Answered step by step

Verified Expert Solution

Question

1 Approved Answer

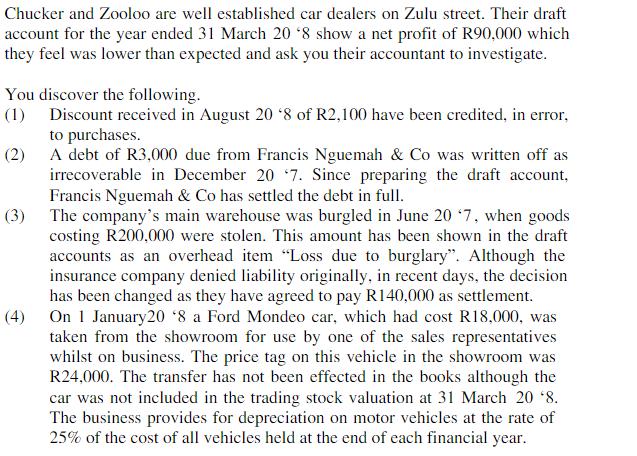

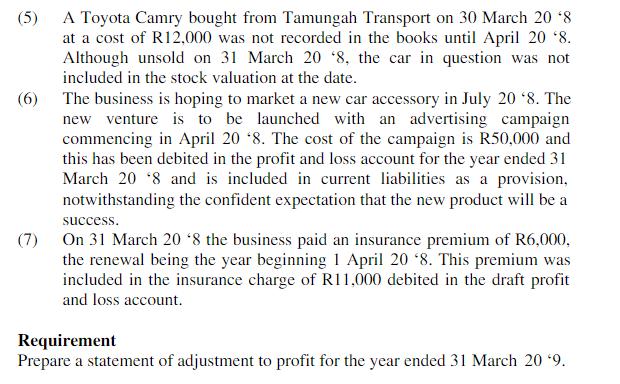

Chucker and Zooloo are well established car dealers on Zulu street. Their draft account for the year ended 31 March 20 8 show a

Chucker and Zooloo are well established car dealers on Zulu street. Their draft account for the year ended 31 March 20 8 show a net profit of R90,000 which they feel was lower than expected and ask you their accountant to investigate. You discover the following. (1) Discount received in August 20 '8 of R2,100 have been credited, in error, to purchases. (2) A debt of R3,000 due from Francis Nguemah & Co was written off as irrecoverable in December 20 7. Since preparing the draft account, Francis Nguemah & Co has settled the debt in full. (3) The company's main warehouse was burgled in June 20 *7, when goods costing R200,000 were stolen. This amount has been shown in the draft accounts as an overhead item "Loss due to burglary". Although the insurance company denied liability originally, in recent days, the decision has been changed as they have agreed to pay R140,000 as settlement. On 1 January20 8 a Ford Mondeo car, which had cost R18,000, was taken from the showroom for use by one of the sales representatives whilst on business. The price tag on this vehicle in the showroom was R24,000. The transfer has not been effected in the books although the car was not included in the trading stock valuation at 31 March 20*8. The business provides for depreciation on motor vehicles at the rate of 25% of the cost of all vehicles held at the end of each financial year. (5) A Toyota Camry bought from Tamungah Transport on 30 March 20'8 at a cost of R12,000 was not recorded in the books until April 20*8. Although unsold on 31 March 20 '8, the car in question was not included in the stock valuation at the date. (6) The business is hoping to market a new car accessory in July 2018. The new venture is to be launched with an advertising campaign commencing in April 20 8. The cost of the campaign is R50,000 and this has been debited in the profit and loss account for the year ended 31 March 208 and is included in current liabilities as a provision, notwithstanding the confident expectation that the new product will be a success. (7) On 31 March 20 8 the business paid an insurance premium of R6,000, the renewal being the year beginning 1 April 20 8. This premium was included in the insurance charge of R11,000 debited in the draft profit and loss account. Requirement Prepare a statement of adjustment to profit for the year ended 31 March 20 *9.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Adjusted Profit and Loss Account for the year ended 31 March 20 9 Revenue Less Di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started