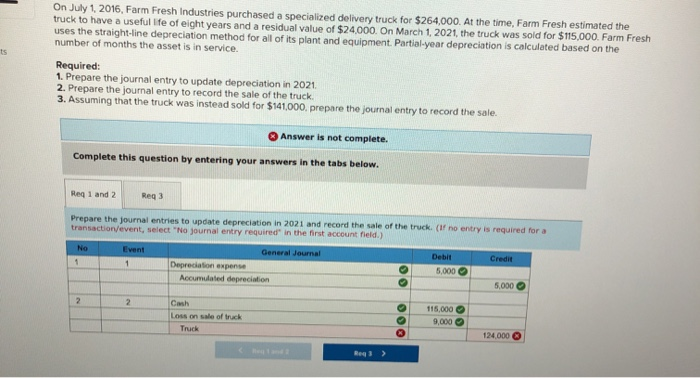

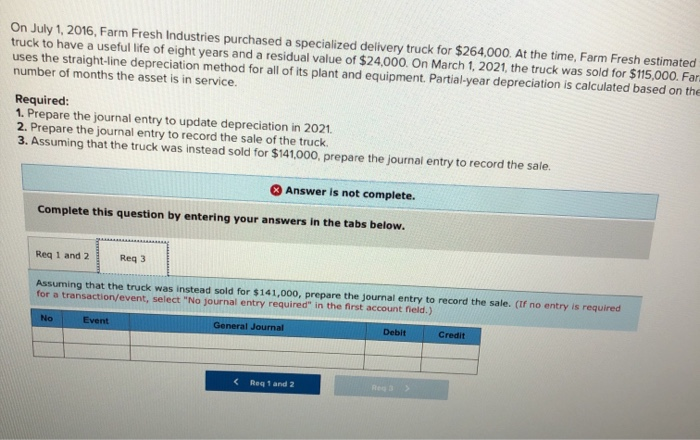

On July 1 2016, Farm Fresh Industries purchased a specialized delivery truck for $264,000. At the time, Farm Fresh estimated the truck to have a useful life of eight years and a residual value of $24,000. On March 1, 2021, the truck was sold for $115,000. Farm Fresh uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. Required: 1. Prepare the journal entry to update depreciation in 2021 2. Prepare the journal entry to record the sale of the truck. 3. Assuming that the truck was instead sold for $141,000, prepare the journal entry to record the sale. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Prepare the journal entries to update depreciation in 2021 and record the sale of the truck. (If no entry is required for a transaction event, select "No journal entry required in the first account field.) General Journal Debit Credit 5.000 Depreciation expense Accumulated depreciation 5.000 115.000 9.000 Los on sale of truck On July 1, 2016, Farm Fresh Industries purchased a specialized delivery truck for $264,000. At the time, Farm Fresh estimated truck to have a useful life of eight years and a residual value of $24,000. On March 1, 2021, the truck was sold for $115 uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. Required: 1. Prepare the journal entry to update depreciation in 2021. 2. Prepare the journal entry to record the sale of the truck 3. Assuming that the truck was instead sold for $141,000, prepare the journal entry to record the sale. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Assuming that the truck was instead sold for $141,000, prepare the journal entry to record the sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account held.) No Event General Journal Debit Credit