Question

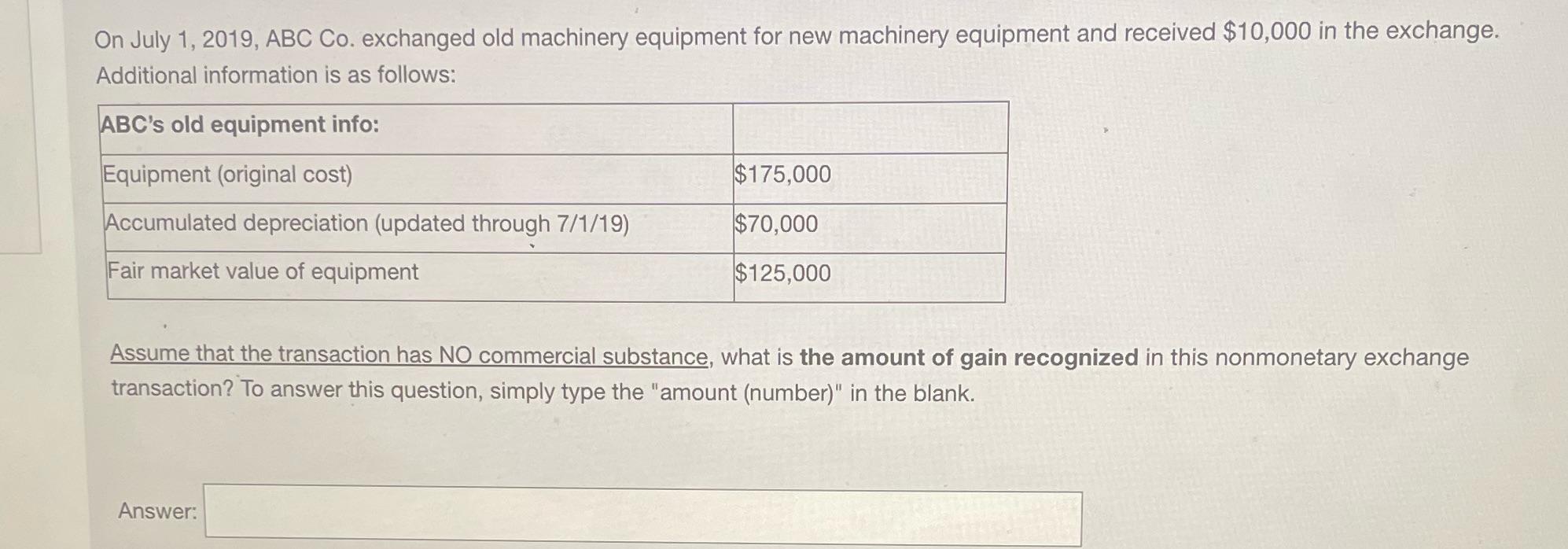

On July 1, 2019, ABC Co. exchanged old machinery equipment for new machinery equipment and received $10,000 in the exchange. Additional information is as

On July 1, 2019, ABC Co. exchanged old machinery equipment for new machinery equipment and received $10,000 in the exchange. Additional information is as follows: ABC's old equipment info: Equipment (original cost) Accumulated depreciation (updated through 7/1/19) Fair market value of equipment $175,000 $70,000 $125,000 Assume that the transaction has NO commercial substance, what is the amount of gain recognized in this nonmonetary exchange transaction? To answer this question, simply type the "amount (number)" in the blank. Answer:

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

In a nonmonetary exchange transaction with no commercia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App