Question

On July 1, 2015, Olivers Oil Change, a sole proprietorship, purchased and placed into service a piece of business-use property for $100,000 (5-year MACRS recovery

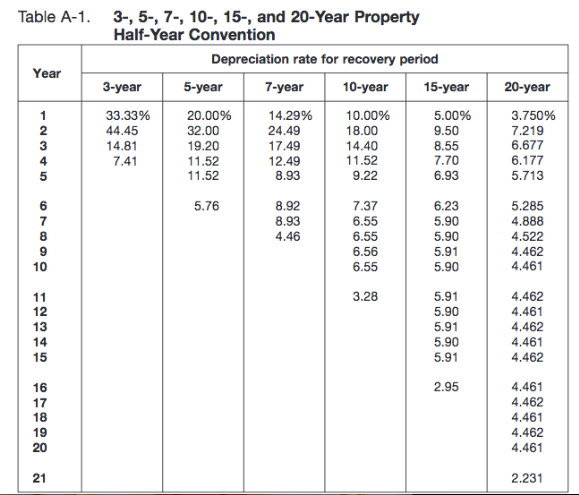

On July 1, 2015, Olivers Oil Change, a sole proprietorship, purchased and placed into service a piece of business-use property for $100,000 (5-year MACRS recovery period, depreciated under MACRS GDS, not SL depreciation). This was the only property that Olivers placed into service in 2015. Olivers did not take a section 179 deduction or section 168(k) bonus. Olivers sold the equipment on March 1, 2017 for $50,000.

A. What are Olivers total depreciation deductions for 2015, 2016 and 2017? Add depreciation deductions for all 3 years together.

B. What is Olivers recognized gain or loss on the sale of the equipment in 2017?

C. What is the character of Olivers recognized gain if Oliver had no other property dispositions during the year (LTCG, LTCL, STCG, STCL, or ordinary Income)?

Note: understand what Olivers total recapture potential in the equipment was prior to the sale and what the character of Olivers recognized gain would be if Oliver sold the equipment for $110,000 instead of $50,000.

Table A-1 3-, 5-, 7-, 10-, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period Year 3-year 5-year 7-year 10-year 15-year 20-year 33.33% 20.00% 14.29% 10.00% 5.00% 3.750% 44.45 32.00 24.49 18.00 9.50 7.219 14.81 19.20 17.49 14.40 8.55 6.677 7.41 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 5.713 8.92 5.76 7.37 6.23 5.285 4.888 8.93 6.55 5.90 4.522 4.46 6.55 5.90 4.462 6.56 5.91 4.461 6.55 5.90 10 3.28 5.91 4.462 11 12 5.90 4.461 5.91 4.462 13 4.461 14 5.90 4.462 15 5.91 4.461 2.95 16 4,462 17 4.461 18 19 4.462 4.461 21 2.231

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started