Question

On July 1, 2017, Bobby's Building Corp. issued $1,000,000 of 10% bonds dated July 1, 2017 for $937,229. The bonds were sold to yield 11%

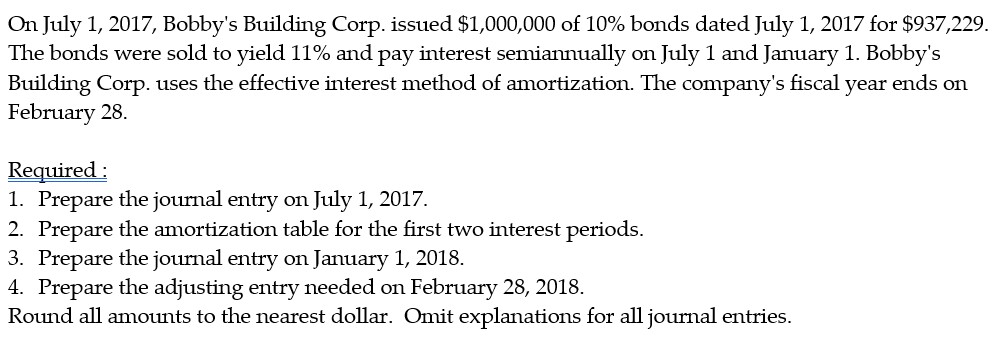

On July 1, 2017, Bobby's Building Corp. issued $1,000,000 of 10% bonds dated July 1, 2017 for $937,229. The bonds were sold to yield 11% and pay interest semiannually on July 1 and January 1. Bobby's Building Corp. uses the effective interest method of amortization. The company's fiscal year ends on February 28. Required : 1. Prepare the journal entry on July 1, 2017. 2. Prepare the amortization table for the first

two interest periods. 3. Prepare the journal entry on January 1, 2018. 4. Prepare the adjusting entry needed on February 28, 2018. Round all amounts to the nearest dollar. Omit explanations for all journal entries.

On July 1, 2017, Bobby's Building Corp. issued $1,000,000 of 1000 bonds dated July 1, 2017 for $937,229. The bonds were sold to yield 11% and pay interest semi annually on July 1 and January 1, Bobby's Building Corp. uses the effective interest method of amortization. The company's fiscal year ends on February 28. Required: 1. Prepare the journal entry on July 1, 2017 2. Prepare the amortization table for the first two interest periods 3. Prepare the journal entry on January 1, 2018. 4. Prepare the adjusting entry needed on February 28, 2018. Round all amounts to the nearest dollar. Omit explanations for all journal entriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started