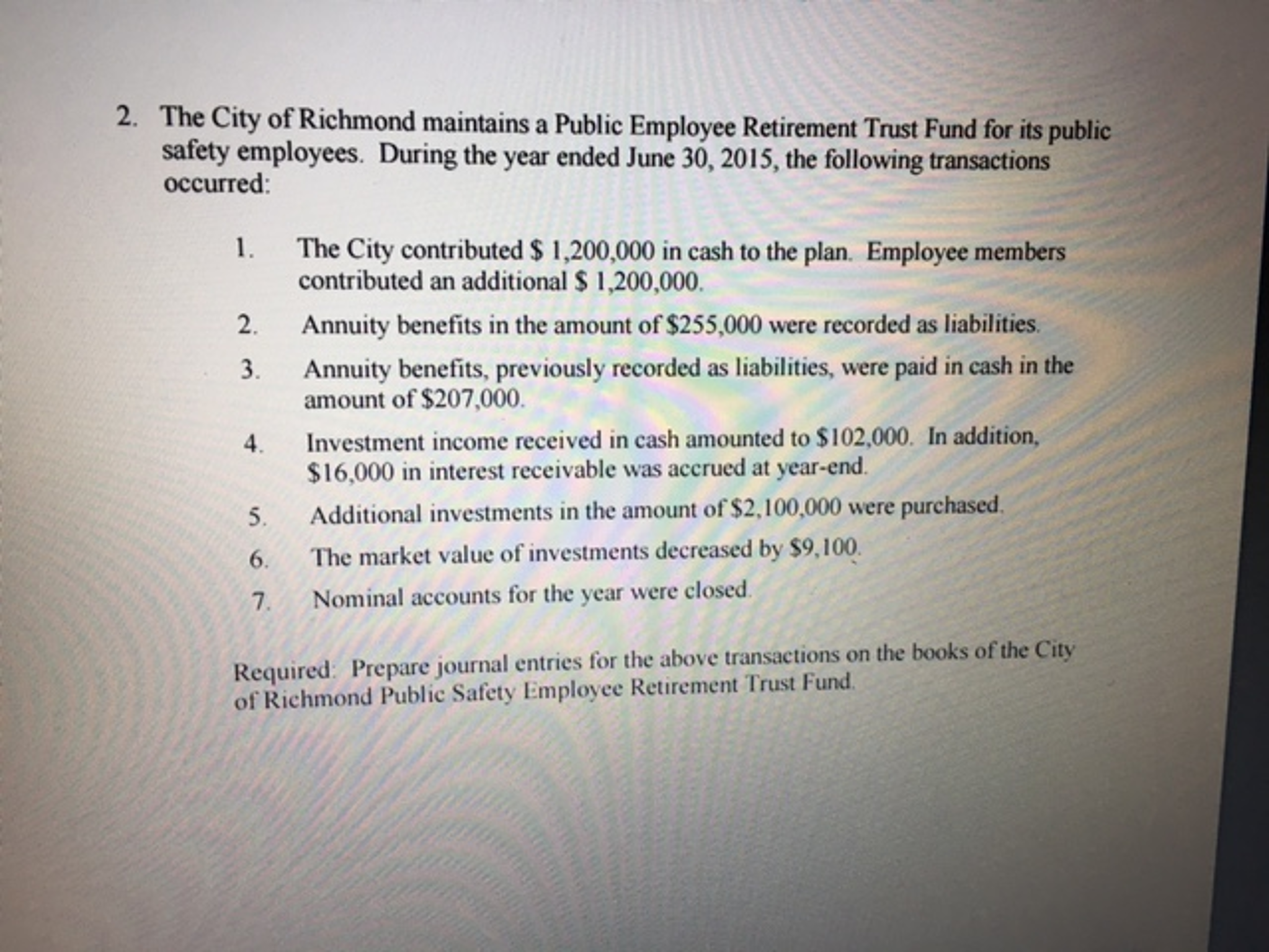

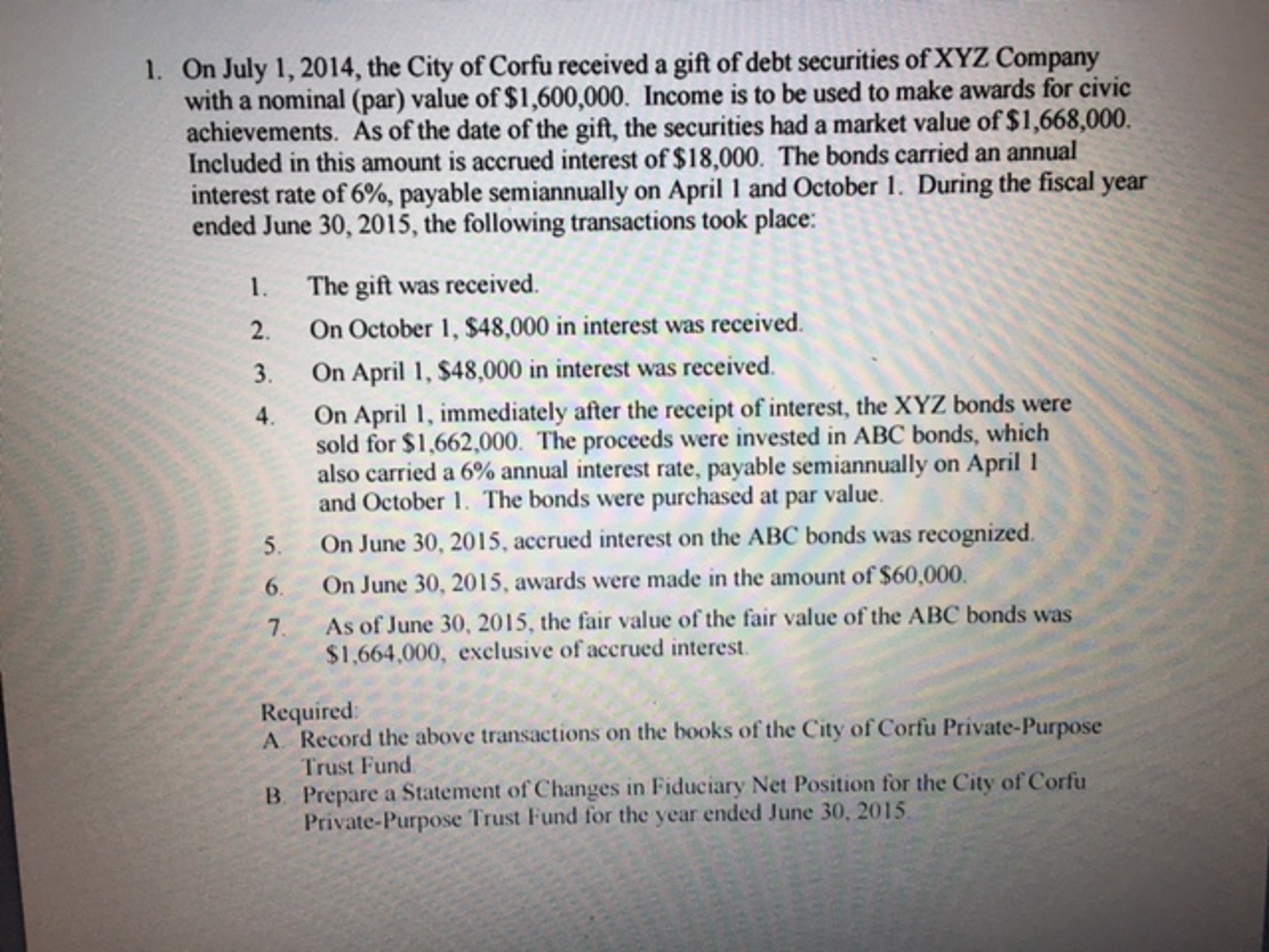

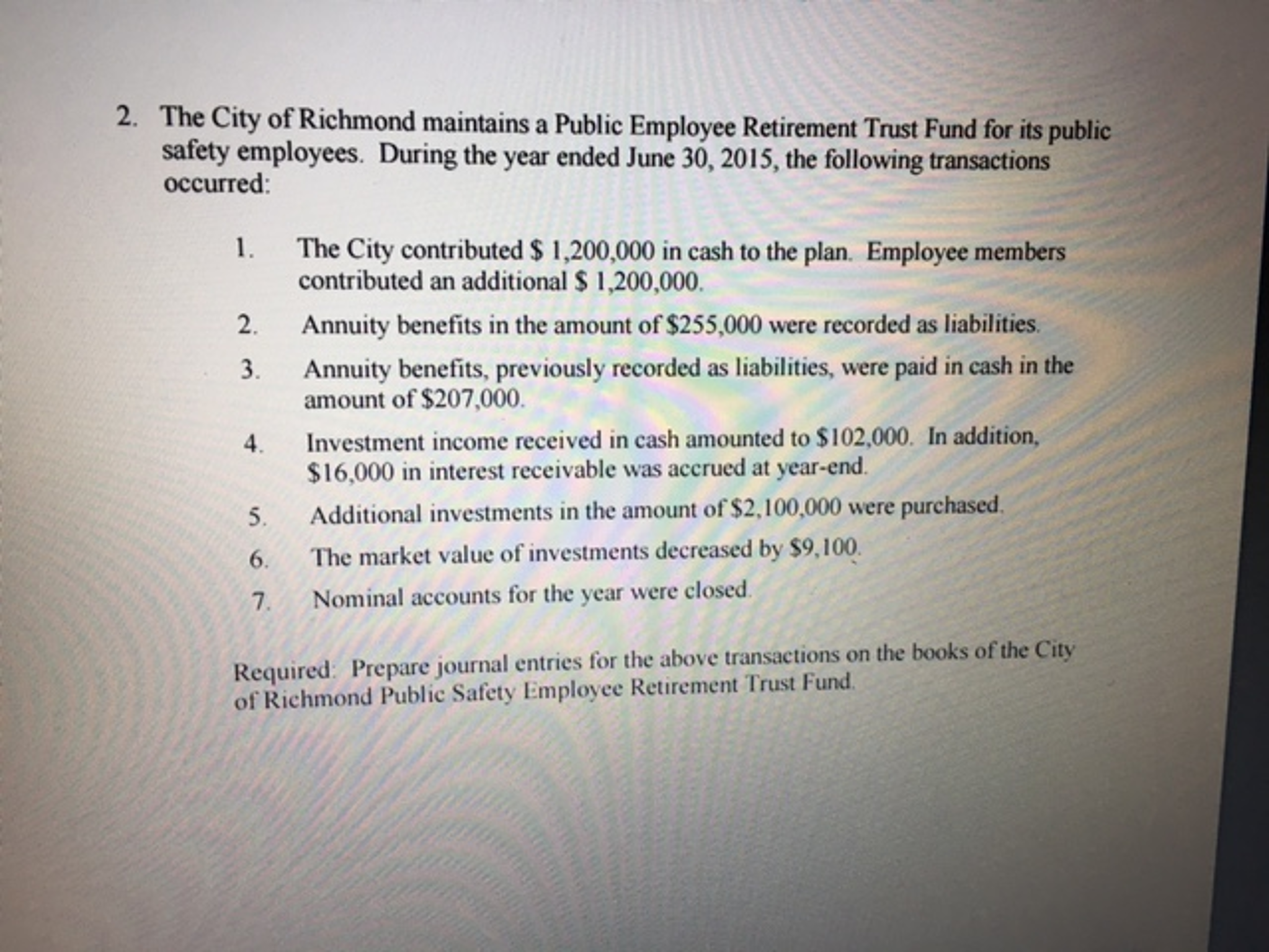

On July 1, 2014, the City of Corfu received a gift of debt securities of XYZ Company with a nominal (par) value of $1, 600,000 Income is to be used to make awards for civic achievements As of the date of the gift the securities had a market value of $1, 668,000. Included in this amount is accrued interest of $18,000 The bonds carried an annual interest rate of 6%, payable semiannually on April 1 and October 1. During the fiscal year ended June 30, 2015, the following transactions took place: The gift was received. On October 1, $48,000 in interest was received. On April 1, $48,000 in interest was received. On April 1, immediately after the receipt of interest, the