Answered step by step

Verified Expert Solution

Question

1 Approved Answer

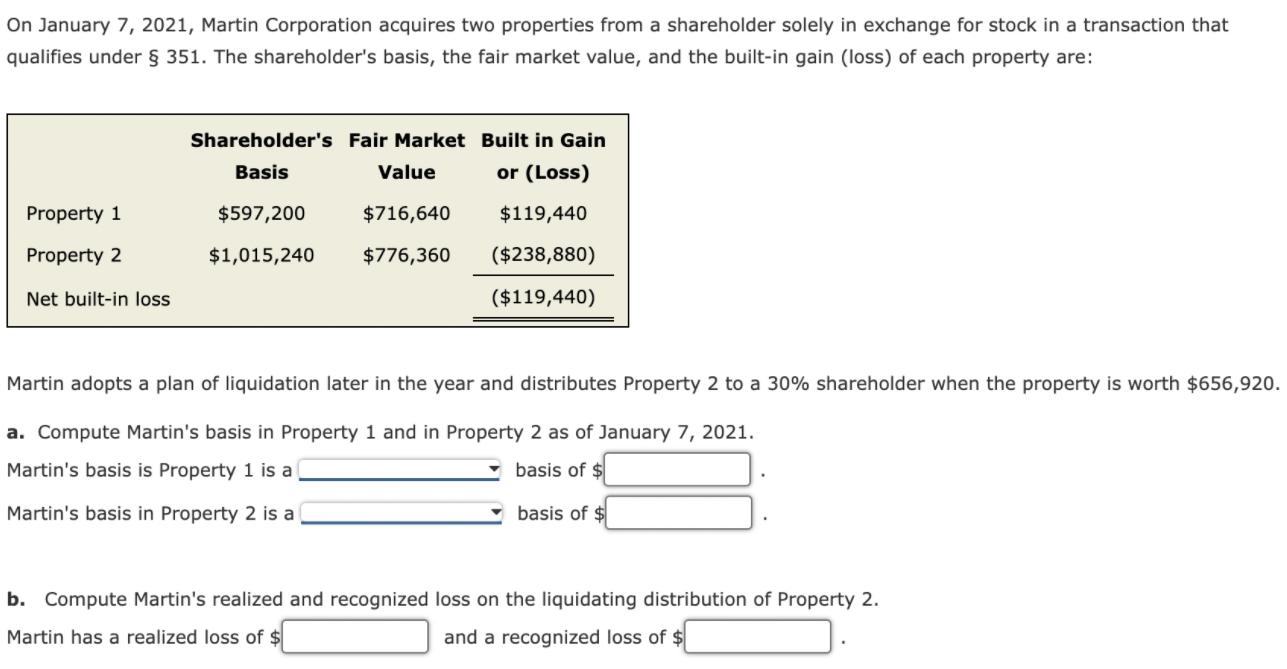

On January 7, 2021, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction that qualifies under 351.

On January 7, 2021, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction that qualifies under 351. The shareholder's basis, the fair market value, and the built-in gain (loss) of each property are: Shareholder's Fair Market Built in Gain Basis Value or (Loss) Property 1 $597,200 $716,640 $119,440 Property 2 $1,015,240 $776,360 ($238,880) Net built-in loss ($119,440) Martin adopts a plan of liquidation later in the year and distributes Property 2 to a 30% shareholder when the property is worth $656,920. a. Compute Martin's basis in Property 1 and in Property 2 as of January 7, 2021. Martin's basis is Property 1 is a basis of $ Martin's basis in Property 2 is a basis of $ b. Compute Martin's realized and recognized loss on the liquidating distribution of Property 2. Martin has a realized loss of $ and a recognized loss of $

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 1 a Martins basis in Property 1 is a carryover basis of 597200 Martins basis in Proper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started