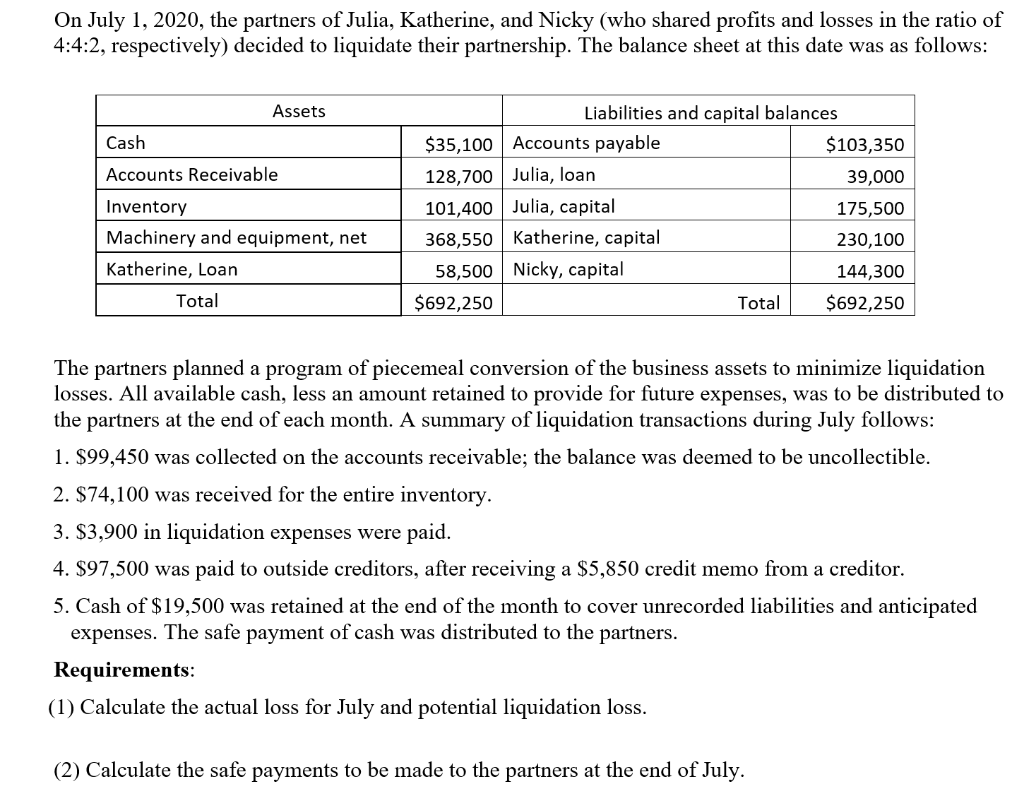

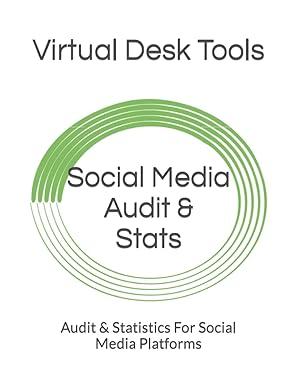

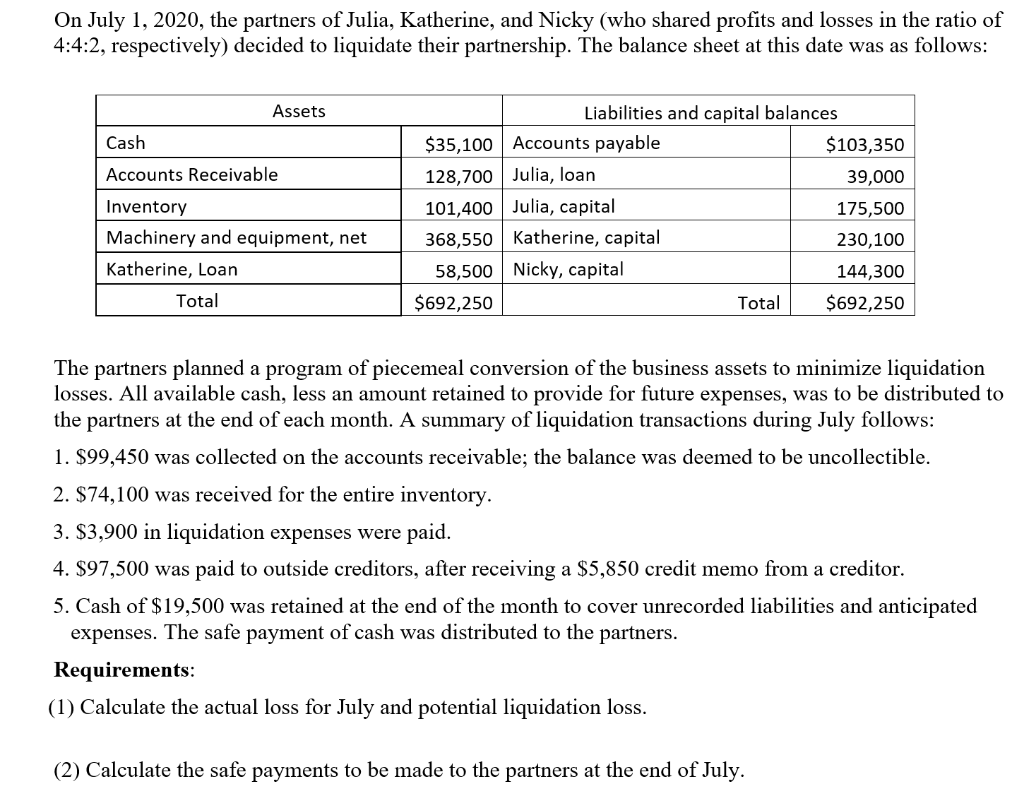

On July 1, 2020, the partners of Julia, Katherine, and Nicky (who shared profits and losses in the ratio of 4:4:2, respectively) decided to liquidate their partnership. The balance sheet at this date was as follows: Assets Cash Accounts Receivable Inventory Liabilities and capital balances $35,100 Accounts payable $103,350 128,700 Julia, loan 39,000 101,400 Julia, capital 175,500 368,550 Katherine, capital 230,100 58,500 Nicky, capital 144,300 $692,250 Total $692,250 Machinery and equipment, net Katherine, Loan Total The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions during July follows: 1. $99,450 was collected on the accounts receivable; the balance was deemed to be uncollectible. 2. $74,100 was received for the entire inventory. 3. $3,900 in liquidation expenses were paid. 4. $97,500 was paid to outside creditors, after receiving a $5,850 credit memo from a creditor. 5. Cash of $19,500 was retained at the end of the month to cover unrecorded liabilities and anticipated expenses. The safe payment of cash was distributed to the partners. Requirements: (1) Calculate the actual loss for July and potential liquidation loss. (2) Calculate the safe payments to be made to the partners at the end of July. Safe installment payment Name: (1) Calculate the actual loss for July and potential liquidation loss. Answer: Actual loss: Potential loss: (2) Calculate