Answered step by step

Verified Expert Solution

Question

1 Approved Answer

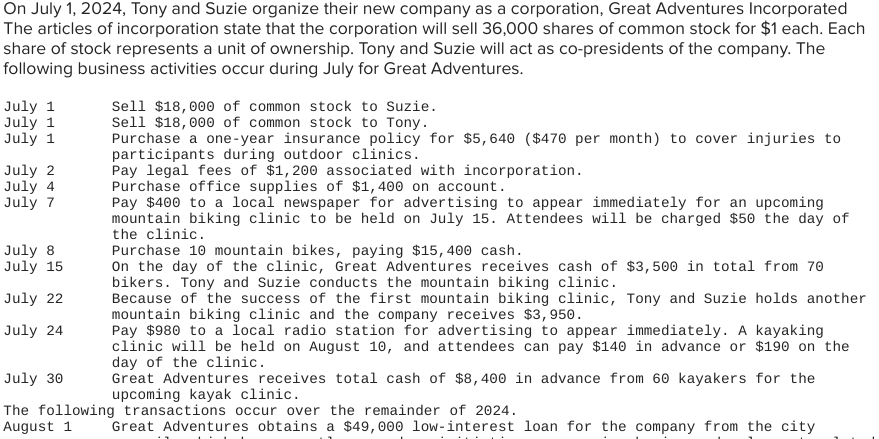

On July 1 , 2 0 2 4 , Tony and Suzie organize their new company as a corporation, Great Adventures Incorporated The articles of

On July Tony and Suzie organize their new company as a corporation, Great Adventures Incorporated

The articles of incorporation state that the corporation will sell shares of common stock for $ each. Each

share of stock represents a unit of ownership. Tony and Suzie will act as copresidents of the company. The

following business activities occur during July for Great Adventures.

The following information relates to yearend adjusting entries as of December

a Depreciation of the mountain bikes purchased on July and kayaks purchased on August totals $

b Six months' of the oneyear insurance policy purchased on July has expired.

c Four months of the oneyear rental agreement purchased on September has expired.

d Of the $ of office supplies purchased on July $ remains.

e Interest expense on the $ loan obtained from the city council on August should be recorded.

f Of the $ of racing supplies purchased on December $ remains.

g Suzie calculates that the company owes $ in income taxes.

Prepare an adjusted trial balance as of December Required information

The questions auto copied all except for the second and last one. Help would be very much appreciated!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started