XYZ bonds were sold for $1, 662,000. The proceeds were invested in ABC bonds, which also carried a 6% annual interest rate, payable semiannually on April 1 and October 1. The bonds were purchased at par value On June 30, 2015, accrued interest on the ABC bonds was recognized. On June 30, 2015, awards were made in the amount of $60,000. As of June 30, 2015, the fair value of the fair value of the ABC bonds was $1, 664.000, exclusive of accrued interest. A. Record the above transactions on the books of the City of Corfu Private-Purpose Trust Fund B. Prepare a Statement of Changes in Fiduciary Net Position for the City of Corfu Private-Purpose Trust Fund for the year ended June 30, 2015. The City of Richmond maintains a Public Employee Retirement Trust Fund for its public safety employees During the year ended June 30, 2015, the following transactions occurred: The City contributed $ 1, 200,000 in cash to the plan. Employee members contributed an additional $ 1, 200,000. Annuity benefits in the amount of $255,000 were recorded as liabilities. Annuity benefits, previously recorded as liabilities, were paid in cash in the amount of $207,000. Investment income received in cash amounted to $102,000. In addition, $16,000 in interest receivable was accrued at year-end. Additional investments in the amount of $2, 100,000 were purchased. The market value of investments decreased by $9, 100. Nominal accounts for the year were closed. Prepare journal entries for the above transactions on the books of the City of Richmond Public Safety Employee Retirement Trust Fund