Answered step by step

Verified Expert Solution

Question

1 Approved Answer

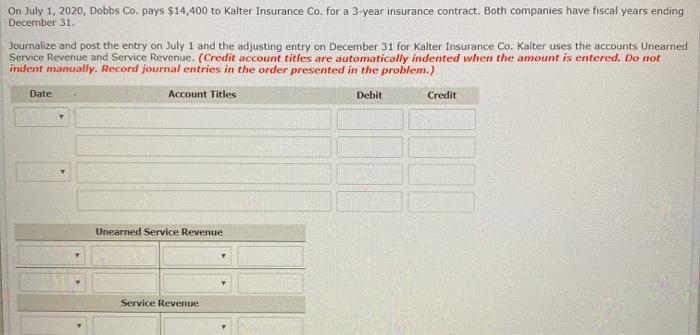

On July 1, 2020, Dobbs Co. pays $14,400 to Kalter Insurance Co. for a 3-year insurance contract. Both companies have fiscal years ending December

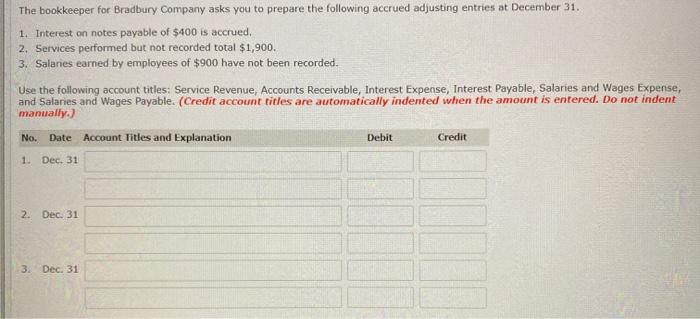

On July 1, 2020, Dobbs Co. pays $14,400 to Kalter Insurance Co. for a 3-year insurance contract. Both companies have fiscal years ending December 31. Journalize and post the entry on July 1 and the adjusting entry on December 31 for Kalter Insurance Co. Kalter uses the accounts Unearned Service Revenue and Service Revenue. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles Debit Credit Unearned Service Revenue Service Revenue The bookkeeper for Bradbury Company asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of $400 is accrued. 2. Services performed but not recorded total $1,900. 3. Salaries earned by employees of $900 have not been recorded. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit 1. Dec. 31 2. Dec. 31 Dec. 31 3.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 1 Journal Entries Date General Journal Debit Credit July 1 2020 Cash 14400 Unea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started