Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2005, the Town of Logan began two construction projects: (1) an addition to the town hall and (2) a curbing construction project

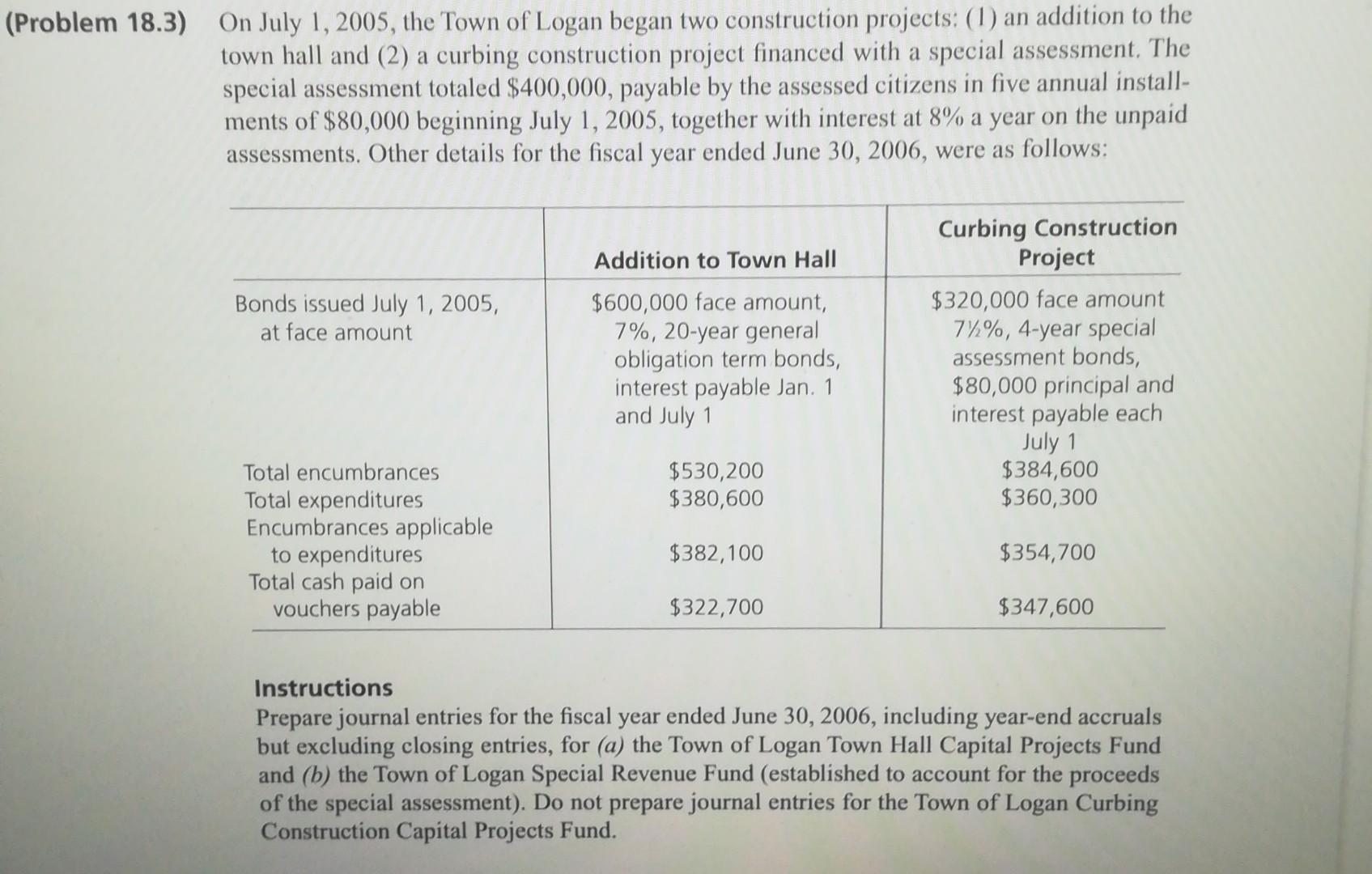

On July 1, 2005, the Town of Logan began two construction projects: (1) an addition to the town hall and (2) a curbing construction project financed with a special assessment. The special assessment totaled $400,000, payable by the assessed citizens in five annual installments of $80,000 beginning July 1,2005 , together with interest at 8% a year on the unpaid assessments. Other details for the fiscal year ended June 30,2006 , were as follows: Instructions Prepare journal entries for the fiscal year ended June 30, 2006, including year-end accruals but excluding closing entries, for (a) the Town of Logan Town Hall Capital Projects Fund and (b) the Town of Logan Special Revenue Fund (established to account for the proceeds of the special assessment). Do not prepare journal entries for the Town of Logan Curbing Construction Capital Projects Fund

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started