Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2016, the City of Corfu received a gift of debt securities of XYZ Company with a nominal (par) value of $1,600,000.

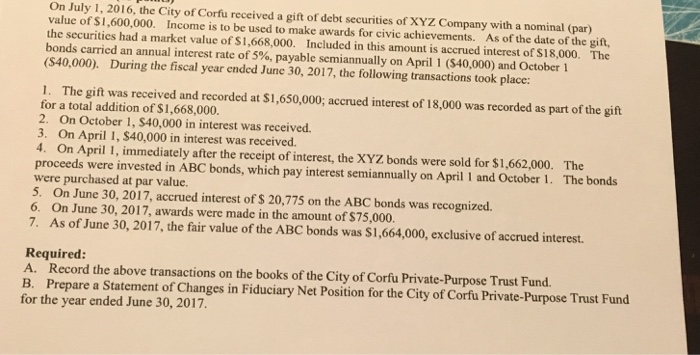

On July 1, 2016, the City of Corfu received a gift of debt securities of XYZ Company with a nominal (par) value of $1,600,000. Income is to be used to make awards for civic achievements. As of the date of the gift, the securities had a market value of $1,668,000. Included in this amount is accrued interest of $18,000. The bonds carried an annual interest rate of 5%, payable semiannually on April 1 ($40,000) and October 1 ($40,000). During the fiscal year ended June 30, 2017, the following transactions took place: 1. The gift was received and recorded at $1,650,000; accrued interest of 18,000 was recorded as part of the gift for a total addition of $1,668,000. 2. On October 1, $40,000 in interest was received. 3. On April 1, $40,000 in interest was received. 4. On April 1, immediately after the receipt of interest, the XYZ bonds were sold for $1,662,000. The proceeds were invested in ABC bonds, which pay interest semiannually on April 1 and October 1. The bonds were purchased at par value. 5. On June 30, 2017, accrued interest of $ 20,775 on the ABC bonds was recognized. 6. On June 30, 2017, awards were made in the amount of $75,000. 7. As of June 30, 2017, the fair value of the ABC bonds was $1,664,000, exclusive of accrued interest. Required: A. Record the above transactions on the books of the City of Corfu Private-Purpose Trust Fund. B. Prepare a Statement of Changes in Fiduciary Net Position for the City of Corfu Private-Purpose Trust Fund for the year ended June 30, 2017.

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started