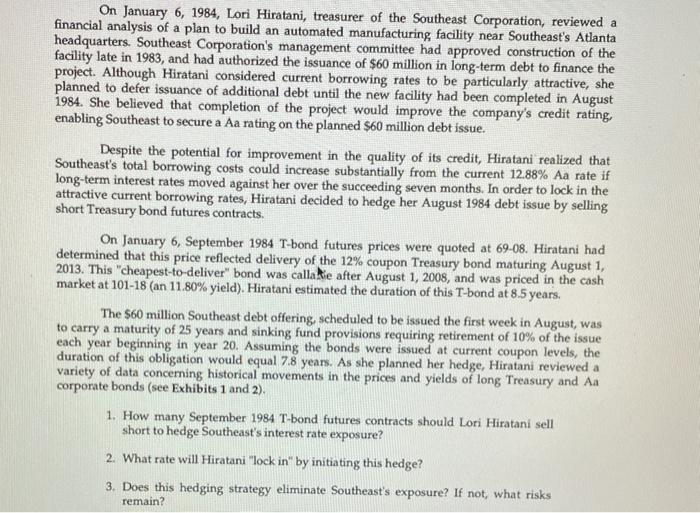

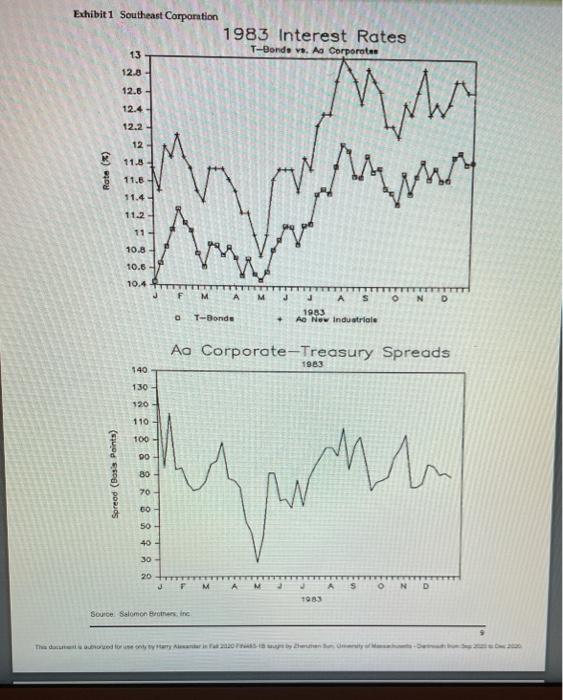

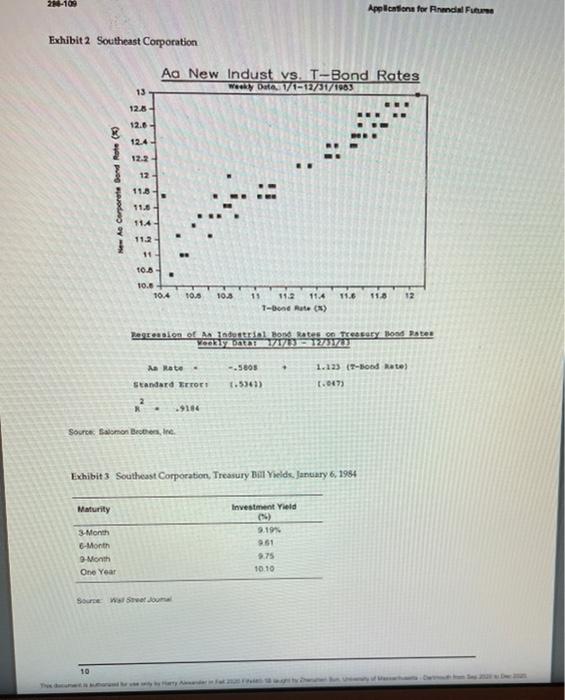

On January 6, 1984, Lori Hiratani, treasurer of the Southeast Corporation, reviewed a financial analysis of a plan to build an automated manufacturing facility near Southeast's Atlanta headquarters. Southeast Corporation's management committee had approved construction of the facility late in 1983, and had authorized the issuance of $60 million in long-term debt to finance the project. Although Hiratani considered current borrowing rates to be particularly attractive, she planned to defer issuance of additional debt until the new facility had been completed in August 1984. She believed that completion of the project would improve the company's credit rating, enabling Southeast to secure a Aa rating on the planned $60 million debt issue. Despite the potential for improvement in the quality of its credit, Hiratani realized that Southeast's total borrowing costs could increase substantially from the current 12.88% Aa rate if long-term interest rates moved against her over the succeeding seven months. In order to lock in the attractive current borrowing rates, Hiratani decided to hedge her August 1984 debt issue by selling short Treasury bond futures contracts. On January 6, September 1984 T-bond futures prices were quoted at 69-08. Hiratani had determined that this price reflected delivery of the 12% coupon Treasury bond maturing August 1, 2013. This "cheapest-to-deliver" bond was callade after August 1, 2008, and was priced in the cash market at 101-18 (an 11.80% yield). Hiratani estimated the duration of this T-bond at 8.5 years. The $60 million Southeast debt offering, scheduled to be issued the first week in August, was to carry a maturity of 25 years and sinking fund provisions requiring retirement of 10% of the issue each year beginning in year 20. Assuming the bonds were issued at current coupon levels, the duration of this obligation would equal 7.8 years. As she planned her hedge, Hiratani reviewed a variety of data concerning historical movements in the prices and yields of long Treasury and Aa corporate bonds (see Exhibits 1 and 2). 1. How many September 1984 T-bond futures contracts should Lori Hiratani sell short to hedge Southeast's interest rate exposure? 2. What rate will Hiratani "lock in" by initiating this hedge? 3. Does this hedging strategy eliminate Southeast's exposure? If not, what risks remain? Exhibit1 Southeast Corporation 1983 Interest Rates 13 T-Donde vs. As Corporates 12.8 12.8 - 12.4 12.2 12 11.8 Rate (*) 11.6 11.4 w fear - 11.2- 11 10.8 10.6 10.4 J F M M J o N D A 1983 Ao New Industriale T-Bonda Ao Corporate-Treasury Spreads 1983 140 130 320 - 110 100 DO Spread (Boss Points) 80 70 zu BO 50 45 30 20 JT M s A 1983 Source Salomon Brothers, Inc The data on yrity 2N-109 Application for Financial Fue Exhibit 2 Southeast Corporation Aa New Indust vs. T-Bond Rates werky Date 11-12/31/1963 13 12.6 12.6 12.4 12.2+ 12 New As Corporate Bond Rolex 11.8 - 11.6 !! 