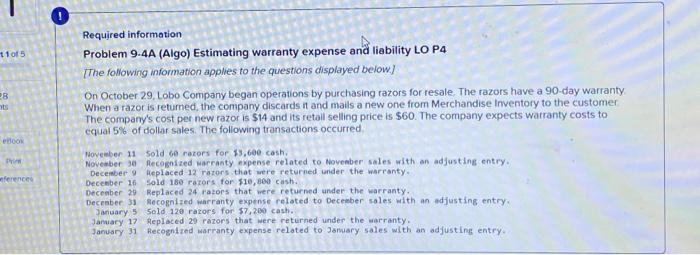

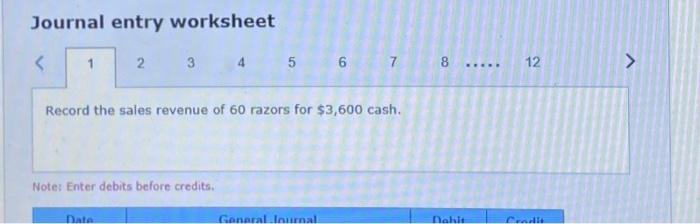

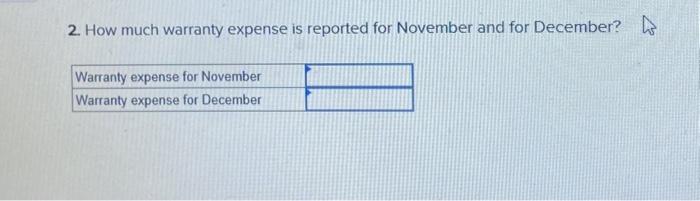

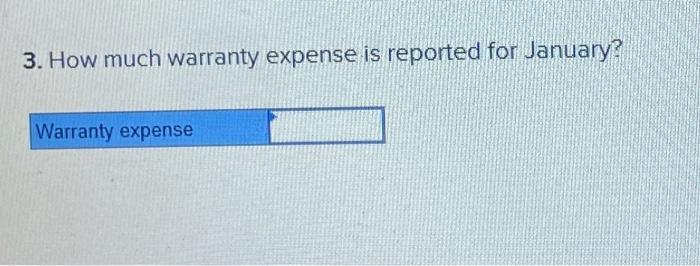

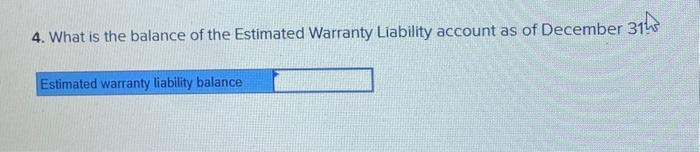

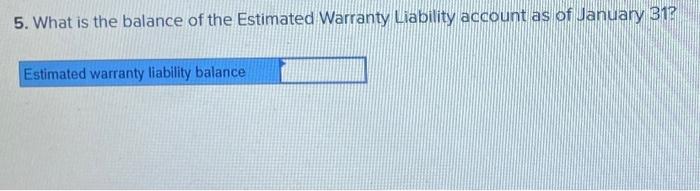

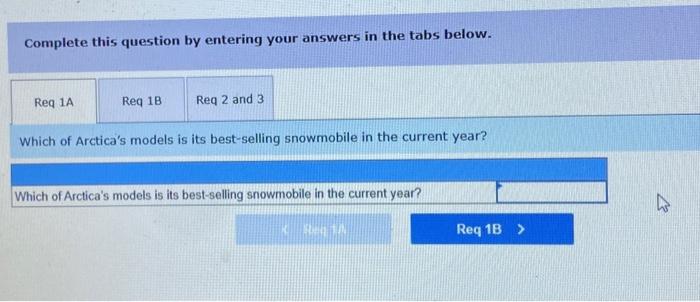

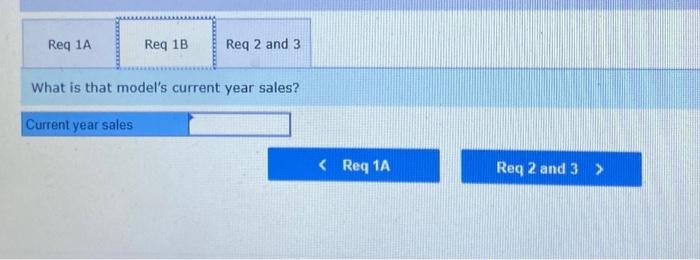

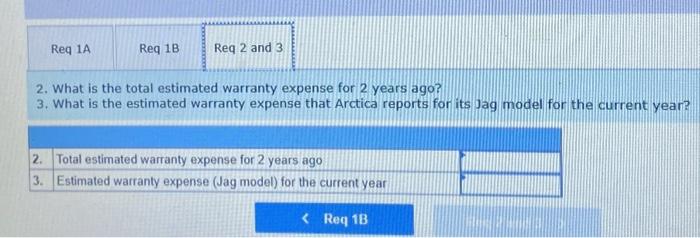

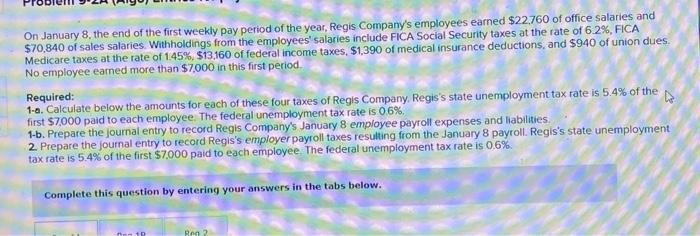

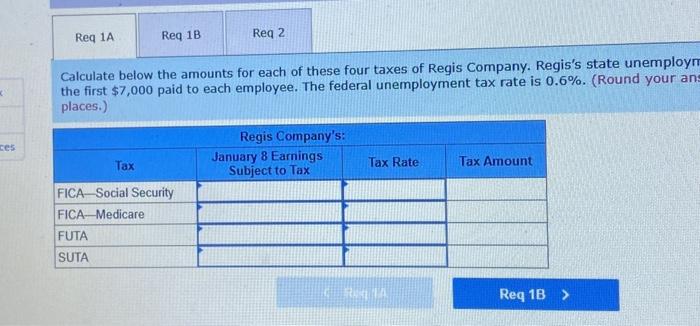

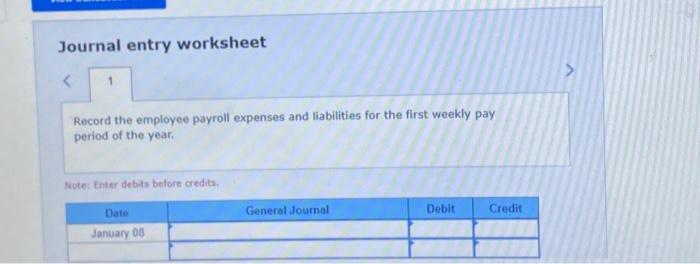

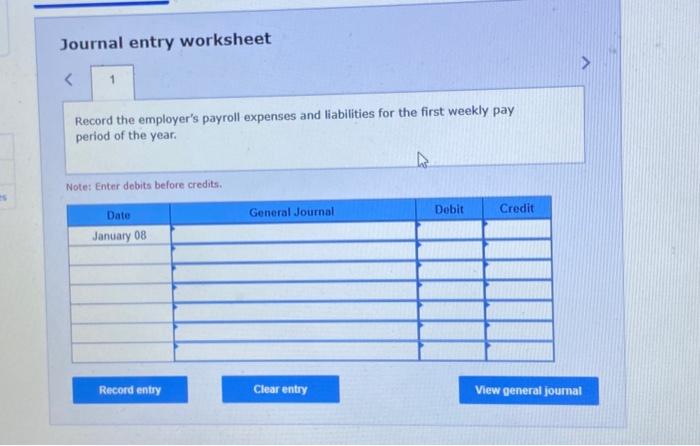

On January 8 , the end of the first weekly pay period of the year, Regis Company's employees earned $22,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%,$13,160 of federal income taxes, $1,390 of medical insurance deductions, and $940 of union dues, No employee earned more than $7,000 in this first period. Required: 1-a. Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%, 1-b. Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. 2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is 5.4% of the first $7.000 paid to each employee. The federal unemployment tax rate is 0.6%. Complete this question by entering your answers in the tabs below. 5. What is the balance of the Estimated Warranty Liability account as of January 31 ? Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployn the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. (Round your an 2. What is the total estimated warranty expense for 2 years ago? 3. What is the estimated warranty expense that Arctica reports for its jag model for the current year? Complete this question by entering your answers in the tabs below. Which of Arctica's models is its best-selling snowmobile in the current year? What is that model's current year sales? 