the safe payments to be made to the partners at the end of July. On July 1, 2020, the partners of Julia, Katherine, and Nicky (who shared profits and losses in the ratio of 4:4:2, respectively) decided to liquidate their partnership. The balance sheet at this date was as follows: Assets Cash Accounts Receivable Inventory Liabilities and capital balances $35,100 Accounts payable $103,350 128,700 Julia, loan 39,000 101,400 Julia, capital 175,500 368,550 Katherine, capital 230,100 58,500 Nicky, capital 144,300 $692,250 Total $692,250 Machinery and equipment, net Katherine, Loan Total The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions during July follows: 1. $99,450 was collected on the accounts receivable; the balance was deemed to be uncollectible. 2. $74,100 was received for the entire inventory. 3. $3,900 in liquidation expenses were paid. 4. $97,500 was paid to outside creditors, after receiving a $5,850 credit memo from a creditor. 5. Cash of $19,500 was retained at the end of the month to cover unrecorded liabilities and anticipated expenses. The safe payment of cash was distributed to the partners. Requirements: (1) Calculate the actual loss for July and potential liquidation loss. (2) Calculate the safe payments to be made to the partners at the end of July. Safe installment payment Name: (1) Calculate the actual loss for July and potential liquidation loss. Answer: Actual loss: Potential loss: (2) Calculate the safe payments to be made to the partners at the end of July