11.4 11-2 11 10.B 10.6 10.4 10S 10.6 11 11.6 118 12 11.2 11.4 1-Bond Rate (N) Regieasion of an industrial Bond Rates on Trestatynoad Pater . A Rate - Standard Error 1.123 (9-Hond mate) 1.047 1.5361) Source Salomon Brothers, ne Exhibit3 Southeast Corporation, Treasury Bal Yields, January 6, 1984 Maturity 3-Month 6 Month Month One Year investment Yield C) 9.1994 961 9.75 10.10 Source Swan 10 On January 6, 1984, Lori Hiratani, treasurer of the Southeast Corporation, reviewed a financial analysis of a plan to build an automated manufacturing facility near Southeast's Atlanta headquarters. Southeast Corporation's management committee had approved construction of the facility late in 1983, and had authorized the issuance of $60 million in long-term debt to finance the project. Although Hiratani considered current borrowing rates to be particularly attractive, she planned to defer issuance of additional debt until the new facility had been completed in August 1984. She believed that completion of the project would improve the company's credit rating, enabling Southeast to secure a Aa rating on the planned $60 million debt issue. Despite the potential for improvement in the quality of its credit, Hiratani realized that Southeast's total borrowing costs could increase substantially from the current 12.88% Aa rate if long-term interest rates moved against her over the succeeding seven months. In order to lock in the attractive current borrowing rates, Hiratani decided to hedge her August 1984 debt issue by selling short Treasury bond futures contracts. On January 6, September 1984 T-bond futures prices were quoted at 69-08. Hiratani had determined that this price reflected delivery of the 12% coupon Treasury bond maturing August 1, 2013. This "cheapest-to-deliver" bond was callade after August 1, 2008, and was priced in the cash market at 101-18 (an 11.80% yield). Hiratani estimated the duration of this T-bond at 8.5 years. The $60 million Southeast debt offering, scheduled to be issued the first week in August, was to carry a maturity of 25 years and sinking fund provisions requiring retirement of 10% of the issue each year beginning in year 20. Assuming the bonds were issued at current coupon levels, the duration of this obligation would equal 7.8 years. As she planned her hedge, Hiratani reviewed a variety of data concerning historical movements in the prices and yields of long Treasury and Aa corporate bonds (see Exhibits 1 and 2). 1. How many September 1984 T-bond futures contracts should Lori Hiratani sell short to hedge Southeast's interest rate exposure? 2. What rate will Hiratani "lock in" by initiating this hedge? 3. Does this hedging strategy eliminate Southeast's exposure? If not, what risks remain? Exhibit1 Southeast Corporation 1983 Interest Rates 13 T-Donde vs. As Corporates 12.8 12.8 - 12.4 12.2 12 11.8 Rate (*) 11.6 11.4 w fear - 11.2- 11 10.8 10.6 10.4 J F M M J o N D A 1983 Ao New Industriale T-Bonda Ao Corporate-Treasury Spreads 1983 140 130 320 - 110 100 DO Spread (Boss Points) 80 70 zu BO 50 45 30 20 JT M s A 1983 Source Salomon Brothers, Inc The data on yrity 2N-109 Application for Financial Fue Exhibit 2 Southeast Corporation Aa New Indust vs. T-Bond Rates werky Date 11-12/31/1963 13 12.6 12.6 12.4 12.2+ 12 New As Corporate Bond Rolex 11.8 - 11.6 !! 11.4 11-2 11 10.B 10.6 10.4 10S 10.6 11 11.6 118 12 11.2 11.4 1-Bond Rate (N) Regieasion of an industrial Bond Rates on Trestatynoad Pater . A Rate - Standard Error 1.123 (9-Hond mate) 1.047 1.5361) Source Salomon Brothers, ne Exhibit3 Southeast Corporation, Treasury Bal Yields, January 6, 1984 Maturity 3-Month 6 Month Month One Year investment Yield C) 9.1994 961 9.75 10.10 Source Swan 10