Question

On July 1, 2020, North Mining Company paid P3,600,000 for mining property with a supply of natural resources estimated at 800,000 tons. The mining

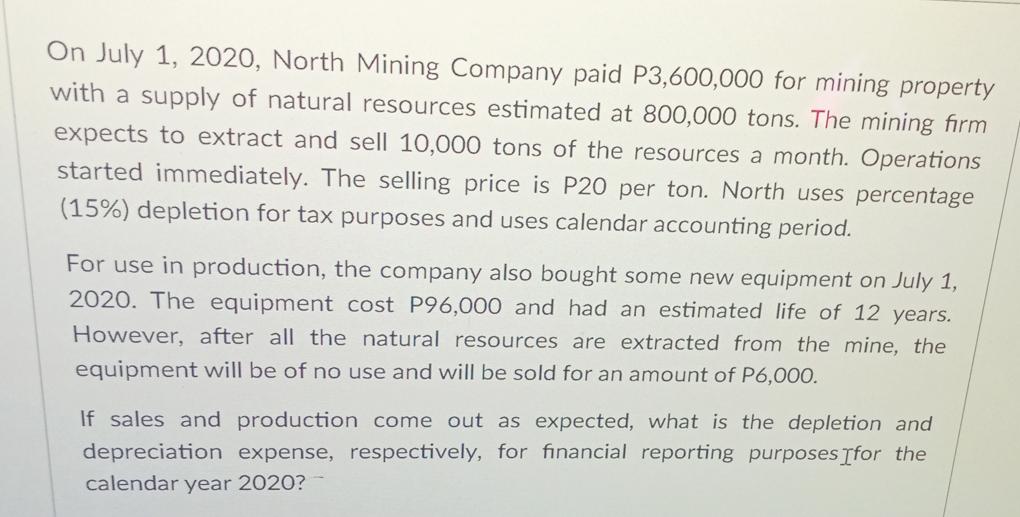

On July 1, 2020, North Mining Company paid P3,600,000 for mining property with a supply of natural resources estimated at 800,000 tons. The mining firm expects to extract and sell 10,000 tons of the resources a month. Operations started immediately. The selling price is P20 per ton. North uses percentage (15%) depletion for tax purposes and uses calendar accounting period. For use in production, the company also bought some new equipment on July 1, 2020. The equipment cost P96,000 and had an estimated life of 12 years. However, after all the natural resources are extracted from the mine, the equipment will be of no use and will be sold for an amount of P6,000. If sales and production come out as expected, what is the depletion and depreciation expense, respectively, for financial reporting purposes for the calendar year 2020?

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App