4. What is the balance of the Estimated Warranty Liability account as of December 31hr 2. How much warranty expense is reported for November and for December? Required information Problem 9-4A (Algo) Estimating warranty expense and liability LO P4 The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer The company's cost per new razor is $14 and its retall selling price is $60. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred November 11 sold 60 razors for $3,600 cash, November 36 Recognized warranty expense related to Novenber sales with an adjusting entry. Decenber 9 fleplaced 12 razors that were returned under the warranty. Decenber if Sold 180 rators for $10,800 cash. Decenber 29 Replaced 24 razors that were returned under the warranty. Decraber 31 Aecognlzed warranty expense reloted to Deceeber sales with an adjusting entry. January 5 sold 120 rasors for $7,200 cash. January 17 , geplaced 29 phzors that were retterned under the warranty. January 31 Hecogntzed warranty expense related to Jomusry sales with an adjusting entry. Journal entry worksheet \begin{tabular}{|c|cccccccc|c|} \hline 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & & 12 \end{tabular} \mid> Record the sales revenue of 60 razors for $3,600 cash. Note: Enter debits before credits. Journal entry worksheet Record the employee payroll expenses and liabilities for the first weekly pay period of the year. Noter Enter debits belore credits. 3. How much warranty expense is reported for January? Journal entry worksheet Record the employer's payroll expenses and liabilities for the first weekly pay period of the year. Note: Enter debits before credits