Answered step by step

Verified Expert Solution

Question

1 Approved Answer

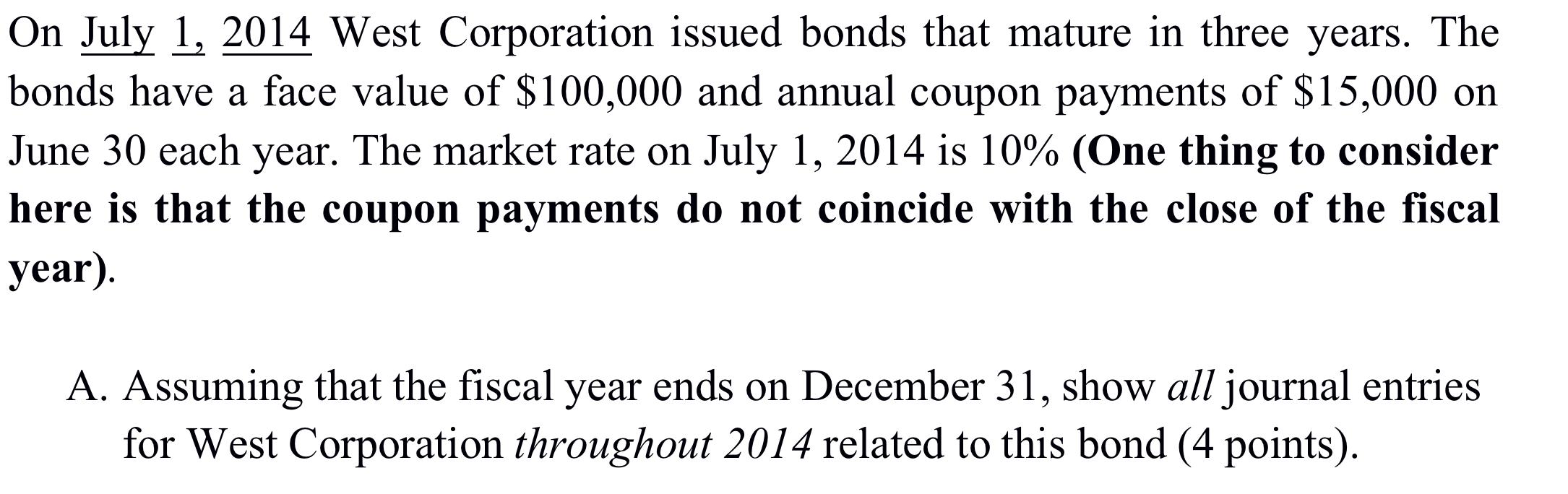

On July 1, 2014 West Corporation issued bonds that mature in three years. The bonds have a face value of $100,000 and annual coupon

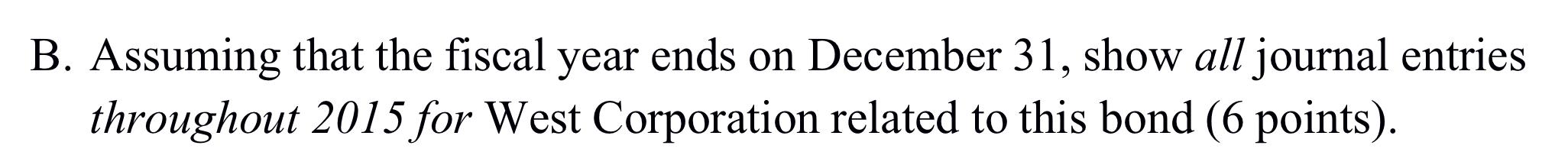

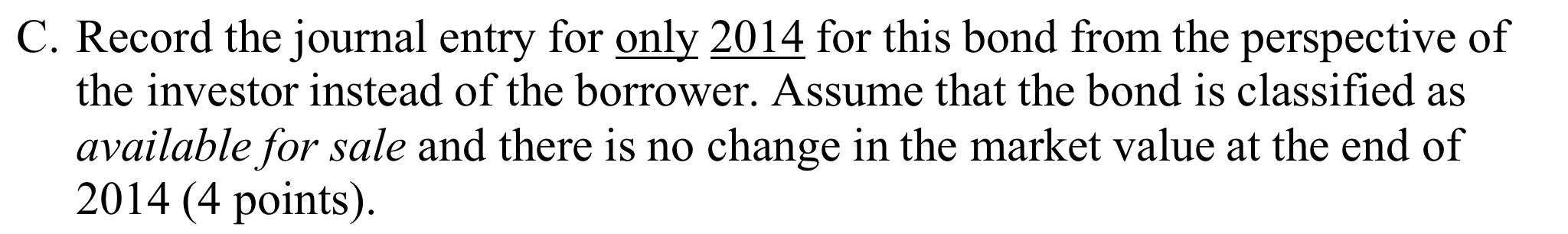

On July 1, 2014 West Corporation issued bonds that mature in three years. The bonds have a face value of $100,000 and annual coupon payments of $15,000 on June 30 each year. The market rate on July 1, 2014 is 10% (One thing to consider here is that the coupon payments do not coincide with the close of the fiscal ear). A. Assuming that the fiscal year ends on December 31, show all journal entries for West Corporation throughout 2014 related to this bond (4 points). B. Assuming that the fiscal year ends on December 31, show all journal entries throughout 2015 for West Corporation related to this bond (6 points). C. Record the journal entry for only 2014 for this bond from the perspective of the investor instead of the borrower. Assume that the bond is classified as available for sale and there is no change in the market value at the end of 2014 (4 points).

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Present Value of 100000 receivabele after 3 year discounted 10 7513148 Present Value of Annual coupo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started